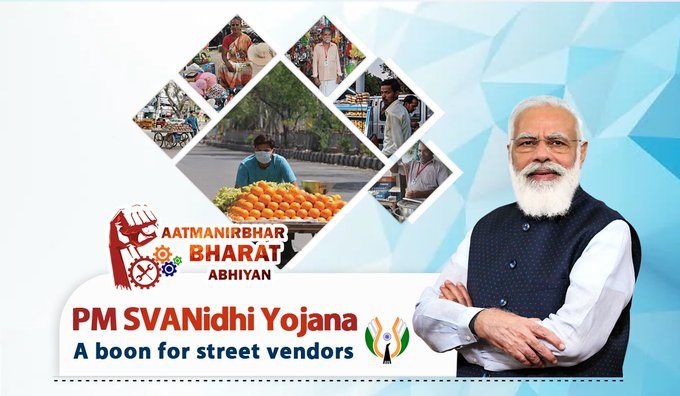

PM SVANidhi Yojana: What are it’s objectives, Eligibility Criteria and Benefits?

What Is PM SVANidhi Yojana?

Street vendors are an essential component of the urban informal economy, playing a vital role in providing the availability of products and services at reasonable prices at the doorsteps of city people. In different areas/contexts, they are called as vendors, hawkers, thelewala, rehriwala, theliphadwala, and so on. They supply vegetables, fruits, ready-to-eat street food, tea, pakodas, breads, eggs, textile, clothes, footwear, artisan products, books/stationery, and so on. Barbershops, cobblers, pan shops, and laundry services are among the services available. The COVID-19 epidemic and resulting lockdowns have harmed the livelihoods of street vendors. They often work with a tiny capital base and may have depleted it during the lockdown. The project is a Central Sector project, which means it is wholly sponsored by the Ministry of Housing and Urban Affairs, and it has the following goals: (i) To make a working capital loan of up to 10,000 available; (ii) To encourage regular repayment; and (iii) To reward digital transactions.

The plan will assist to formalise street sellers and provide new chances for this sector to progress up the economic ladder.

OBJECTIVES OF PM SVANIDHI YOJNA

The recurrent lockdowns in India as a result of the epidemic have harmed the livelihoods of street sellers. Given this, the Ministry of Housing and Urban Affairs created the PM SVANidhi initiative, which provides hawkers and street vendors with holistic development and economic upliftment.

Here are some of the scheme’s characteristics:

- It is a central government-backed initiative, which means it is directly sponsored by the central ministries.

- This will be available to street sellers until March 2022.

- They can initially obtain collateral-free loans and operating capital of up to $10,000.

- In the previous transactions, early or prompt repayment might result in interest subsidies and a larger loan amount.

- Because of digital purchases, street merchants can now receive cash back incentives.

- It offers financial assistance in the form of low-interest working capital loans of up to $10,000.

- The goals of this plan additionally stipulate that suppliers are eligible for rewards based on timely return of loan amounts.

- Additionally, it rewards digital transactions.

Eligibility Criteria of PM SVANIDHI YOJNA

- This plan is open to vendors who have a Certificate of Vending or a valid identity card issued by an Urban Local Body (ULB).

- If a person fails to show a Certificate of Vending and want to apply for a street vendor loan, he might consider obtaining a Letter of Recommendation (LoR) from the municipality.

- Furthermore, vendors who live and work in peri-urban or rural locations might meet the qualifying requirements by providing the same letter.

- Additionally eligible under SVANidhi are ULB approved vendors who have fled their operational region as a result of the epidemic.

- Before granting them a certificate, the Town Vending Committees (TVC) carried out a survey in accordance with the Street Vendors Act of 2014. To that aim, sellers who were identified by the TVC but did not get a certificate are given a provisional certificate of vending. These people are also eligible for the financing programme for street sellers.

Eligibility of States/UTs of PM SVANIDHI YOJNA

Only those States and UTs that have published their rules and programme under the 2014 Street Vendors (Protection of Livelihood and Regulation of Street Vending) Act are eligible for the programme. However, participants from Meghalaya, which has its own State Street Vendors Act, are allowed.

Benefits of the PM SVANidhi Scheme

- Loans for working capital

Under this plan, a working capital loan in the amount of 10,000 is available for a year and can be paid back in monthly installments. Additionally, as these loans are uncollateralized, you are not required to mortgage your assets in order to secure them. Beneficiaries may receive a higher loan amount limit for the following cycle if a loan is repaid early or on time.

2.Interest Subsidy

A 7% interest subsidy is available to street vendors who use the PM vendor programme to borrow working capital. This sum will be paid to borrowers on a quarterly basis. The deadline for this interest subsidy is March 31, 2022.

- People who choose digital transactions are eligible for rewards in the form of cashback. Vendors can adopt digital procedures with the aid of a big network of lending institutions and digital payment aggregators.