Post Office Investment Schemes: Features, Benefits, Tax Implications

Do you ever think about where to park your money for guaranteed returns while sipping on chai?

Sure, there are many roads to park your hard-earned money. But post office investment schemes, post office insurance schemes, and post office senior citizen saving schemes, and their like stand out as reliable and secure options for individuals across India.

These schemes are supported by the Indian Government, offering the much-needed sovereign guarantee that can instill confidence in you.

Today, we’ll explore the various Post Office Investment Schemes, their features, benefits, and tax implications, followed by the post office monthly income scheme calculator.

Summary

- Diverse Investment Options

- Prominent Post Office Investment Schemes

- Post Office Savings Account

- Post Office Monthly Income Scheme (POMIS)

- Post Office Recurring Deposit

- Post Office Time Deposit

- Kisan Vikas Patra (KVP)

- Post Office Senior Citizen Saving Scheme (SCSS)

- Public Provident Fund (PPF)

- National Savings Certificate (NSC)

- Sukanya Samriddhi Scheme

- Post Office Monthly Income Scheme Calculator

Advantages of Post Office Savings Schemes - Aadhar and PAN Card Now Mandatory

Diverse Investment Options

Indian Post offers a bouquet of investment options tailored to meet the needs of various investors. The hallmark of these schemes is their government backing and competitive interest rates.

Moreover, most of these schemes offer tax benefits under Section 80C, making them a compelling choice for those seeking both returns and fiscal advantages.

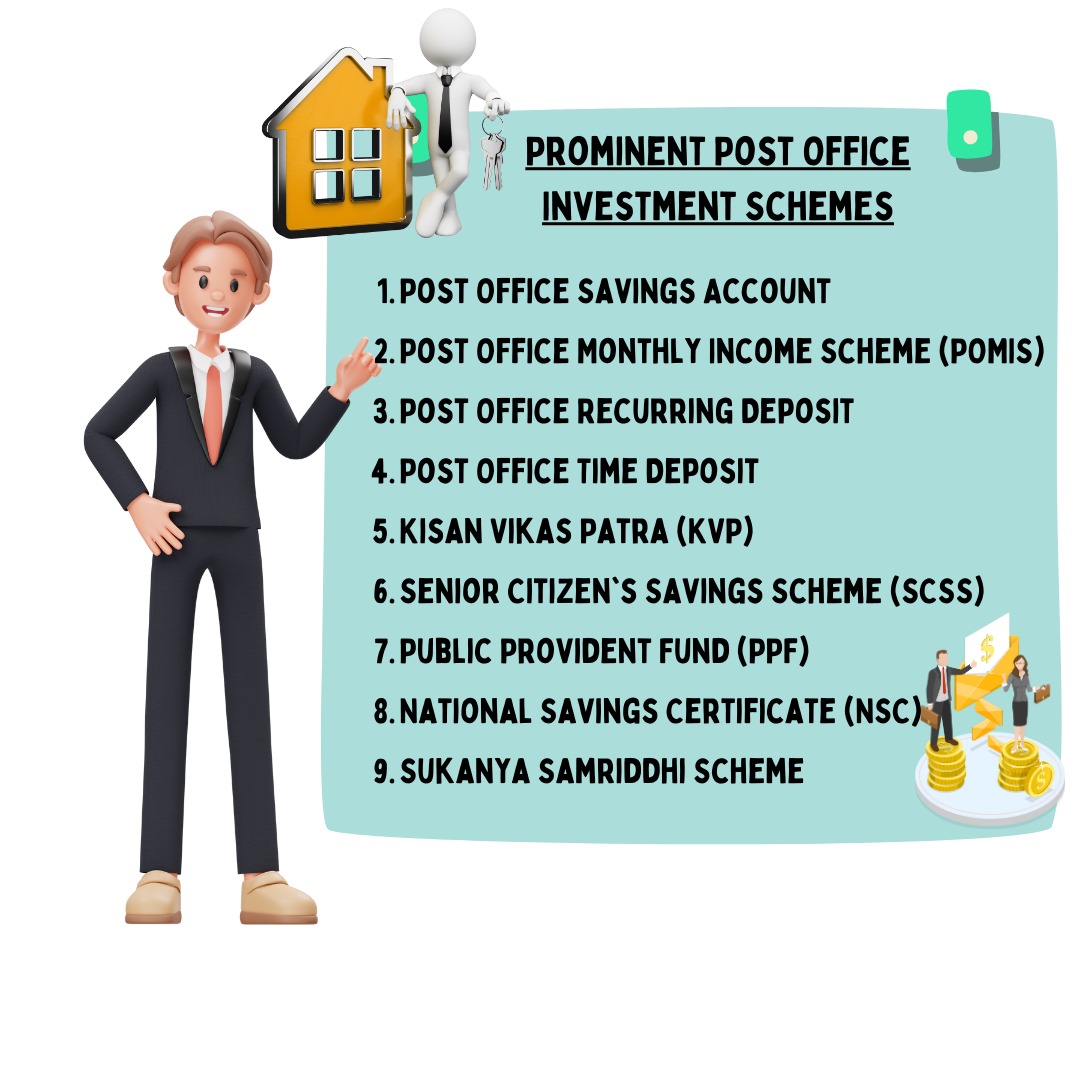

Prominent Post Office Investment Schemes

From here on, you will find the 9 best post office investment options. Feel free to choose the best for yourself!

1. Post Office Savings Account

The Post Office Savings Account is akin to a traditional bank savings account but with the added security of being government-backed. Key features of this scheme include:

- A 4.0% interest rate.

- No tax benefits and the interest earned is fully taxable.

- Minimum balance requirement of Rs. 50 under the non-cheque facility.

- Tax deduction of Rs. 10,000 per annum on the total savings account interest under Section 80TTA of the Income Tax Act, 1961.

2. Post Office Monthly Income Scheme (POMIS)

POMIS is a unique scheme that offers guaranteed monthly income on lump sum investments. Notable features include:

- A high-interest rate of 7.4%.

- Taxable interest every month.

- A maximum investment limit of Rs. 9 lakh for an individual and Rs. 15 lakh for joint accounts.

- Liquidity with a penalty for premature withdrawals.

- No major tax benefits in this scheme.

3. Post Office Recurring Deposit

Next in line amongst post office investment schemes is post office recurring deposits. This is a monthly savings scheme with a fixed five-year tenure, offering an interest rate of 6.7% per annum (compounded quarterly). Key highlights are:

- Flexibility to start with as little as Rs. 100 per month.

- No upper limit on investment.

- Penalty of Rs. 1 for every Rs. 100 in case of missed monthly investments.

- Partial withdrawals up to 50% of the balance allowed.

- Interest is taxable as per the investor’s tax slab.

4. Post Office Time Deposit

Post Office Time Deposit provides various tenure options for investments, each with different interest rates:

- 1 Year Time Deposit: 6.9%

- 2 Year Time Deposit: 7%

- 3 Year Time Deposit: 7%

- 5 Year Time Deposit: 7.5%

- Tax benefits on the 5-year Time Deposit under Section 80C.

5. Kisan Vikas Patra (KVP)

Kisan Vikas Patra is a simple yet effective scheme that offers a fixed interest rate of 7.5% compounded annually. Notable features include:

- Doubling of the invested amount every 115 months.

- Minimum investment of Rs. 1,000 with no maximum limit.

- Easy transferability and encashment facility.

- Tax implications include no deduction on the principal amount but taxable interest.

6. Post Office Senior Citizen Saving Scheme (SCSS)

SCSS is designed for individuals aged 60 and above. Key points of interest are:

- A competitive interest rate of 8.2%.

- Maximum investment limit of Rs. 15 lakh.

- Premature withdrawal options with penalties.

- Tax deductions under Section 80C but TDS applicable if interest exceeds Rs. 10,000 annually.

7. Public Provident Fund (PPF)

The Public Provident Fund is a long-term investment with an interest rate of 7.1% per annum. Highlights include:

- A maximum deposit of Rs. 1,50,000 per financial year.

- Flexible investment amounts.

- Options for partial withdrawals and loans.

8. National Savings Certificate (NSC)

NSC has a maturity period of 5 years with a competitive interest rate of 7.7%. Features of this scheme include:

- No maximum limit with a minimum investment of Rs. 1,000.

- Compounded interest paid at maturity.

- Tax deductions under Section 80C.

- NSC certificates can be pledged as security for bank loans.

9. Sukanya Samriddhi Scheme

Sukanya Samriddhi Yojana (SSY) is tailored for the benefit of girl children. It offers:

- Attractive interest rate of 8%.

- Tax deductions under Section 80C.

- Investment up to Rs. 1,50,000 per annum.

- Account closure on maturity or for the girl’s marriage or higher education.

- Penalty for not meeting the minimum annual investment.

These 9 post office investment schemes are amongst the best. To reach the best decision for yourself, analyze each one of them according to your personal goals, priorities, and ambitions.

Post Office Monthly Income Scheme Calculator

The Post Office Monthly Income Scheme Calculator is a valuable tool for individuals seeking to invest their hard-earned money wisely.

This handy calculator enables you to plan your financial future with ease. By inputting essential details like your investment amount and the current interest rate, you can swiftly calculate your monthly income from the scheme.

Whether you’re saving up for a dream vacation, your child’s education, or a comfortable retirement, this user-friendly tool helps you estimate your returns effortlessly.

It’s an excellent resource for anyone looking to secure a steady monthly income and take control of their financial well-being.

Advantages of Post Office Savings Schemes

Other than the obvious advantages that come with post office insurance schemes, the clear benefits that come with post office investment schemes are:

1. Simple Documentation & Procedure

Minimal documentation and straightforward procedures make these schemes accessible to a wide range of investors, both in urban and rural areas.

2. Competent Interest Rates and Risk-free

The competitive interest rates offered by these schemes are coupled with minimal risk, thanks to the government’s backing.

3. Tax Exemption

Many schemes are eligible for tax rebates under Section 80C. Some schemes also provide tax exemption on the interest earned, making them an excellent choice for tax-conscious investors.

4. Diverse Investment Options

With various schemes catering to different needs, investors can choose the one that aligns with their unique requirements (click here to learn about best retirement planning options).

Caveat: Aadhaar and PAN Now Mandatory!

It’s important to note that to open any new Post Office scheme/account, providing your Aadhaar number and PAN is now mandatory. For existing accounts, these details must be submitted within specified time frames depending on the account balance and transactions.

Post Office Investment Schemes offer a compelling avenue for investors to secure their financial future.

With a range of options to choose from and the assurance of government backing, these schemes are a smart choice for those looking to balance returns with safety.

Don’t miss out on these opportunities – take advantage of the Post Office Investment Schemes and post office insurance schemes today and unlock your financial potential.

Subscribe to NewsCanvass for more useful financial guides!