Pet Insurance: What is it, Types, Benefits, Best Plans, Requirements

Do you have a plan to deal with any unforeseen circumstances that might befall your furry kids? If not, you’re at the right place to discover exactly what you need – pet insurance.

Pet insurance has emerged as a valuable solution to safeguard your pets against unexpected veterinary expenses due to accidents or illnesses.

While the Indian pet insurance market is still nascent compared to other countries, several insurers now offer comprehensive coverage for pets, including dogs and cats.

Here, we’ll delve into the world of pet insurance so that you’re able to show love to your pets exactly how it needs to be shown.

Summary

- What Is Pet Insurance?

- Types of Pet Insurance

- Benefits of Buying Pet Insurance

- Best Pet Insurance Plans In India

- Requirements for a Pet Insurance Policy

- Documents Required When Buying Pet Insurance

- Claim Settlement Procedure for a Pet Insurance Policy

- FAQs

What Is Pet Insurance?

Pet insurance is a contract between pet owners and insurance companies designed to provide optimal coverage for veterinary expenses related to a pet’s medical treatment.

This ensures that your beloved cat or dog receives the best possible healthcare without causing you financial distress.

In India, you can typically choose between two types of pet insurance coverage: Cat Insurance and Dog Insurance. Both policies can be tailored to meet your specific needs and ensure that your pets remain healthy, without straining your finances.

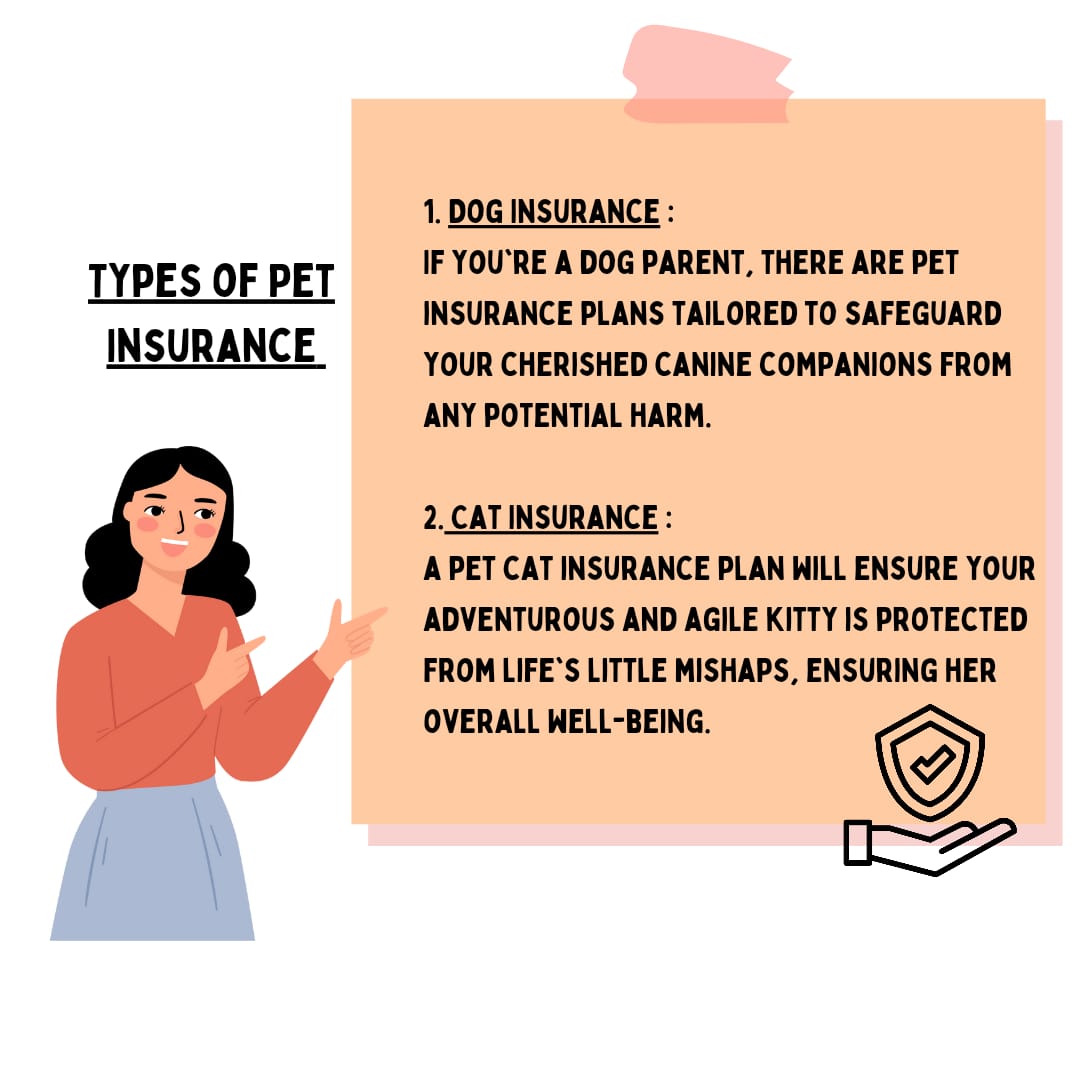

Types of Pet Insurance

In the world of pet insurance in India, things have evolved beyond just cattle and livestock coverage.

Nowadays, private insurers go the extra mile, offering protection for a wide range of expenses.

These plans cover not only the unfortunate loss of a pet but also global transit, third-party liabilities, pet theft or loss, even entry fees for dog shows, and much more. Let’s dive into the specific types of pet insurance plans available:

1. Dog Insurance

With approximately 28-29 million pets in India, dogs have become the leading stars in the world of pet insurance. Their numbers have surged, especially since the COVID-19 pandemic, as many people have welcomed these furry companions into their lives.

If you’re a dog parent, there are pet insurance plans tailored to safeguard your cherished canine companions from any potential harm.

2. Cat Insurance

We can’t forget our feline friends! Many insurance providers now offer coverage for cat owners as well. If you have a cat, a pet cat insurance plan will ensure your adventurous and agile kitty is protected from life’s little mishaps, ensuring her overall well-being.

Also Read: How to plan your finances?

Benefits of Getting Pet Insurance

There are plenty of benefits you can cash with pet insurance. The ones mentioned below are just few of the benefits of pet insurance:

1.Financial Safety

Pet insurance ensures that pet parents have financial support when their pets become ill or require immediate medical treatment.

2.Routine Check-ups

Some plans offer free annual health check-ups for your pet, allowing you to monitor their health without incurring additional costs.

3.Special Benefits

Pet insurance may provide benefits if your pet is lost, stolen, or causes damage to a third party or property.

4.Coverage for Modern Treatments

Certain plans cover modern and expensive treatments, ensuring your pet has access to the latest medical advancements.

5.Global Coverage

Some policies offer global coverage, which can be invaluable when travelling abroad with your pet, providing protection in case of mishaps during your trip.

Best Pet Insurance Plans In India

After familiarising yourself with the benefits of pet insurance, here, you will find the list of some of the best pet insurance plans in India. Find the top 5 pet insurance plans below:

Bajaj Allianz Pet Dog Insurance Policy

Maximum Annual coverage: Up to INR 50,000

Entry Age: 3 months – 7 years

Coverage Available For: Only Dogs

Future Generali India Dog Health Insurance

Maximum Annual Coverage: Depending upon breed and size of dog.

Entry Age: 6 months to 10 years

Coverage Available For: Only Dogs

The New India Assurance Dog Insurance Policy

Maximum Annual Coverage: INR 50,000

Entry Age: 8 weeks to 8 years

Coverage Available For: Only Dogs

The Oriental Insurance Dog Insurance

Maximum Annual Coverage: Up to INR 50,000

Entry Age: 8 weeks to 8 years

Coverage Available For: Only Dogs

Digit Pet Insurance Policy

Maximum Annual Coverage: INR 50,000

Entry Age: 8 weeks to 8 years

Coverage Available For: Dogs and Cats

Also Read: What is financial planning?

Requirements for a Pet Insurance Policy

To be eligible for pet insurance:

- Your cat or dog must be registered with the Municipal Corporation or deemed local government authority, certified by the Kennel Club of India, or micro-chipped.

- You’ll also need to submit photographs of your pet as specified.

Documents Required When Buying Pet Insurance

You need to check the boxes for the following documents while seeking an insurance for your pets:

- Fill out the insurance proposal form with your pet’s details.

- Provide colour photos of your pet as specified.

- Declare that your pet has received all vaccinations on time.

- In some cases, submit diagnostic test results, such as circulatory blood count (CBC), urine tests, or chest X-rays.

- If choosing a Sum Insured based on pedigree lineage, provide a pedigree certificate from the Kennel Club of India (KCI).

Claim Settlement Procedure for a Pet Insurance Policy

Now that you know the documents you’ll require, let’s take a quick look at how pet insurance claims can be settled through two methods:

1. Cashless Claim Settlement Process

- Notify network veterinary hospitals at least 72 hours before planned medical treatment or within one day in emergencies.

- Share a copy of E-Cards and your ID proof at the veterinary hospital to get a pre-authorization form.

- Submit the filled and signed pre-authorization form to the veterinary hospital.The insurance company will settle the bills directly with the hospital once all formalities are complete.

2. Reimbursement Claim Process

- Pay for all expenses upfront at your chosen veterinary hospital.

- Submit the original bills and expenses to the insurance company.

- The insurer will reimburse the expenses within 30 days after you submit the bills on time.

So, choosing the right policy can provide you with peace of mind and financial security in case your pets need medical attention. Be sure to explore your pet insurance options, compare policies, and find the best coverage that suits your pet’s needs and your budget.

Can anyone open a Public Provident Fund account?

Pet insurance typically covers accidents and illnesses. Pre-existing conditions are usually

not covered. It’s essential to thoroughly review the policy terms to understand what is

included.

Can Public Provident Fund account be opened for minor?

The cost of pet insurance varies based on factors like the pet's age, breed, and the coverage

you choose. There are different plans available, so you can find one that suits your budget.

How to open Public Provident Fund account for minor in HDFC?

Yes, many pet insurance policies have waiting periods, often 15-30 days for illnesses and

24-48 hours for accidents. During the waiting period, coverage may not apply, so it's crucial

to be aware of this when signing up.

Are there any rules for opening a minor Public Provident Fund account?

Most pet insurance plans in India allow you to choose your preferred veterinarian. There’s

usually no restriction on the choice of providers, but you should confirm this with the insurer.