Whole Life Insurance: What is it, 4 Types, How it Works, Pros and Cons

Do you want to make smart choices about your insurance? You need to understand the inner workings of Whole Life Insurance.

Unlike term life insurance, which only covers you for a set amount of time, Whole Life Insurance is there for you throughout your entire life. It provides long-lasting financial security and peace of mind for both you and your family.

So if you want to safeguard your family’s well-being and leave a lasting legacy, read ahead because we are going to introduce you to how exactly whole life insurance works.

What is Whole Life Insurance?

Whole life insurance is a type of insurance that covers you for your entire life, unlike term life insurance, which is only for a specific number of years.

With whole life insurance, you pay level premiums, meaning the amount you pay every month stays the same. It includes a savings component called the cash value, which earns interest over time on a tax-deferred basis.

You can access this cash value while you’re alive by borrowing against it or making withdrawals, but keep in mind that unpaid loans reduce the death benefit.

Overall, whole life insurance provides lifetime coverage, a guaranteed death benefit, and a predictable premium payment, but it can be more expensive than term life insurance and may offer slower cash value growth.

What Are the Types of Whole Life Insurance?

Types of whole life insurance include:

Level Payment

Premiums remain unchanged throughout the duration of the policy, offering stability in payments.

Single Premium

One large premium is paid upfront, funding the policy for life, though this type often comes with tax consequences.

Limited Payment

You pay premiums for a set number of years, after which coverage continues without further payments.

Modified Whole Life Insurance

Offers lower premiums initially, but higher ones later, making it more costly in the long run.

These policies are further categorized as participating and non-participating. With participating policies, excess premiums are redistributed to policyholders as dividends, while non-participating policies don’t offer this feature.

How Does Whole Life Insurance Work?

Whole life insurance is a type of insurance that promises to give money to chosen people after the insured person passes away. In exchange, the insured person pays a fixed amount of money regularly.

This insurance also has a part where your money grows, called “cash value.” This cash value can earn interest over time without you having to pay taxes immediately. It’s important because it helps your insurance grow.

To make this cash value bigger, you can pay more than what you’re asked to, or use any dividends you get. As time goes on, the money you earn from dividends and interest will be more than what you’ve paid in total.

One good thing about this cash value is that you can use it while you’re alive. You can take out some money or ask for a loan. When you take out money, you don’t have to pay taxes on the part that’s equal to what you’ve already paid in premiums.

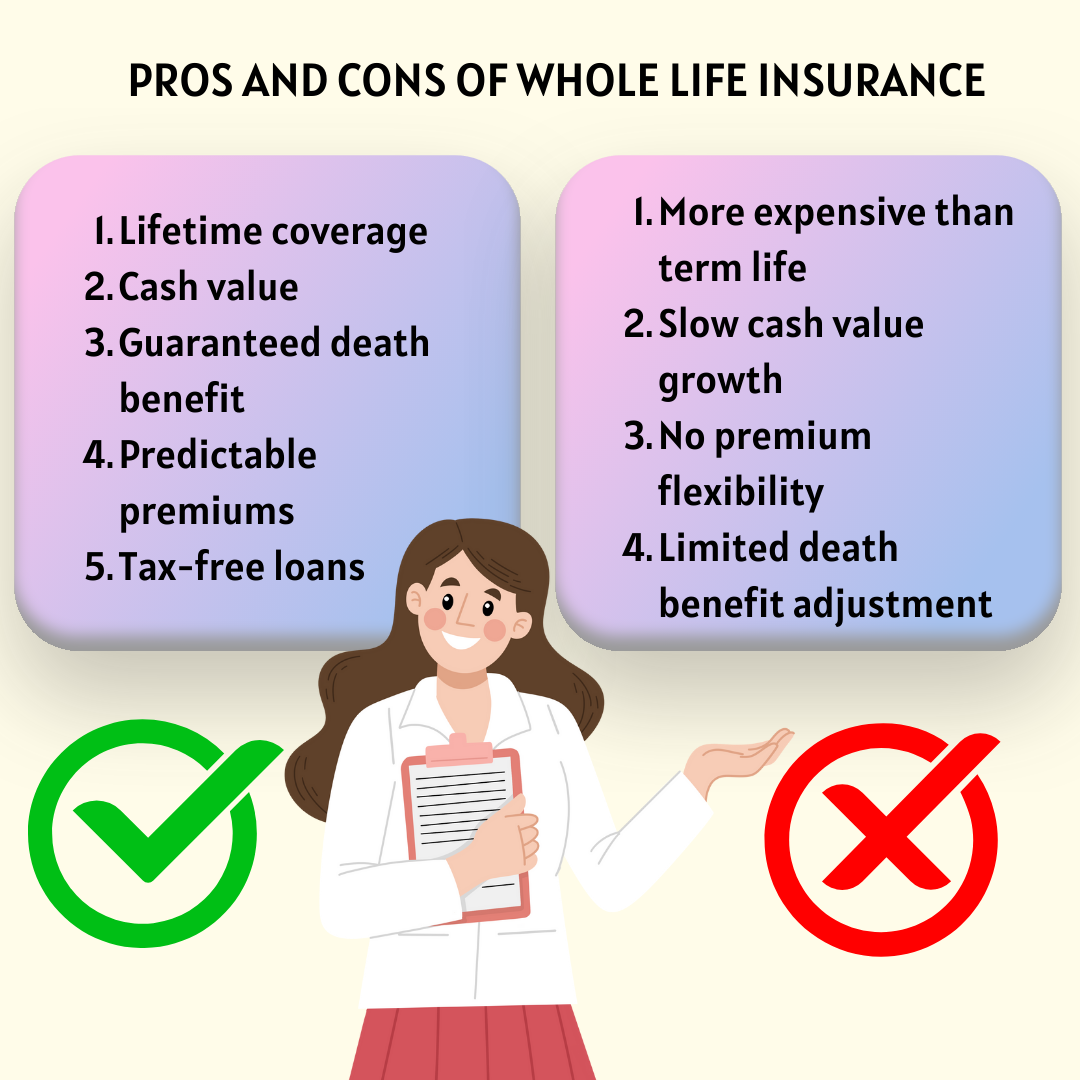

What Are the Pros and Cons of Whole Life Insurance?

Here are the pros and cons of whole life insurance:

Advantages:

Lifetime coverage

You’re covered until you pass away, providing security for your loved ones.

Cash value

You can use the cash value for loans, withdrawals, or even to pay premiums.

Guaranteed death benefit

The amount paid to your beneficiaries is fixed, offering peace of mind.

Predictable premiums

Your premium payments stay the same over time, making budgeting easier.

Tax-free loans

You can borrow from the policy’s cash value without worrying about taxes.

Disadvantages

More expensive than term life

Premiums are usually higher, making it costlier.

Slow cash value growth

The cash value may not grow as quickly as with other policies.

No premium flexibility

You can’t adjust your premium payments.

Limited death benefit adjustment

You can’t easily change the death benefit amount once the policy is set up.

Does Whole Life Insurance Cost an Arm and a Leg?

The cost of whole life insurance depends on different things like your age, job, and health. If you’re older, you usually pay more than younger people. If you’re really healthy, you might get a better price compared to someone with health issues.

How much insurance you want changes how much you pay. If you want more coverage, you’ll have to pay more every month. Different insurance companies may also charge different prices, even if everything else is the same.

And remember, whole life insurance is generally more costly than term life insurance for the same coverage amount.

How to Get Whole Life Insurance For Yourself?

You need to follow just 8 simple steps to get whole life insurance:

- Find an insurance company.

- Apply for the insurance policy.

- Answer questions about your health and lifestyle.

- Choose the coverage amount you want.

- Pay regular premiums.

- The insurance company will review your application.

- If approved, you’ll receive your policy documents.

- Your coverage starts, providing lifetime protection.

By now, you have a good idea of what Whole Life Insurance is, how it can be advantageous, what its cost will come out to be, and how you can get it.

With all this information in the back of you head, it will not be difficult for you to take a call on whether Whole Life Insurance is meant for you. If you want to keep yourself updated with more such guides like benefits of insurance, types of insurance, and more follow NewsCanvass.