Aditya Birla Group’s $20 Billion Vision: Scaling Success for Long-Term Leadership

The Aditya Birla Group has invested approximately $20 billion, primarily in manufacturing, as it strives to secure a top-two position in every sector it operates in.

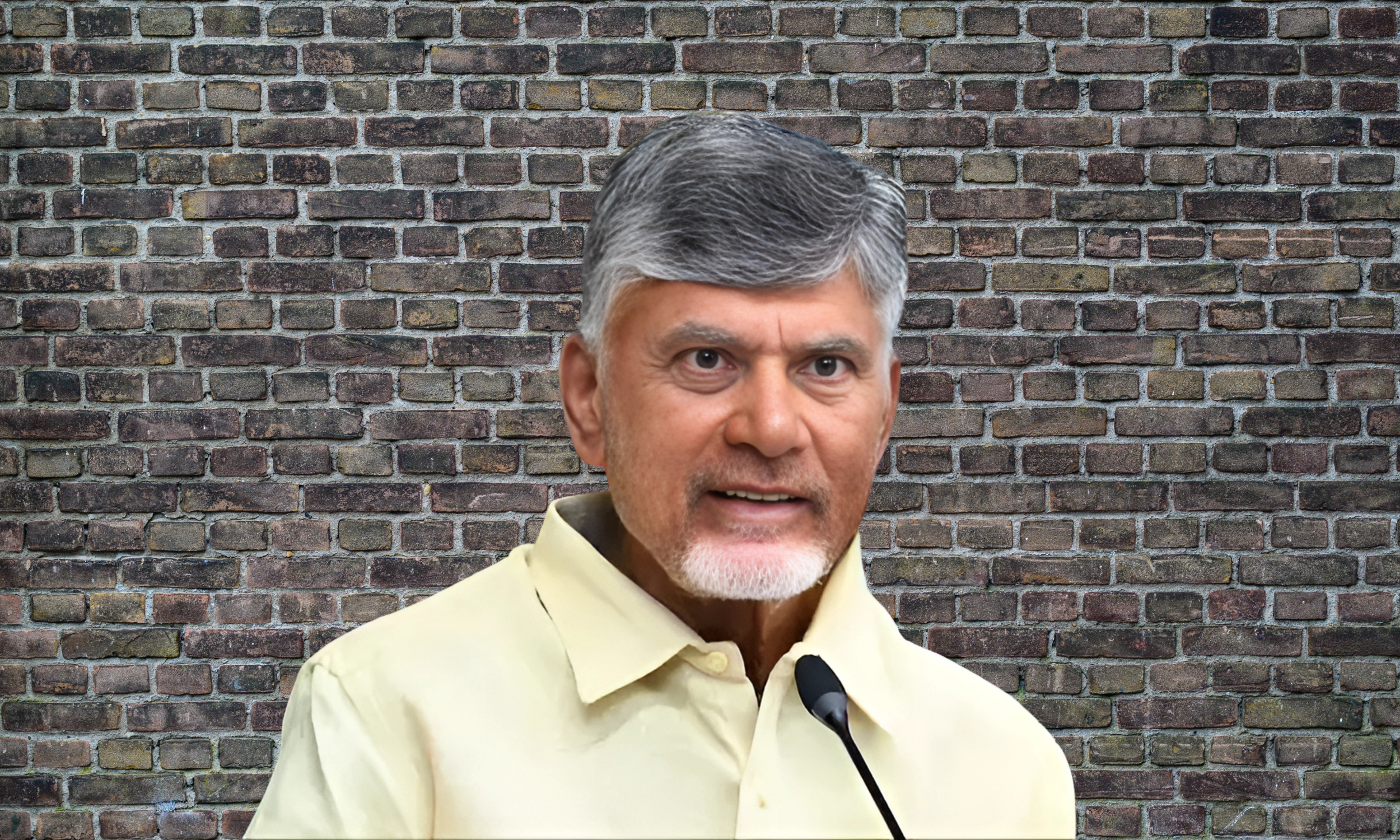

Speaking at the Hindustan Times Leadership Summit 2024, Kumar Mangalam Birla, chairman of the Aditya Birla Group, highlighted the company’s focus on scalability and long-term growth.

He mentioned the acquisition of Novelis by Hindalco as a key example of the tough decisions undertaken to achieve this vision. The group now aims to double its cement business capacity from 100 million tonnes to 200 million tonnes within the next decade.

Birla emphasized that most of the group’s investments have a long-term outlook of 15-20 years, particularly in manufacturing, while consumer-facing businesses operate on a shorter timeline.

“We have $20 billion of announced investments on the ground,” Birla said. “Many of them are in the manufacturing space. You would look at the next 15-20 years. Shorter than that doesn’t make sense in that kind of business… If you’re looking at fashion retail or jewellery retail or financial services, then you are looking at a much shorter time frame.”

Scalability as the Core Strategy

The Aditya Birla Group’s business philosophy is built on values, people, scale, and a long-term vision. Birla highlighted the critical importance of scale for survival and competitiveness in today’s business landscape.

“We want to be number one or two in every business that we are in or get into,” Birla stated. “Scale is in everything, but it’s the only thing. Without scale, I think it’s very difficult to survive today unless you have something very unique, very high technology, which gives you very high margins. So, scale is very important.”

Over the past 36 years, the group built a cement capacity of 100 million tonnes. Now, it plans to increase this to 150 million tonnes within five years and reach 200 million tonnes within the next decade.

UltraTech Cement, the group’s flagship cement company, currently boasts a consolidated capacity of 156.06 million tonnes of grey cement annually.

The Bold Novelis Acquisition

One of the defining moments of the Aditya Birla Group’s growth was Hindalco’s $6 billion acquisition of Novelis. The decision, seen as risky at the time, tested the group’s resolve and Birla’s ability to think beyond short-term results.

“I acquired a company (Novelis) which was much larger… The stock took a beating, investors wrote us off,” Birla shared.

“It took about a year to come back. Any professional CEO who had taken that decision would have been sacked because it just seemed at that time to be the wrong thing to do. As a promoter, I had the prerogative and the desire to see much beyond not just quarters, but years.”

This acquisition proved successful over time, reinforcing the group’s focus on long-term sustainability.

Evolving with National Priorities

Reflecting on the group’s history, Birla acknowledged the influence of his great-grandfather, G.D. Birla, who collaborated with Mahatma Gandhi to promote self-reliance post-Independence.

However, he noted that today’s business strategies are not dictated solely by national priorities. “Businesses are not set up based on the growth curve the nation is in,” Birla remarked.

While scale is not the sole factor for success, Birla affirmed it is often decisive in determining a company’s longevity and relevance. This approach underscores the Aditya Birla Group’s commitment to staying ahead in an increasingly competitive global market.