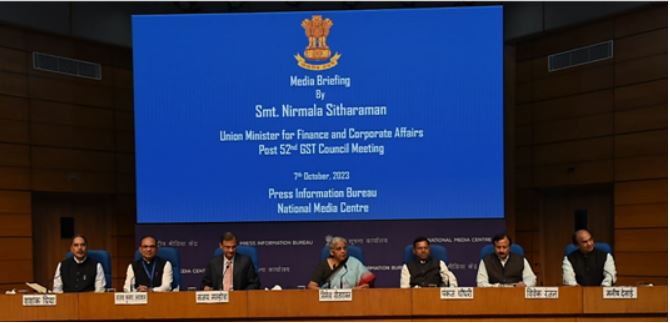

Highlights from the 52nd GST Council Meeting

On 7th October 2023, the 52nd GST Council met under the Chairpersonship of Union Minister for Finance & Corporate Affairs Smt. Nirmala Sitharaman in New Delhi. The meeting was also attended by Union Minister of State for Finance Shri Pankaj Chaudhary, Chief Ministers of Goa and Meghalaya holding finance portfolio, besides Finance Ministers of States & UTs (with legislature) and senior officers of the Ministry of Finance & States/ UTs.

Changes in GST Rates for Goods

- Food Preparation of Millet Flour: The GST rates for “Food preparation of millet flour in powder form, containing at least 70% millets by weight” under HS 1901 have been adjusted. These rates will be 0% for non-pre-packaged and labeled forms and 5% for pre-packaged and labeled forms.

- Imitation Zari Thread: Imitation zari thread or yarn made from metallized polyester film/plastic film (HS 5605) will now be categorized under the entry for imitation zari thread or yarn, attracting a 5% GST rate.

- GST on Foreign Going Vessels: Foreign going vessels will be liable to pay 5% IGST on the vessel’s value when it converts to coastal run. However, conditional IGST exemption will be recommended when a foreign flag foreign going vessel converts to coastal run, subject to its reconversion to a foreign going vessel within six months.

- Extra Neutral Alcohol (ENA): The GST Council delegated the authority to tax Extra Neutral Alcohol (ENA) to the states. ENA used for human consumption will be exempt from GST, while ENA intended for industrial use will be taxed at an 18% GST rate.

- GST on Molasses: GST on molasses will be reduced from 28% to 5%, enhancing liquidity for mills and facilitating faster payment of cane dues to sugarcane farmers. This reduction will also lead to cost savings in the manufacture of cattle feed.

Changes in GST Rates for Services

- Exemptions for Pure and Composite Services: Services provided to Central/State/UT governments and local authorities in relation to functions entrusted to Panchayat/Municipality under Article 243G and 243W of the Constitution of India will continue to be exempt from GST. Additionally, services of water supply, public health, sanitation conservancy, solid waste management, slum improvement, and upgradation supplied to Governmental Authorities will also be exempt.

- Clarification on Job Work Services: Job work services for processing barley into malt will attract a 5% GST rate, similar to “job work in relation to food and food products.”

- GST on Bus Transportation Services: Liability to pay GST on bus transportation services supplied through Electronic Commerce Operators (ECOs) has been placed on ECOs. However, bus operators organized as companies may be excluded from this provision, allowing them to pay GST using their Input Tax Credit (ITC).

- District Mineral Foundations Trusts (DMFT): DMFTs set up by State Governments in mineral mining areas will be considered Governmental Authorities and eligible for the same GST exemptions as other Governmental Authorities.

- GST on Indian Railways: All goods and services supplied by Indian Railways will be taxed under the Forward Charge Mechanism, enabling them to claim Input Tax Credit and reducing costs.

Revised Age Limits for GSTAT President and Members

The GST Council introduced new age caps for the president and members of the GST Appellate Tribunal (GSTAT). The maximum age limit for the GSTAT president has been increased to 70 years, while the limit for members will be 67 years. This is a change from the previous age limits of 67 years for the president and 65 years for members.

Clarification on Corporate and Personal Guarantees

The GST Council provided clarification on the taxation of guarantees:

- Guarantees provided by corporates to their subsidiaries will attract an 18% GST rate.

- Personal guarantees given by directors of companies raising loans from the market will not be subject to GST.