Is Tomato Price Hike in India Due to Greedflation?

“Greedflation” is accused as a reason behind the inflation in Europe and USA. During the pandemic, multinational corporations (MNCs) raised prices due to supply chain issues, resulting in cost-push inflation. However, according to proponents of greedflation, the price increases were disproportionate to the economic challenges, leading to a substantial rise in the profit margin of the firms and ultimately contributing to high inflation in the economy during the pandemic. In other words, greedflation refers to inflation caused by corporate greed.

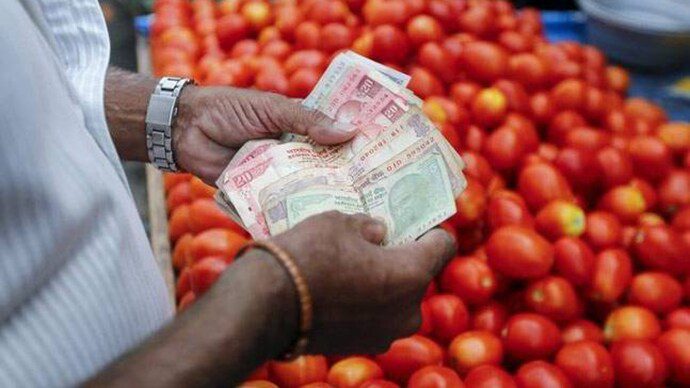

Recently, the inflationary pressure in India has led to a sharp increase in tomato prices across several cities. While some have attributed this surge to greedflation, it is necessary to understand the underlying factors behind the price hike.

What is Greedflation?

Greedflation is a term gaining prominence in the United States, where it is contributing to price hikes in the country. It refers to the inflationary trend driven by corporate greed rather than natural economic forces. This phenomenon occurs when large corporations raise prices on essential commodities to maximize their profit margins, disregarding the actual economic flow.

Impact of greedflation in Western Countries

While India has not experienced a significant rise in greedflation, countries like the United States and the United Kingdom have witnessed its adverse effects. Foreign companies operating in India may follow similar tactics to increase their profits by inflating prices, posing a potential threat to consumers.

Current Tomato Price Hike in India

The zonal wise average retail price of tomatoes collected from the Price Monitoring Division under the Union Ministry of Consumer Affairs is given in Table 1.

Table. 1: Zonal Wise Average Retail Price of Tomatoes

Source: Price Monitoring Division

According to the Price Monitoring Division, India has witnessed a tomato price hike of 114 percent in July 2023 when compared to the tomato prices in June 2023 (see Table 1). The recent surge in tomato prices in India cannot be attributed to greedflation. Instead, extreme weather conditions and low tomato yields are the primary factors driving up prices. Erratic weather patterns and supply shortages have resulted in a reduced tomato supply, leading to increased demand and subsequent price escalation.

As per past trends, there has been a spike in tomato prices during the June-July period of every year due to either bad weather or lack of rainfall, so the price will come down to normal levels when the yield is supported by good weather.

Privatization and the Risk of Greedflation in India

Although greedflation has not gained significant momentum in India, there is a concern that the ongoing privatization of industries may pave the way for its emergence. Without proper price regulations, private companies could potentially exploit consumers and inflate prices to boost their profit margins. It is crucial for the government to monitor and regulate prices to prevent such practices.

Need for Price Regulation

To safeguard consumers and the overall economy, the Indian government should consider implementing stringent price regulations. By doing so, they can ensure that essential commodities remain affordable and prevent the unchecked rise in prices driven by corporate greed. This proactive approach would help mitigate the risks associated with greedflation and maintain a balance between market dynamics and consumer welfare.

Way Forward

While tomato price hikes in India have raised concerns, they are not the result of greedflation. However, the concept of greedflation, driven by corporate greed rather than economic forces, is a growing concern in countries like the United States and the United Kingdom. As India moves towards increased privatization, it becomes essential to regulate prices effectively to prevent similar inflationary practices. By implementing appropriate measures, the Indian government can safeguard consumers, maintain economic stability, and mitigate the potential risks of greedflation.