Capital Market: What is it, Categories, Distinction From Money Market, Time Frame

Amongst the wide range of markets involved in the financial world, one of the most important is the capital market – a market where investments like stocks and bonds are bought and sold, connecting those with money to those in need of funds.

But for many, this market is like a puzzle with a variety of factors influencing it.

If this problem sounds similar, and if you’re looking to say goodbye to all your questions on capital market, read ahead:

Summary

- What is Capital Market?

- Categories of Capital Market

- Difference Between Capital Market and Money Market

- Timeframe in Capital Market

- Frequently Asked Questions

What is Capital Market?

In contrast, the capital market sets the scene for long-term financial affairs. It is the marketplace where stocks and bonds take centre stage.

These are assets intended for prolonged holding, sought after by financial institutions, seasoned brokers, and individual investors alike.

This realm echoes with activity—each fluctuation meticulously tracked and analysed. It serves as a barometer for the broader economy’s health, industry-specific insights, and future outlook.

Companies and institutions venture into the capital market with a singular goal: to amass funds for enduring, transformative purposes.

This often translates to expanding their businesses, enhancing revenues, and reaching new heights. They achieve this through the issuance of stocks and corporate bonds.

Categories of Capital Market

The capital market can be further divided into two categories:

- the primary market

- the secondary market

When a company issues stocks or new bonds and offers them directly to investors or institutions, it enters the primary market.

Later, when these buyers decide to sell their shares or bonds, the secondary market comes into play.

The original issuer does not profit immediately from these resales, though they naturally have a vested interest in the long-term trajectory of their stock prices.

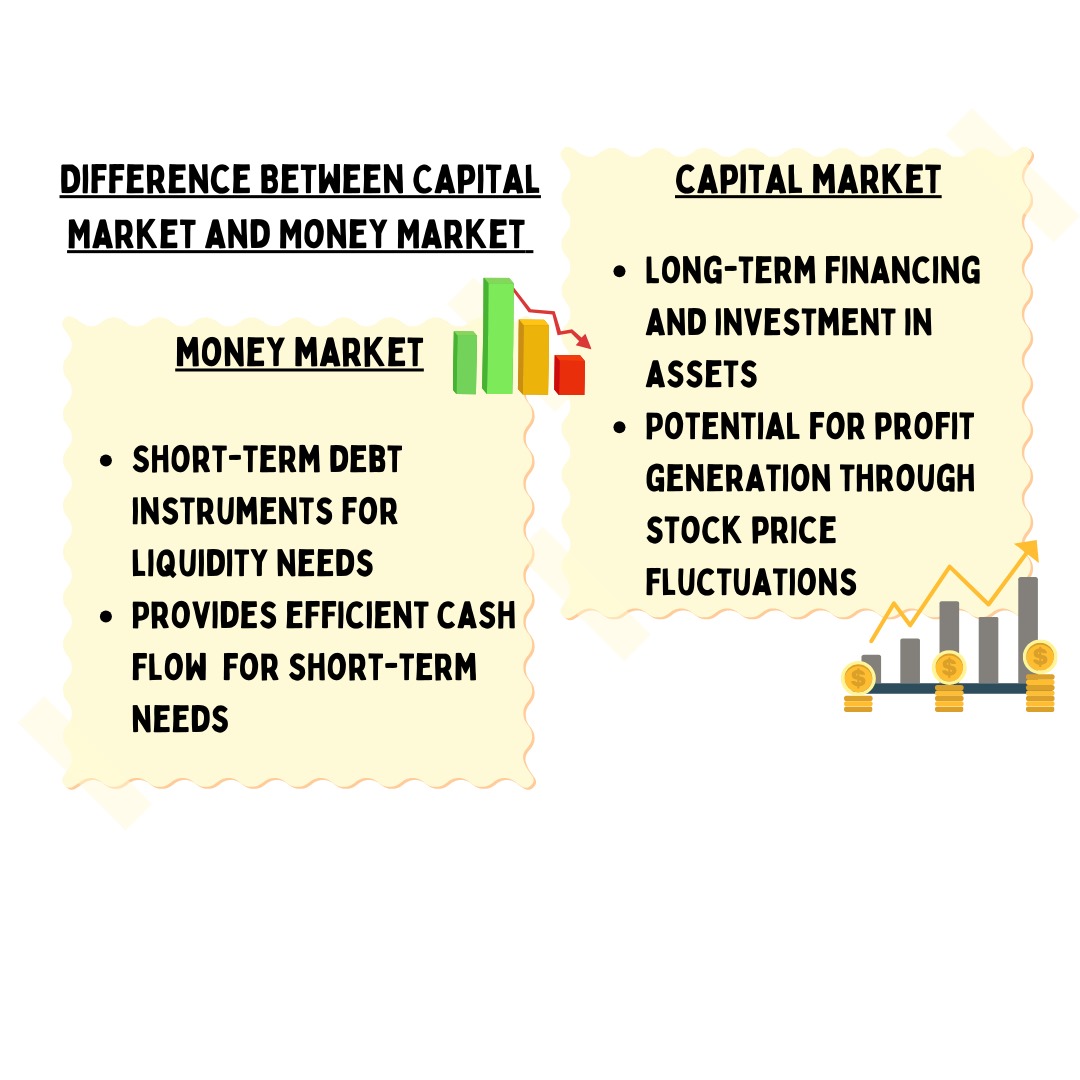

Difference Between Capital Market and Money Market

Since money market is a concept that’s often confused with capital market, here is a table that clarifies the difference between the two:

Aspect | Money Market | Capital Market |

Purpose | Short-term debt instruments for liquidity needs | Long-term financing and investment in assets |

Participants | Governments, corporations, banks, financial institutions | Financial institutions, seasoned brokers, individual investors |

Investment Horizon | Typically short-term, ranging from overnight to one year | Long-term assets for prolonged holding |

Instruments | Deposits, collateral loans, acceptances, bills of exchange | Stocks and corporate bonds |

Key Function | Facilitates short-term borrowing and lending | Serves as a platform for trading stocks and bonds |

Market Activity | Focused on daily operational needs and working capital | Tracks fluctuations, industry insights, and economic health |

Funding Objectives | Routine expenses and working capital | Fundraising for enduring, transformative purposes |

Market Segments | Federal Reserve, commercial banks, acceptance houses | Primary market (new stock and bond issuance), secondary market (resale) |

Profit Generation | Provides efficient cash flow for short-term needs | Potential for profit generation through stock price fluctuations |

Timeframe in Capital Market

In the capital market, time frames are durations for analyzing and trading financial instruments—short-term (intraday), medium-term (daily/weekly), and long-term (monthly/yearly). Traders and investors use these frames to make decisions based on market trends.

Short-term frames, like intraday charts, focus on daily price movements, ideal for day traders. Medium-term frames, such as daily or weekly charts, help identify trends over weeks or months. Long-term frames provide a broader perspective, aiding investors in understanding overall market direction for strategic decisions. Each frame caters to diverse strategies and goals.

To summarise it for you, the capital market is the stage for those with a longer investment horizon, where opportunities for greater rewards are met with heightened risks.

FAQs

- What is the capital market, and how is it different from the stock market?

The capital market is like a financial arena where companies and governments raise funds by selling securities like stocks and bonds. It’s like the big stage of finance, while the stock market is like one of the acts where stocks are traded.

- Why should I care about the capital market?

Well, the capital market affects more than just Wall Street. It influences interest rates, job opportunities, and the overall health of the economy. Plus, if you’re an investor, it’s where you can potentially make some moolah or lose some too.

- What’s the deal with stocks and bonds in the capital market?

Stocks represent ownership in a company, while bonds are like IOUs. Stocks can be exciting and volatile, while bonds are often seen as more stable. It’s a bit like the difference between a rollercoaster and a lazy river ride at an amusement park.

- How do I start investing in the capital market?

First, get your financial house in order – make sure you’re not drowning in debt. Then, do your homework, choose your investment strategy (stocks, bonds, or both), and open an investment account with a brokerage. It’s like preparing for a road trip, but with your money.

- Is the capital market a guaranteed way to get rich?

Nope, definitely not. It’s more like a wild adventure with twists and turns. There are risks involved, and no guarantees of striking it rich. But if you play your cards right and diversify your investments, you might just come out ahead in the long run.