HDFC Debit Card: Types, Eligibility Criteria, Features, Benefits, and More

Can you name a powerful financial tool that adds convenience to your life? We’ll give it away.

It’s the HDFC Debit Card!

Not only does this card offer a range of benefits, but it also offers features that enhance your financial experience. And that’s exactly what we’re going to cover!

Below, you will explore the various aspects of HDFC Debit Cards, including their types, features, benefits, application process, and more.

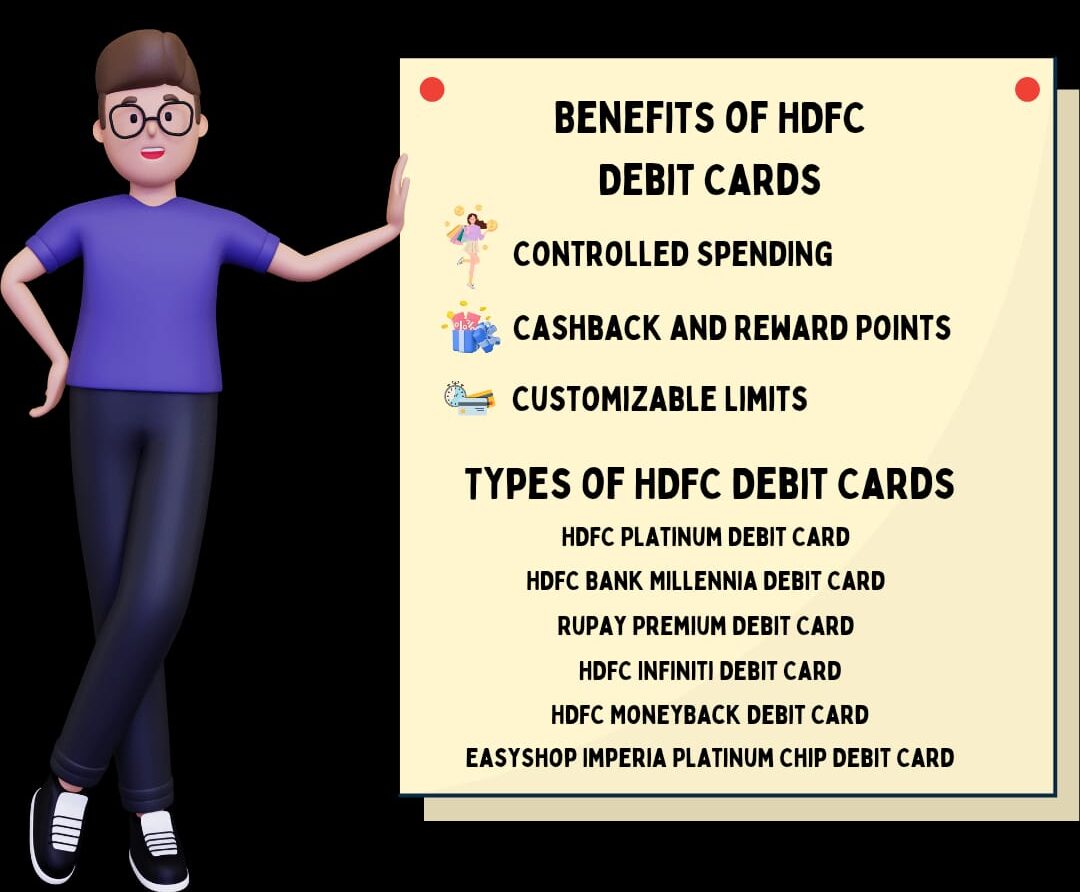

HDFC Debit Card Types

HDFC offers a range of debit cards that cater to different preferences and living styles. Let’s take a look at some of the top HDFC Debit Cards in 2023.

HDFC Platinum Debit Card

Annual Fee: Rs. 750

Key Features & Benefits:

- Daily domestic shopping limit: Rs. 5 lakh

- Daily domestic ATM withdrawal limit: Rs. 1 lakh

- 1 cashback point on every Rs. 100 spent on telecom & utilities

- 2 complimentary domestic lounge access per calendar quarter

HDFC Bank Millennia Debit Card

Annual Fee: Rs. 500

Key Features & Benefits:

- Daily domestic ATM withdrawal limit: Rs. 50,000

- Daily domestic shopping limit: Rs. 3.5 lakh

- 5% cashback points on shopping via PayZapp and SmartBuy

- 4 complimentary domestic airport lounge access annually

RuPay Premium Debit Card

Annual Fee: Rs. 200

Key Features & Benefits:

- Daily domestic ATM withdrawal limit: Rs. 25,000

- Daily domestic shopping limit: Rs. 2.75 lakh

- 20% instant discount on Swiggy & Amazon Pay on Fridays

- Up to 5% cashback on your transactions through PayZapp & SmartBuy

HDFC Infiniti Debit Card

Type: Invite-only card

Key Features & Benefits:

- Daily domestic ATM withdrawal limit: Rs. 2 lakhs

- Daily domestic shopping limit: Rs. 10 lakh

- Preferential forex markup fee of 0.99%

- Complimentary domestic lounge access in a quarter

- Complimentary air accidental insurance and zero-liability coverage

- Taj voucher worth Rs. 7,500 each quarter on spending Rs. 3 Lakhs or above in a quarter (offer valid only for the first year)

HDFC MoneyBack Debit Card

Annual Fee: Rs. 200

Key Features & Benefits:

- Daily domestic ATM withdrawal limit: Rs. 25,000

- Daily domestic shopping limit: Rs. 3 lakh

- Welcome voucher worth Rs. 500 on the first transaction on categories like entertainment & dining

- 5% cashback on your debit card on transactions via PayZapp & SmartBuy

EasyShop Imperia Platinum Chip Debit Card

Annual Fee: Rs. 750

Key Features & Benefits:

- Daily domestic ATM withdrawal limit: Rs. 1 lakh

- Daily domestic shopping limit: Rs. 5 lakh

- Issued to Imperia customers only

- 1 cashback point on every Rs. 100 spent on telecom & utilities

- 2 complimentary domestic lounge access per calendar quarter

Times Points Debit Card

Annual Fee: Rs. 650

Key Features & Benefits:

- Daily domestic ATM withdrawal limit: Rs. 1 lakh

- Daily domestic shopping limit: Rs. 3.5 lakh

- Complimentary access to Clipper lounges at airports across India

- 2 Times Points on every Rs. 150 spent

HDFC Bank Rewards Debit Card

Annual Fee: Rs. 500

Key Features & Benefits:

- Daily domestic ATM withdrawal limit: Rs. 50,000

- Daily domestic shopping limit: Rs. 3.5 lakh

- 5% savings on everyday spends on partner merchants

- Free Amazon Prime subscription/ Amazon voucher/ Flipkart voucher on reaching the spending milestone

Now that you’ve had a glimpse of the wide range of HDFC Debit Card offerings, let’s look into various aspects of these cards.

Eligibility Criteria for HDFC Debit Card

Simply put, to obtain an HDFC Debit Card, you need to meet the following eligibility criteria:

- Both Residents and NRIs can apply.

- You must hold either a Savings account, Current account, SuperSaver account, Salary account, or Loan against Shares account with HDFC Bank.

But you must note that the eligibility criteria mentioned are purely indicative. The type of debit card issued depends on factors such as

- minimum account balance

- account type

- your relationship with HDFC Bank

Features and Benefits of HDFC Debit Cards

HDFC Debit Cards offer several benefits that you need to know, which may vary depending on the specific card variant. Here are some general features and benefits shared by HDFC Debit Cards which might give you a good idea:

Controlled Spending

Debit cards are linked to your bank account. So as to ensure that you spend within your means, reducing the risk of falling into a debt trap.

Cashback and Reward Points

Like HDFC Credit Cards, HDFC Bank offers cashback and reward points on debit card transactions. This means that you can save while you spend and enjoy exclusive rewards with partnered brands.

Customizable Limits

Through HDFC NetBanking, you can adjust your withdrawal and shopping limits for POS and online transactions, eliminating the need to visit a bank branch for these modifications.

Debit Card EMI

HDFC Bank provides Debit Card EMI options for purchasing consumer durables or making high-value purchases, often with low-interest rates and no-cost EMI offers.

Additional Benefits

HDFC Bank Debit Cards come with

- complimentary lounge access

- insurance coverage

- entertainment benefits

- dining discounts

although the range of benefits may vary between card variants.

How to Apply for an HDFC Debit Card

Applying for an HDFC Bank Debit Card is a straightforward process. Here’s how you can do it online:

- Visit the official HDFC Bank website and navigate to the ‘Debit Cards’ section under personal/retail banking.

- Choose the specific debit card you want to apply for and click on ‘Sign Up/Apply Now.’

- Complete the application form by entering the required details, such as your mobile number, PAN, date of birth, and more.Submit the form and upload the necessary documents.

- After successful verification, you will receive your debit card along with the PIN, which you will need for every transaction.

Now let’s see how you can apply for it offline:

If you want to apply for an HDFC Debit Card offline, visit your nearest HDFC Bank branch. Fill out the application form and submit it along with the required documents. Upon approval, you will receive your debit card within 2-3 working days.

After following the steps mentioned in this guide, you’ll not face trouble dealing with anything related to HDFC debit cards.

Be it deeply understanding its features and benefits or learning how to get an HDFC debit card, this guide will always come in handy for you. Save it for later.

Keep checking out Newscanvass for more useful guides for your finances.