Credit Score: What is Credit Score, Steps to Check Your Credit Score & Benefits of Checking Your Credit Score

Interested in learning the steps to check your credit score and the incredible benefits that come with it? You’ve come to the right place!

Whether you’re new to the world of finance or looking to sharpen your credit knowledge, this article will equip you with valuable insights into why your credit score matters and how it can shape your financial future. Let’s start with what credit score is!

What Is Credit Score?

A credit score is your financial report card, predicting how well you handle money. It forecasts whether you’ll repay loans on time based on your credit history. Think of it as a trustworthiness rating.

Why does it matter? Companies use credit scores to decide if they should lend you money, give you credit cards, or rent you things like apartments. It also affects loan terms, like the interest rate you’ll pay and how much credit you can access.

How’s it calculated? Companies use a special maths formula called a scoring model. It looks at factors like your bill payment history, debt levels, types of loans, and more.

Here’s the twist: You don’t have just one credit score. It varies depending on the data used and the scoring model. Generally, a higher score means easier access to loans and better terms. Scores typically range from 300 to 850.

In essence, a credit score is your financial trustworthiness grade, influencing your ability to borrow and manage credit responsibly.

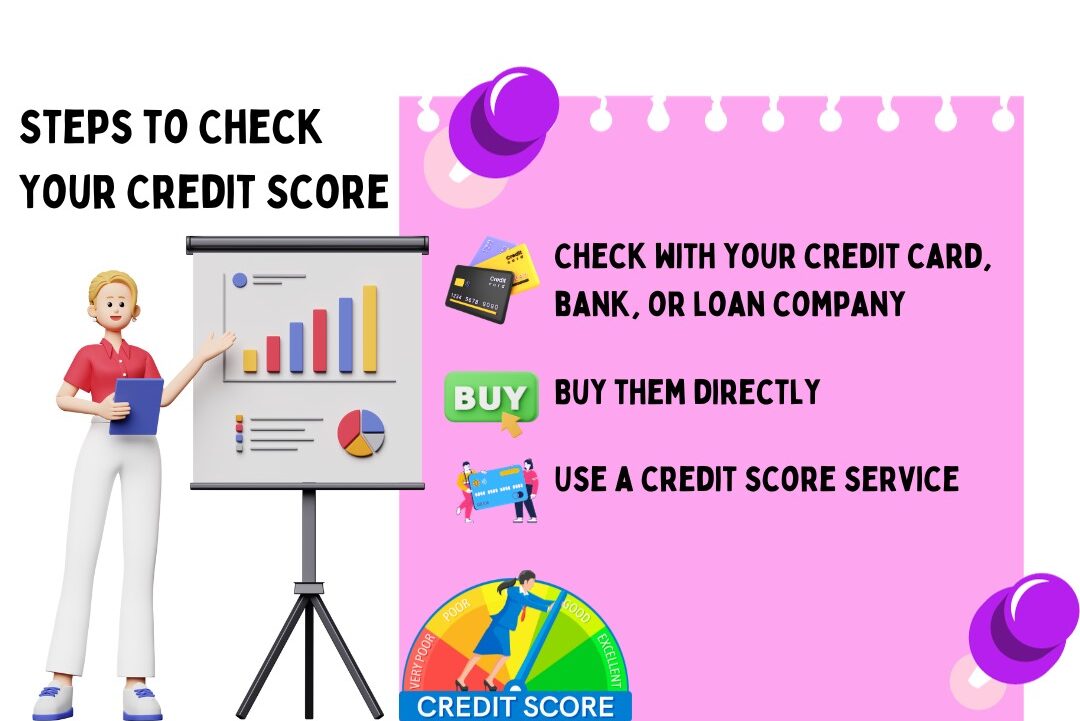

Steps to Check Your Credit Score

First off, you should know that you don’t have just one credit score. These scores are calculated based on the info in your credit reports, and there are different ways to calculate them.

Here’s how you can get your credit scores:

- Check with your credit card, bank, or loan company: Many of these businesses now provide credit scores to their customers. You might see it on your statement or access it online.

- Buy them directly: You can purchase your scores from major credit bureaus like Equifax, Experian, or TransUnion. Companies like FICO also offer them.

- Use a credit score service: Some websites offer free credit scores to users, while others charge a subscription fee for credit monitoring services.

Remember, besides checking your credit scores, it’s wise to regularly review your credit reports to make sure they’re accurate. You can get free credit reports every year from each of the three major credit bureaus.

Benefits of Checking Your Credit Score

Having a good credit score comes with a bunch of great benefits that can make your financial life smoother and more affordable. Let’s break down these advantages:

- Easier Apartment Rentals: A good credit score, usually around 700 or higher, can make it much easier to rent an apartment. Some landlords prefer tenants with good credit because it suggests financial responsibility. This can save you from needing a cosigner or paying a hefty security deposit.

- Lower Insurance Costs: Many insurance companies use your credit score to assess your risk. With a good score, you might qualify for lower premiums on car and homeowners insurance. This can result in significant savings over time.

- Cheaper Loans: When you need to borrow money for a car, home renovation, or business venture, a good credit score helps you secure loans with lower interest rates. This means you’ll pay less in interest over the life of the loan. For a mortgage, it could save you thousands of dollars.

- Financial Flexibility: A good credit score opens doors when you need credit in a pinch. You’re more likely to qualify for credit cards with introductory 0% APR offers, which can be a lifesaver during big life changes, like a move or home remodel.

- Access to the Best Rewards: High-quality rewards credit cards usually require good credit. With a good score, you can enjoy perks like cashback, travel rewards, and exclusive access to events. Some top-tier cards even offer freebies like streaming services and swag.

- Reputation Matters: A good credit score attracts offers to refinance debt, upgrade credit cards, and more. Plus, some employers in certain states check credit reports when making hiring and promotion decisions. Demonstrating financial responsibility can be an asset in the workplace.

- The Most Important Habit: If you’re aiming for a good credit score, the key is simple: pay your bills on time. Timely payments are the most significant factor in your credit score, so making sure you never miss a due date is crucial.

That concludes our discussion on credit scores, how to check them, and the benefits of doing so.

Remember,your credit score is like your financial report card, influencing your access to loans, rental opportunities, insurance costs, and more.

Regularly monitoring it can help you make informed financial decisions and secure a brighter financial future. If you have any more questions or need further guidance, feel free to ask!