Gold Overdraft Loans: 5 Lucrative Benefits For Financial Flexibility

In the world of money matters, convenience and adaptability reign supreme. That’s where

the concept of a gold overdraft loans comes into the picture.

Recently, gold loans have taken the spotlight for their easy accessibility, minimal paperwork,

and appealing interest rates. And in this arena, the gold overdraft loan facility stands tall as

an all-around option, granting borrowers speedy fund access while using their gold assets as

leverage.

So, let’s take a closer look at gold overdraft loans, understand what they entail, explore their

benefits, and learn how you can make the most of them.

Unraveling the Gold Overdraft Loans Essence

Imagine this: you can put your gold to work as collateral and secure an overdraft gold loans

facility. That’s the essence of a gold overdraft loan. Instead of parting ways with your gold

permanently, you can use it as a financial cushion.

By pledging your gold, a lending institution extends a credit limit against its value. This limit operates like an overdraft setup, allowing you to withdraw funds as and when needed, up to the specified cap.

The Upsides of a Gold Overdraft Loans Facility

1. Friendly Interest Rates

One of the most attractive features of a gold overdraft loans is the favorable interest rates,

often lower than other borrowing avenues. This makes it a smart option for those seeking

financial help without sinking into heavy debt.

2. Flexi-Repayment Choices

Unlike traditional loans or credit cards that adhere to rigid repayment timelines, an overdraft

loans hand you the reins of repayment. Pick a plan that syncs perfectly with your financial

situation.

3. Swift Cash Access

Need funds in a hurry? Gold overdraft loans are your go-to solution. Once your credit cap is

set, you can draw funds on demand, without the lengthy approval waits.

4. No Credit Checks Needed

Unlike personal loans or credit cards, overdraft gold loans sidestep the need for credit

checks. The loan’s security rests on your gold holdings, minimizing dependence on your

credit history.

5. Collateral-Free Borrowing

While loans typically demand collateral, overdraft gold loans give you an edge. You can

borrow sans the need for additional security, making it an accessible option for those without

conventional collateral.

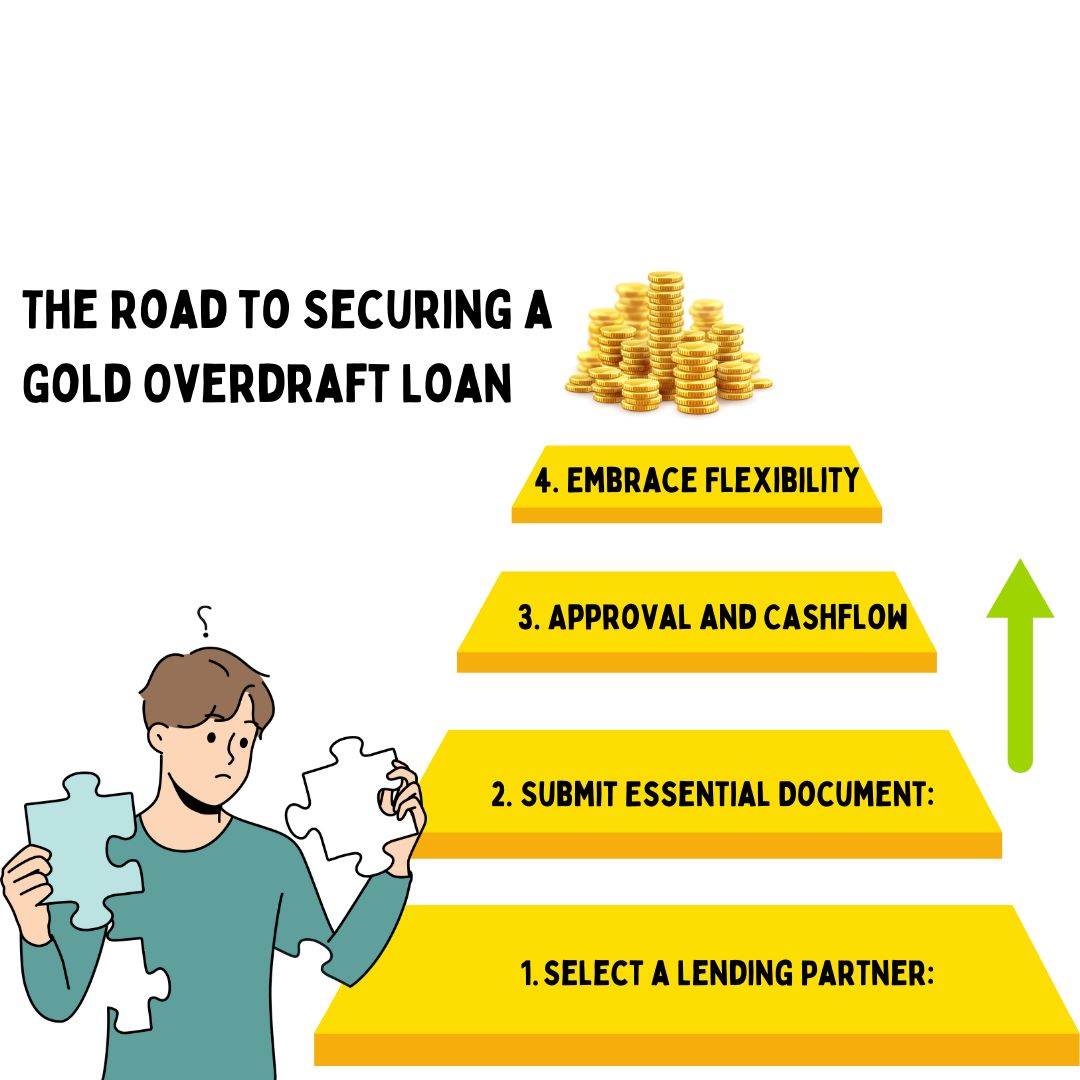

The Road to Securing Gold Overdraft Loans

Applying for an overdraft gold loans is a breeze. Here’s a quick guide:

1. Select a Lending Partner

Begin by finding a financial institution offering gold overdraft loans. Research their terms,

interest rates, and customer feedback to ensure it aligns with your needs.

2. Submit Essential Documents

Fill out application forms and furnish documents like proof of identity, address, and proof of

gold ownership. The lender will evaluate your gold’s worth to determine your credit limit.

3. Approval and Cashflow

Once your documents are verified, and your gold’s value assessed, you’ll get the green light

for your gold overdraft loans. Your credit cap will be established, and you can withdraw funds

as required.

4. Embrace Flexibility

With your credit cap set, you can tap into funds whenever the need arises, up to the

specified limit. Repayments can be tailored to match your financial capacity.

To sum it up, the gold overdraft loan facility offers a savvy solution for those chasing quick,

adaptable access to funds. Its lower interest rates, collateral-free borrowing, and

customization perks position it as a handy choice in the financial arena.

Before you take the plunge, scout various lenders to find the one that perfectly aligns with

your financial needs.

So, if you’re facing a cash crunch and have gold treasures to your

name, the gold overdraft loan facility might just be your route to financial empowerment and

adaptability.