Government Bonds: What is it, Types, Pros and Cons

Are you tired of unreliable saving options? If yes, you could benefit greatly from shifting your gaze to government bonds. In today’s date, for both new and experienced investors, government bonds are a smart investment choice.

But, hold on right there, an investment option may be smart, but it is always good to know its in and out. That’s exactly what we will help you do in this article.

(If you want to learn about Post Office Investment Scheme, click here.)

Let’s uncover what government bonds are.

What are Government Bonds?

A government bond is like an IOU note from a government. It’s a way for the government to raise money to pay for things it needs or has promised to do. These bonds usually pay you back with extra money called interest over time. People like to invest in them because they’re pretty safe bets – after all, they’re backed by the government itself. If a country’s government issues these bonds, they might also be called sovereign debt.

Now that you have a clear idea of what government bonds are, let’s take a look at the pros and cons of government bonds.

Types of Government Bonds

These are the types of Government Bonds in India that you must know about.

Fixed-rate bonds:

- These bonds offer a set interest rate throughout the investment period, regardless of changes in the market rates.

Floating Rate Bonds (FRBs):

- The interest rates on these bonds change periodically based on pre-declared intervals, providing flexibility to investors.

Sovereign Gold Bonds (SGBs):

- Investors can invest in gold through these bonds without the need for physical gold ownership. Interest earned is tax-exempt, and prices are linked to gold prices.

Inflation-Indexed Bonds (IIBs):

- These bonds adjust both the principal and interest according to inflation rates, protecting investors from the effects of inflation.

7.75% GOI Savings Bond:

- Introduced as a replacement for the 8% Savings Bond, these bonds offer an interest rate of 7.75% and are available for specific entities.

Bonds with Call or Put Option:

- Issuers or investors have the option to buy back or sell bonds on a designated interest disbursal date, providing flexibility in managing investments.

Zero-Coupon Bonds:

- These bonds do not pay regular interest but are sold at a discount and redeemed at face value, offering potential earnings through price difference.

Now that you know about the different types of government bonds, let’s take a look at the advantages and disadvantages of it. It will help you have a holistic outlook.

Pros and Cons of Government Bonds

There are both benefits and disadvantages of government bonds. Let’s check out both of them here.:

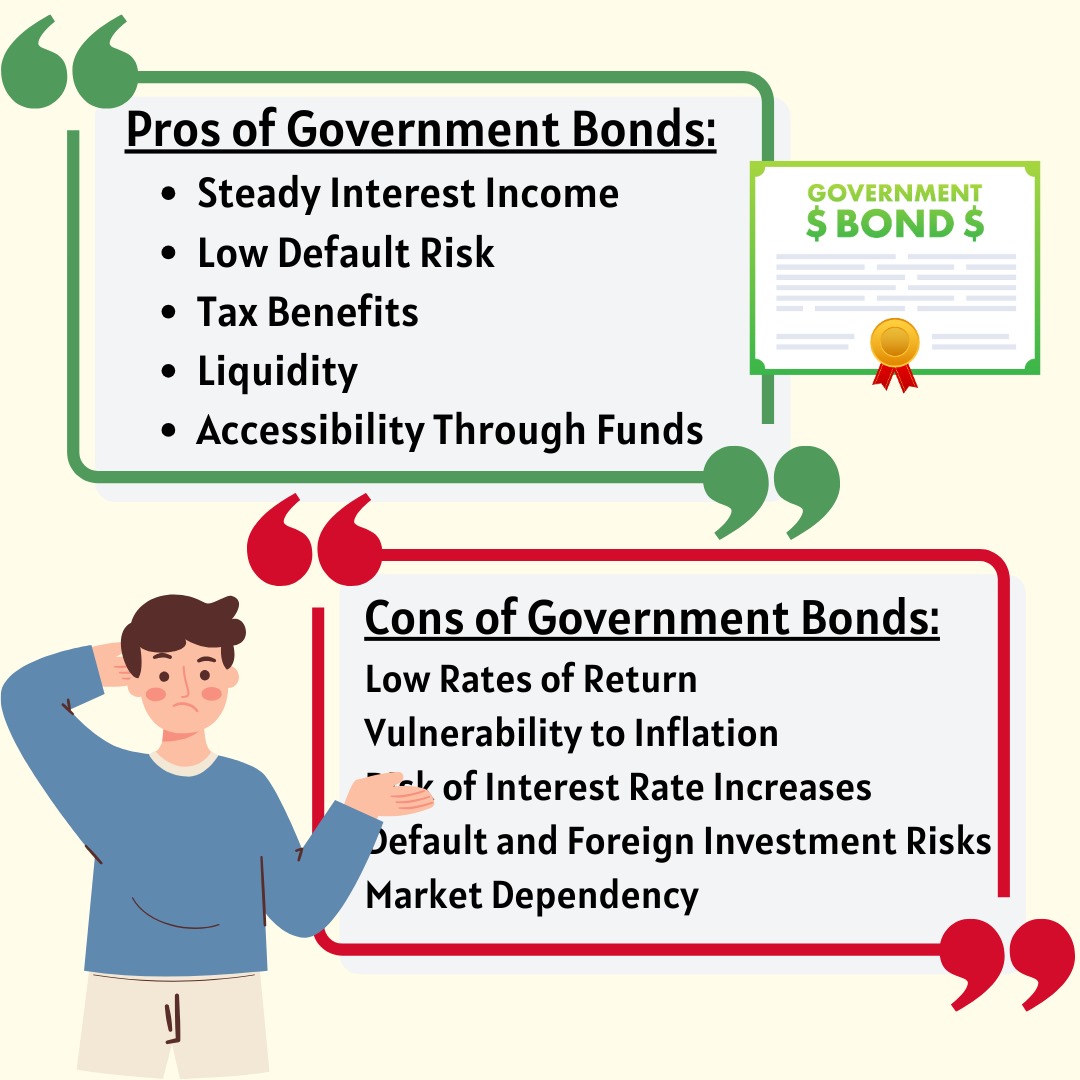

Pros of Government Bonds:

Steady Interest Income:

Government bonds provide a consistent stream of interest income, offering stability to investors seeking regular returns.

Low Default Risk:

U.S. government bonds are considered low-risk investments, as the likelihood of the government defaulting on its debt obligations is minimal.

Tax Benefits:

Some government bonds, such as certain U.S. Treasury bonds, are exempt from state and local taxes, allowing investors to keep more of their earnings.

Liquidity:

The market for government bonds, especially U.S. Treasury bonds, is highly liquid, meaning investors can easily buy and sell them on the secondary bond market.

Accessibility Through Funds:

Investors can access government bonds through mutual funds and exchange-traded funds (ETFs), providing diversified exposure to these securities.

Cons of Government Bonds:

Low Rates of Return:

Government bonds typically offer lower returns compared to riskier investments like stocks, potentially resulting in lower overall investment growth.

Vulnerability to Inflation:

Fixed-rate government bonds may lose purchasing power during periods of rising inflation, as the interest earned may not keep pace with increasing prices.

Risk of Interest Rate Increases:

If market interest rates rise after purchasing government bonds, their value may decline, especially for fixed-rate bonds issued before the rate hike.

Default and Foreign Investment Risks:

Investing in foreign government bonds carries additional risks, including the possibility of default, currency exchange rate fluctuations, and differing tax implications.

Market Dependency:

The performance of government bonds is influenced by market conditions, economic factors, and government policies, making them susceptible to external factors beyond investors’ control.

After looking at the advantages and disadvantages of government bonds, it is the perfect time to look at whether you should invest in government bonds.

Should You Invest in Government Bonds?

If you’re someone who doesn’t like taking big risks with your money and prefers investments that are very safe, then government bonds could be a good option for you. These bonds are backed by the government itself, so they’re considered one of the safest investments you can make in India.

Especially if you’re new to investing or you’re not comfortable with the ups and downs of the stock market, government bonds can be a great choice. They’re also good for people who want to make sure they’re getting decent returns on their investments without too much risk.

Even if you already have other investments, adding government bonds to your portfolio can help spread out the risk and give you some extra peace of mind.

The Indian government is also making it easier for regular people to invest in government bonds. They’ve introduced things like Non-Competitive Bidding, which lets you bid and invest in bonds through certain websites and mobile apps, as long as you have a Demat account.

So, if you’re looking to diversify your investments or you’re just starting out as an investor, government bonds could be a smart choice for the extra money you have.