How to Save Money From Salary? 6 Easy Tips With Practical Use Cases

How to save money from salary every month? This is a question many people ask, but not everyone understands that whether you’re earning a modest Rs.10,000 or a hefty Rs. 1,00,000 as a salary, you need to inculcate the habit of saving for a brighter financial future.

This means that to answer how to save money for future, you don’t need a heavy income flow every month. All you need is discipline in the way you spend.

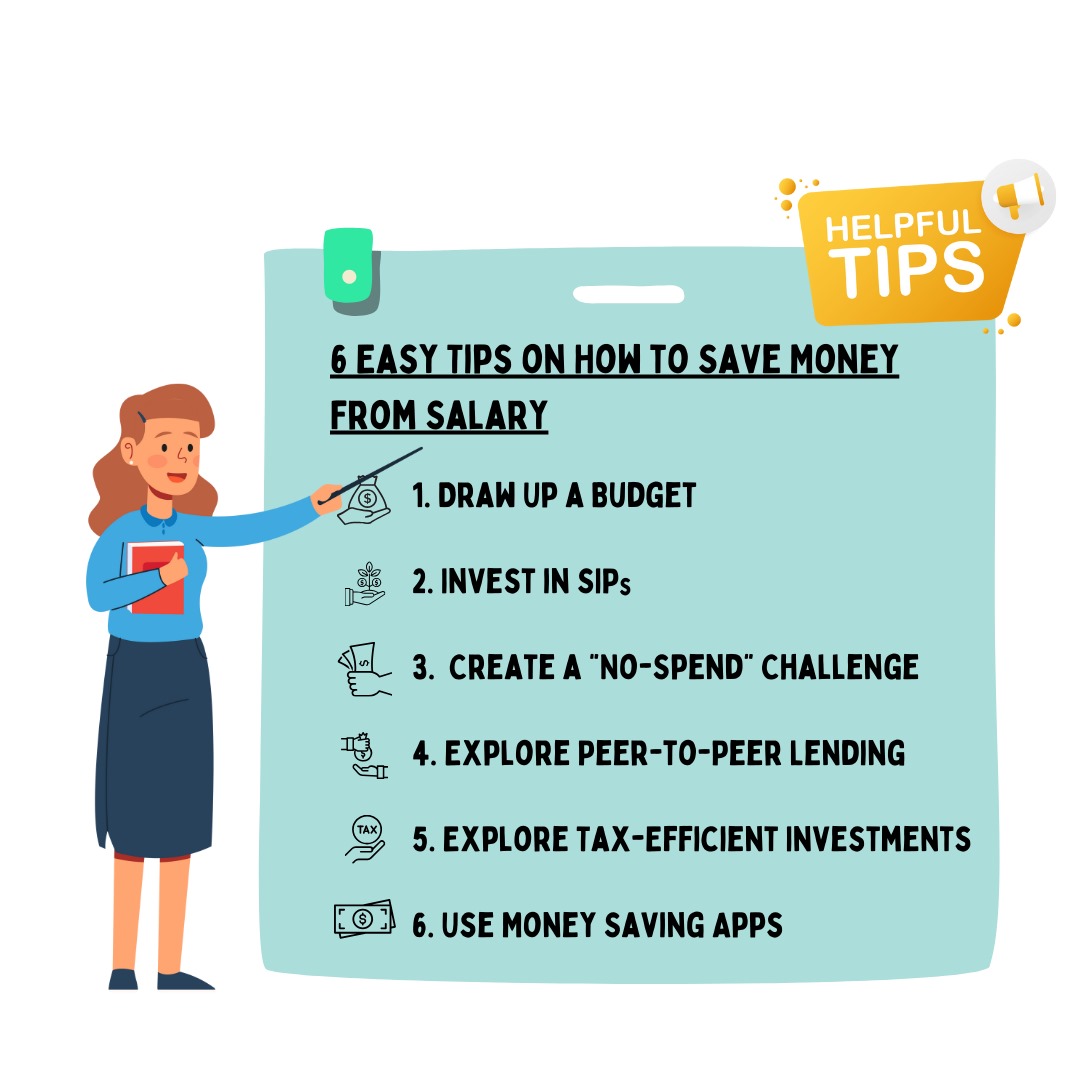

Inspirational investor Warren Buffet once said, “Do not save what is left after spending, but spend what is left after saving.” Keeping this in mind, let’s get to the top 6 easy tips followed by practical use cases on how to save money from salary.

To take the first step towards a brighter financial future, read ahead:

Summary

- Draw Up a Budget

- Invest in SIPs (Systematic Investment Plans)

- Create a “No-Spend” Challenge

- Explore Peer-to-Peer Lending

- Explore Tax-Efficient Investments

- Use Money Saving Apps

1. Draw Up a Budget

If you want to know how to save each month, then you must start with budgeting. Effective money management begins with a budget. Record your income and expenses to understand how much you can save each month.

Identify areas where you can cut discretionary spending, like dining out or impulsive shopping, and redirect those funds to your savings.

Practical use case for students:

Creating a budget can be particularly helpful for students. By meticulously tracking their income from part-time jobs and expenses such as textbooks and rent, students can ensure they have enough money for essentials and avoid overspending, ultimately reducing financial stress. Remember, budgeting is the primary answer to how to save money each month.

2. Invest in SIPs (Systematic Investment Plans):

Consider starting a Systematic Investment Plan (read more on what they are here) in mutual funds. SIPs allow you to invest small, regular amounts, which can grow into significant savings over time due to the power of compounding.

Practical use case for the elderly:

Investing in SIPs is a great choice for long-term financial goals like retirement planning. By consistently putting a small portion of your income into mutual funds, you can harness the magic of compounding to build a substantial nest egg for your golden years. So now you know that answering how to save money from salary isn’t just about saving, but about investing as well.

3. Create a “No-Spend” Challenge

Challenge yourself to a “no-spend” week or month. During this period, avoid all non-essential expenses and redirect the money you would have spent into savings. It’s a fantastic method to get your savings going. Although this might sound rough, a no-spend challenge can be your best friend while answering how to save money from your salary every month.

Practical use case for recreation purposes:

Implementing a “No-Spend” Challenge can be incredibly beneficial when you’re saving for a specific goal, like a vacation. By temporarily cutting out non-essential expenses, you can quickly accumulate the funds needed for your dream getaway and enjoy it without worrying about post-trip debts.

Also Read: Planning a Home Budget: Know The 12-Step Guide For Your Dream Home

4. Explore Peer-to-Peer Lending

Consider peer-to-peer lending platforms where you can lend your money to individuals or small businesses in exchange for attractive interest rates. This can diversify your income streams and provide a steady return on your investment. Read more on what is interest rate here.

Practical use case for investing:

Exploring peer-to-peer lending can be a smart move for investors looking to grow their money. By participating in these platforms, you can potentially earn higher interest rates than traditional savings accounts, increasing your overall income while helping others secure loans for their needs. This understanding will complement your knowledge of how to save money from salary.

5. Explore Tax-Efficient Investments

Invest in tax-efficient instruments like PPF (Public Provident Fund) and tax-saving fixed deposits. These investments not only help you save but also offer tax benefits, increasing your effective returns.

Practical use case for long-term goals:

One practical use case for tax-efficient investments is for individuals looking to reduce their tax liability while saving for long-term goals, such as retirement or children’s education.

Instruments like PPF and tax-saving fixed deposits provide a dual advantage of wealth accumulation and tax savings, allowing you to make the most of your money in a tax-efficient manner.

6. Use Money Saving Apps

Technology has made saving more accessible. Many apps offer reminders, progress tracking, and even rewards for meeting your saving goals. The Fi Money app, for instance, encourages better financial habits, categorizes expenses, and provides insights to help you manage your money more efficiently.

Practical use case for planning an important event:

Money-saving apps are particularly useful for those planning a wedding. These apps can help engaged couples budget for their big day by categorizing expenses, setting spending limits, and sending reminders to ensure they stay on track and don’t overspend during the wedding planning process. Money-saving apps can help you set yourself on the path to answering how to save money for future.

So, these tips are going to help you satisfactorily answer how to save money from salary. These easy tips can help you save money from your salary while also positioning yourself for higher returns and long-term financial security. Remember, the key is to tailor your approach to your individual financial goals and circumstances.