Max Life Insurance Premium Payment: Check Out Your 2 Easy Options

Are you confused about how you’ll make your Max Life Insurance Premium Payment? You don’t have to be puzzled. If you are a Max Life Insurance user, you get a couple of easy options to pay your premium. And we’ll be covering the same in this article.

But before we get down to the brass tacks, let’s look at what the benefits of Max Life Insurance are. But if you want to know about your payment options straight, you can directly jump to that section.

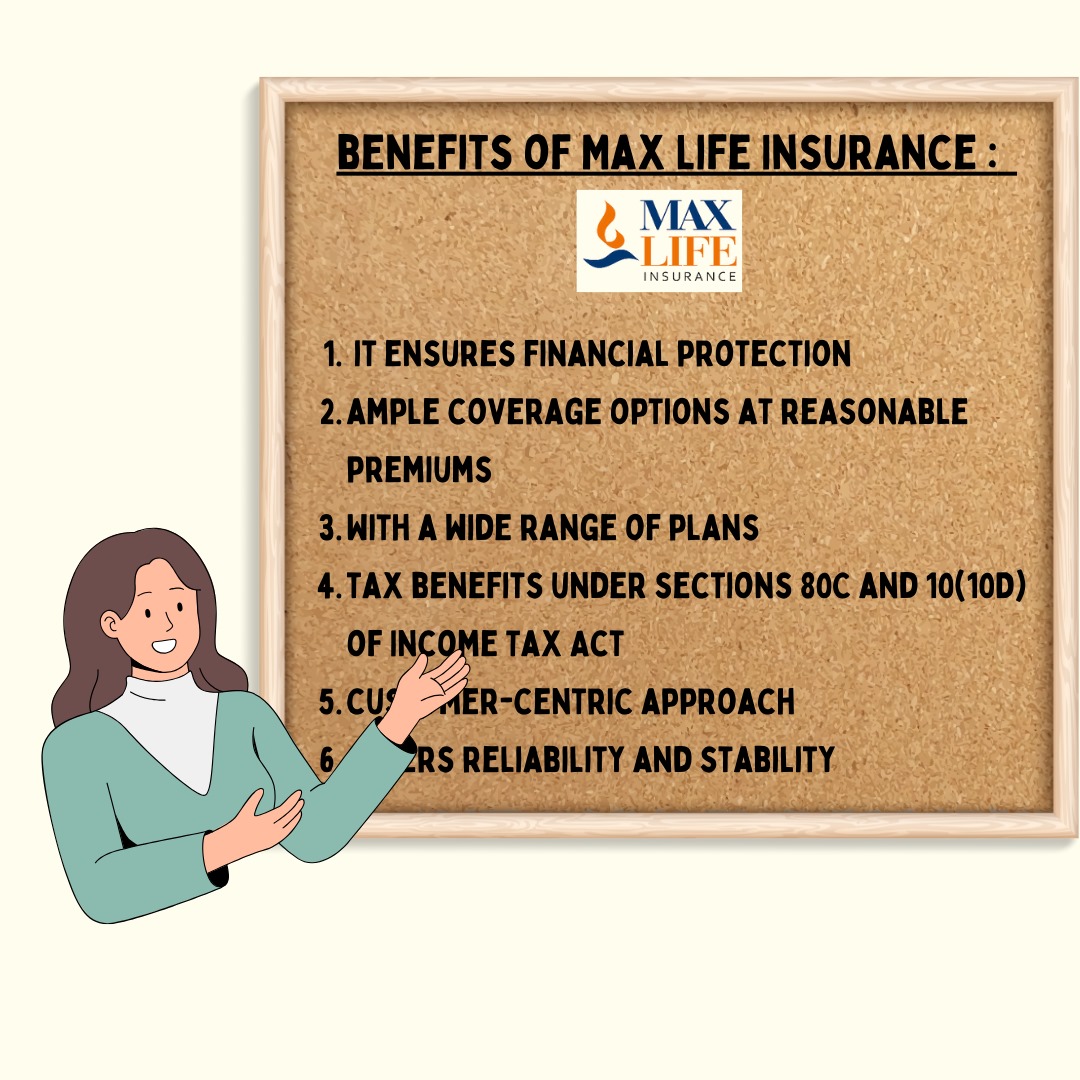

What Are the Benefits of Max Life Insurance?

Max Life Insurance provides a host of benefits to you.

- Firstly, it ensures financial protection, securing the family of the policyholder against unforeseen events.

- It offers ample coverage options at reasonable premiums, allowing policy buyers to choose plans that suit their needs.

- With a wide range of plans, Max Life Insurance caters to diverse requirements, ensuring that customers find options tailored to their preferences.

- A significant advantage of Max Life Insurance policies is the tax benefits they offer under sections 80C and 10(10D) of the Income Tax Act, aiding in financial planning and reducing tax liabilities.

- Max Life Insurance distinguishes itself through its customer-centric approach and commitment to service delivery. With a robust solvency ratio of 190% and an impressive persistence ratio of 84.1%, it demonstrates financial stability and long-term commitment to policyholders.

- With assets under management (AUM) totaling Rs. 1,22,857 crore and a substantial Sum Assured of Rs. 1,397,142 crore, Max Life Insurance offers reliability and stability, making it a wise choice for individuals seeking comprehensive insurance coverage and financial security for their families.

Now that you know about the loads of benefits that come with Max Life Insurance, let’s take a look at the crux of the matter – your top two options for Max Life Insurance Premium Payment.

Top 2 Options For Max Life Insurance Premium Payment

Max Life Insurance offers several convenient options for paying premiums. Here are the top two options among them:

- Auto Debit:

The most recommended method is setting up auto-debit, ensuring a quick and hassle-free process.

Auto-debit options include:

- NACH

- Online standing instructions (SI) on credit cards

- Direct debit

- Through Website:

Alternatively, you can pay premiums online through their website. Over-the-counter payments are accepted at Max Life branches, Axis Bank, and Yes Bank.

Additionally, they provide the flexibility to make payments through

- EBIX counters

- Common Service Centres (CSCs)

- Request a cheque pickup service

These options streamline the premium payment process, enhancing your convenience and satisfaction as a customer.

Now that you know the options for Max Life Insurance Premium payment, let’s take a look at how you can download the premium receipt.

How to Download the Max Life Insurance Premium Payment Receipt?

To download your Max Life Insurance premium receipt, follow these steps:

- Visit the Official Website of Max Life Insurance: Access the Max Life Insurance website through your preferred web browser.

- Navigate to ‘Customer Services’: Once on the website, locate the ‘Customer Services’ section. This is usually found in the main navigation menu or under a specific section dedicated to policyholders.

- Click on ‘Download Premium Receipt’: Under the ‘Customer Services’ section, look for the option labelled ‘Download Premium Receipt’ and click on it.

- Provide Required Details: You’ll be prompted to enter specific details such as your policy number, mobile number, date of birth, etc. Ensure that the information you provide is accurate and matches the details associated with your policy.

- Generate Statement: After entering the required details, click on the ‘Generate Statement’ link. This action will prompt the system to process your request, and your premium receipts will be made available for download.

- Download Receipt: Once the statement is generated, you’ll be able to view and download your premium receipts from the website.

By following these simple steps, you can easily access and download your Max Life Insurance premium receipts whenever needed. If you encounter any difficulties during the process, consider reaching out to Max Life Insurance’s customer support for assistance.

This is all that you needed to know for Max Life Insurance Premium Payment. If you follow the steps in this article with precision, you’ll not face trouble in paying your premium. Additionally, If you want to take a look at how insurance premium calculators work, you can click on this article – HDFC health insurance premium calculator.

Frequently Asked Questions

1. What is the Max Life Insurance customer helpline number?

To reach Max Life Insurance customer helpline, you can email them at claims.support@maxlifeinsurance.com or call them during business hours (Monday to Saturday) between 09:30 AM and 06:30 PM. Here are the numbers you can dial: 0124 421 9090 Extension 9699, 74289 89574, 74289 89554, or 1860-120-5577. These numbers are not toll-free.

2. How can I check my Max Policy details?

You have several options to check your Max Life Insurance policy details:

- Customer Care:

Call 1860 120 5577 and provide your policy number to the executive for assistance

- Online Portal:

Register on www.maxlifeinsurance.com to access your policy details and utilize self-service options.

- Branch Visit:

Visit the nearest branch if you prefer in-person assistance.

- SMS:

Send your policy number (in xxxx format) to a specified number from your registered mobile number to receive details via SMS.

For convenient and quick access, using the online customer portal is recommended.

Follow these steps to check your policy details online:

- Visit www.maxlifeinsurance.com.

- Click on ‘Customer Login’ and provide necessary personal information.

- Enter OTP received on your registered mobile/email.

- Access comprehensive policy information, make premium payments, update personal details, and more.

For further assistance or inquiries, you can contact Max Life Insurance via call, email, SMS, or by visiting a branch office during business hours.

These are all the questions people have asked frequently. For all your needs related to your financial planning journey, follow NewsCanvass where you’ll find all the important listicles and guides.