How to Use Star Health Insurance Premium Calculator in 6 Easy Steps?

Are you planning on getting Star Health Insurance? But don’t know how to calculate the premium? We got you! You don’t have to go through difficult manual calculations. You just need to fill in some details in the Star Health Insurance Premium Calculator. And in this article we’ll explain to you how this calculator works.

But before we get to the steps on how to use the Star Health Insurance Premium Calculator, let’s take a look at what star health insurance is.

What is Star Health Insurance?

Star Health Insurance is like a safety net for your medical expenses. You pay a fee to the insurance company, and if you get sick or hurt, they help cover your medical bills. It’s there to support you when you need medical care.

In return, if you need medical treatment, the insurance company helps cover the cost according to the terms of your policy. It gives you financial support during times of illness or medical emergencies.

What Are the Different Star Health Insurance Plans?

There are several different types of Star Health Insurance Plans. Let’s see them one at a time:

- Individual Health Insurance Plan:

This plan provides coverage for one person and includes expenses related to injuries, illnesses, diseases, accidents, pre- and post-hospitalization expenses, day care procedures, and more.

- Family Floater Health Insurance Plan:

This plan covers the entire family, including the insured, spouse, children, and sometimes parents or parents-in-law. The sum insured floats among family members, covering pre- and post-hospitalization expenses, medical check-ups, and more.

- Group Health Insurance Plan:

Designed for groups like company employees, this plan covers medical expenses for individuals and families, including in-patient hospitalisation, pre-existing diseases, specific illnesses, maternity, and more.

- Senior Citizen Health Insurance Plan:

Specifically for individuals aged 60 and above, this plan covers pre- and post-hospitalization expenses, treatments like chemotherapy, radiotherapy, dialysis, orthopaedic implants, and more.

- Women’s Health Insurance Plan:

This plan is tailored for women’s health needs, covering pre- and post-hospitalization expenses, AYUSH therapies, organ donation charges, pregnancy care, delivery, newborn care, and more

6. Critical Illness Health Insurance Plan:

Offers lump sum compensation for critical illnesses like cancer, stroke, brain tumour, and kidney failure, covering hospitalisation expenses and modern treatments.

7. Top-up Health Insurance Plan:

Purchased to enhance coverage of existing health insurance plans, it offers additional benefits and coverage for medical expenses beyond the regular plan’s limit.

Star Health Insurance also provides customised policies for individuals with specific health conditions such as diabetes, heart surgery patients, cancer patients, and children with autism. These policies offer exclusive coverage and benefits tailored to the individual’s needs.

Now that you know what star health insurance is and what are its different plans, let’s take a look at the factors that influence the premium of Star Health Insurance.

What Factors Influence the Premium of Star Health Insurance?

Based on the provided text, the factors influencing the premium of Star health insurance include:

- Medical History:

Individuals with pre-existing conditions may face higher premiums. Plans may also consider current health status, family history, and lifestyle habits.

- Age:

Premiums tend to increase with the age of the insured due to higher risks of illnesses associated with aging.

- Gender:

Female candidates generally have lower premiums compared to males due to lower risks of certain health conditions.

- Policy Term:

Longer policy terms result in higher premiums, although insurers may offer discounts for longer tenures.

- No Claim Bonus (NCB):

Policyholders receive discounts on renewal premiums if no claims were made in the previous policy year.

- Lifestyle:

Individuals who smoke or drink regularly may face higher premiums due to increased risk factors associated with their lifestyle.

These are the top 6 factors that influence the premium of your Star Health Insurance. Now it’s about time we look at the benefits of Star Health Insurance Premium Calculator.

What Are the Benefits of Star Health Insurance Premium Calculator?

Star Health Insurance Premium Calculator is a simple device that gives you the exact premiums you have to pay. Not just Star Health Insurance, other health insurances also have their respective calculators such as – LIC Health Insurance Premium Calculator and HDFC Health Insurance Premium Calculator (click on the links to find out).

Here are few of the many benefits of Star Health Insurance Premium Calculator:

1. Comparison Made Easy:

It helps you compare different health insurance plans from Star easily so you can find one that fits your budget.

2. Smart Choices:

You can see the costs of various plans upfront, making it easier to choose the best one for your health and wallet.

3. Fast and Simple:

No need to spend time crunching numbers manually. You can quickly check premiums for multiple plans in one place.

4. Tailored Coverage:

You can see how adding extra features affects your premium, allowing you to customise your policy to suit your needs.

5. Totally Free:

It doesn’t cost anything to use, giving you access to accurate quotes without spending a penny.

These are the prime benefits of Star Health Insurance Premium Calculator. Now let’s take a look at how you can access the Star Health Insurance Premium Calculator.

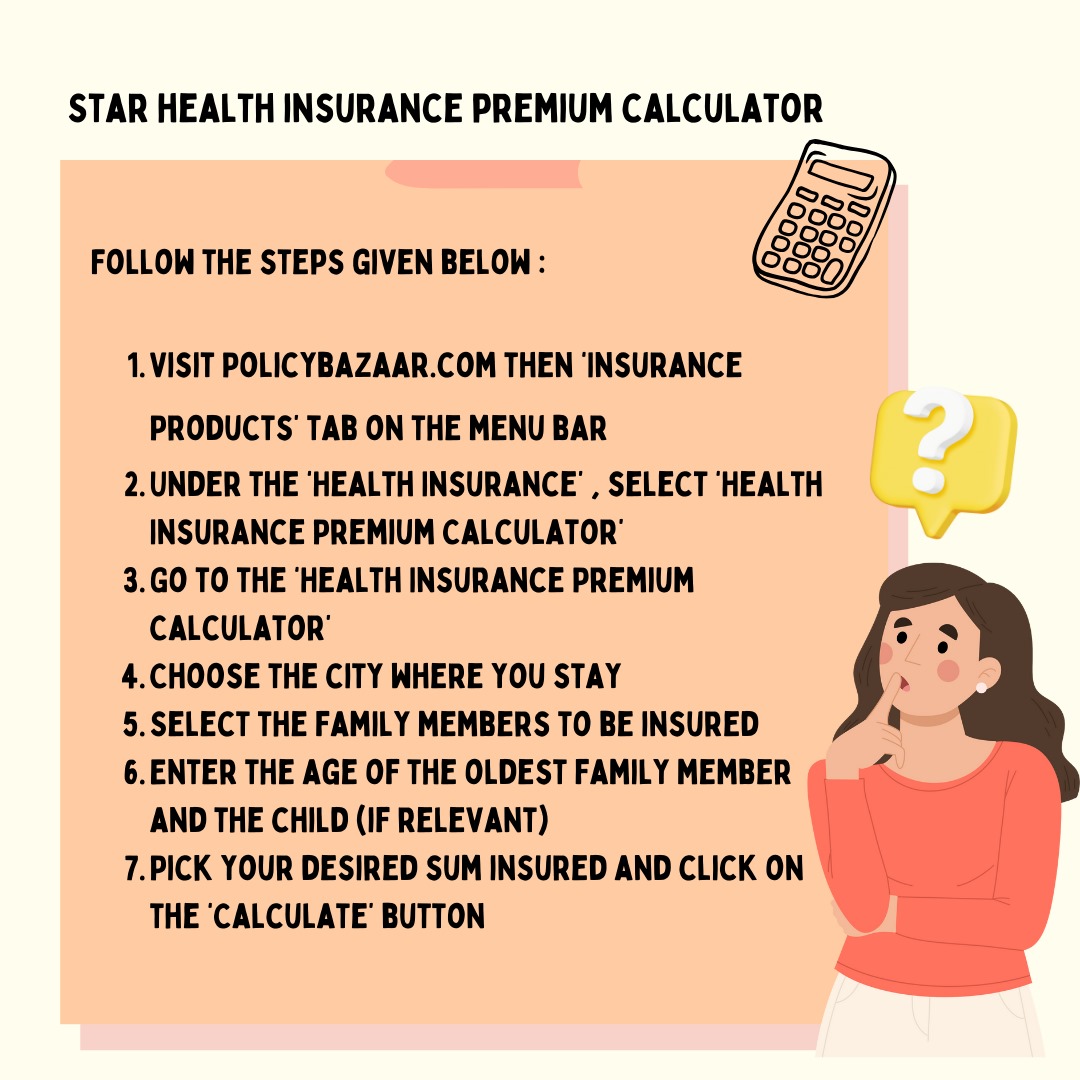

How to Utilize the Star Health Insurance Premium Calculator?

To use the Star Health Insurance Premium Calculator, follow these instructions:

- Go to the official Star Health Insurance website or click on the linked page above.

- Select either “I wish to purchase” or “I wish to renew” according to your requirements.

- Input your personal information like Name, Date of Birth, Mobile Number, Pincode, and the number of individuals to be insured.

- Select the “Buy Now” option.

- Enter your mobile number and proceed.

- The subsequent screen will present the projected premium amounts for different Star Health Insurance plans, reflecting the details you provided.

These are the 6 simple steps you need to take to use the Star Health Insurance Premium Calculator. Now let’s closely look at the details you need to fill in.

What Details Do You Need to Fill in the Star Health Insurance Premium Calculator?

When calculating your premium, you will be required to input basic information such as

1. Name

2. Date of Birth

3. Mobile number

4. Number of members

5. Age

6. Other relevant details which may include any specific health conditions, coverage options, and add-ons you want to include in your insurance plan. These details will help you get the premium on different health plans.

By this point, you’re fully equipped with the knowledge on how you can access the Star Health Insurance Premium Calculator. Your financial planning journey is a series of small financial wins. And these wins come from well thought out decisions. For all things finance, check out NewsCanvass and keep making better decisions.