Term Life Insurance Policy: What is it, Features, Benefits

As a guardian of a family, your primary responsibility is to have a safety net for your family. It is to ensure that your family is secure, no matter what tragedy befalls them. You want to have a tool that provides immediate relief to your family and secures their peace of mind.

Although this seems tough to achieve. But with the right tools, it’s not. Term life insurance policy is your best option for financial security. Here, we’ll cover everything related to Term Life Insurance Policy.

So stick around till the end to be fully informed.

What’s in here for you?

What is a Term Life Insurance policy?

What is a Term Life Insurance policy?

Term life insurance is a type of insurance that provides you with a payout, known as a death benefit, to your beneficiaries if you pass away during a specified period, known as the term. These policies don’t have any cash value and only pay out if you die within the specified term.

Premiums for term life insurance are based on factors like your age, health, and the length of the term. Once the term ends, you can renew the policy, convert it to permanent coverage, or let it lapse. It’s often the most affordable option for getting substantial coverage for a set period, making it popular among young families or individuals with temporary financial obligations.

So now that you know about Term Life Insurance Policy, let’s take a look at the 5 types of Life Insurance Policy.

Types of Life Insurance Policy

In term insurance, there are five types of policies you should be aware of:

- Level Term Insurance

With this policy, you get a fixed sum assured for the entire duration of the policy. Your premiums stay the same, giving you predictable costs.

- Increasing Term Insurance

Here, the sum assured increases gradually over time to keep up with inflation. While premiums may be slightly higher, it’s a good defense against the rising cost of living.

- Decreasing Term Insurance

Tailored for people with specific financial obligations like loans, the sum assured decreases over time, matching your decreasing financial responsibilities. Your premiums, however, remain constant, ensuring steady coverage.

- Term Insurance with Return of Premium (TROP)

If you live longer than the policy term, you receive a refund of all the premiums you’ve paid. Although premiums are higher, TROP comes with a savings component, which some find attractive.

- Convertible Term Insurance

This type offers flexibility. You can convert your term policy into an endowment or whole life policy later on, which is great if your needs change over time.

From Term Insurance with Return of Premium to Decreasing Term Insurance, these are the 5 types of Term Life Insurance policy you should be aware of.

Now that you know about these, let’s take a look at the advantages of term life insurance.

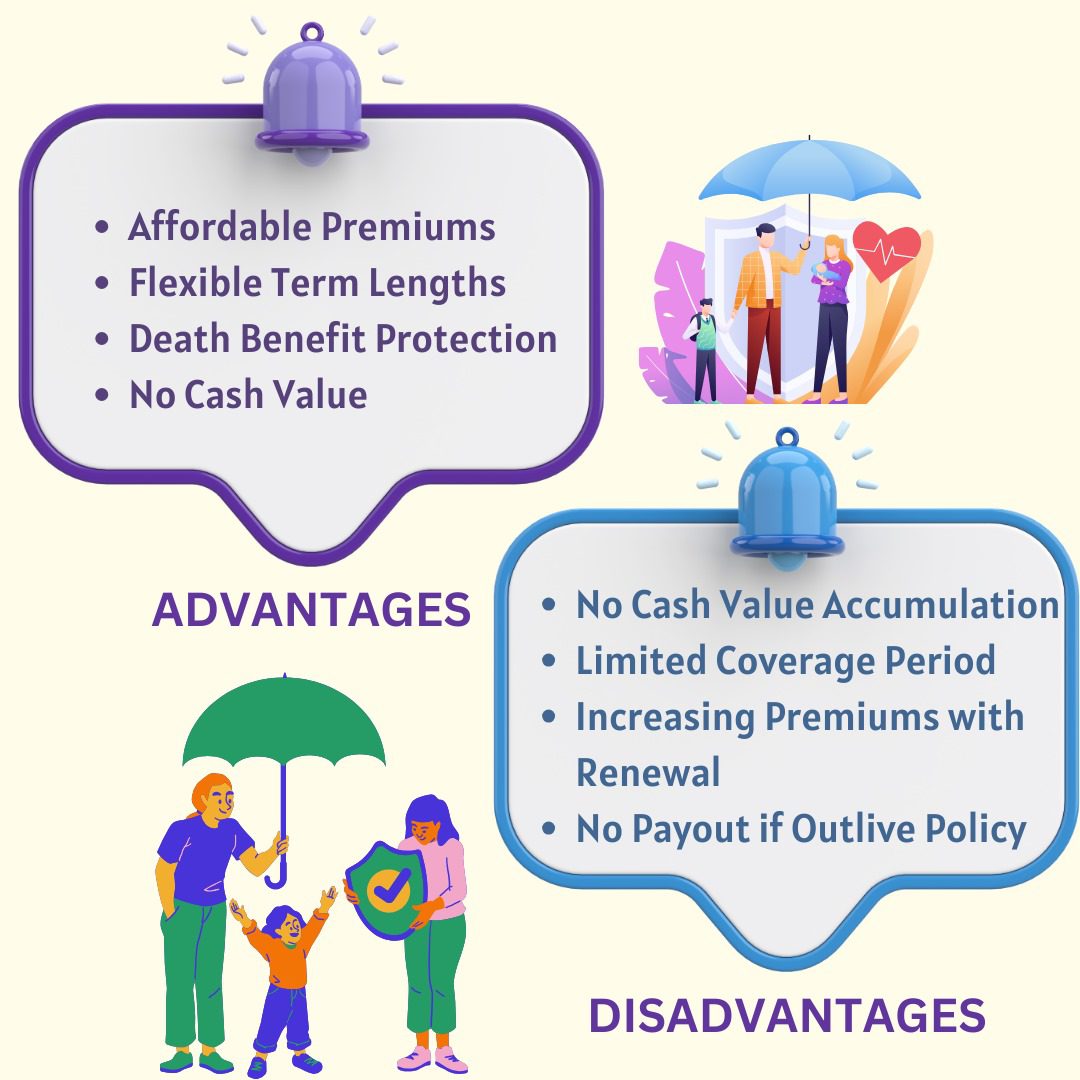

Advantages of Term Life Insurance Policy

Term Life Insurance Policy comes with several benefits. If you are considering going for it, you should know about the following advantages:

Affordable Premiums:

Term life insurance typically offers lower premiums compared to permanent life insurance, making it accessible to individuals and families on a budget.

Flexible Term Lengths:

Policyholders can choose from various term lengths, such as 10, 15, 20 years, or more, allowing flexibility to align coverage with specific financial obligations or life stages.

Death Benefit Protection:

Term life insurance provides a death benefit to beneficiaries if the insured passes away during the policy term, offering financial security to loved ones.

No Cash Value:

Term life insurance policies focus solely on providing a death benefit and do not accumulate cash value, simplifying the policy structure and keeping premiums lower.

These are the advantages of Term Life Insurance Policy. But to balance these, you should also know about the disadvantages.

Disadvantages of Term Life Insurance

Term Life Insurance policy has its downsides and you must take note of them. Go through each one of them carefully:

No Cash Value Accumulation:

Unlike permanent life insurance, term life policies do not build cash value over time, meaning policyholders do not receive any return on premiums paid if they outlive the policy term.

Limited Coverage Period:

Term life insurance coverage is temporary and expires at the end of the specified term, potentially leaving policyholders without coverage if they outlive the policy or cannot renew due to age or health changes.

Increasing Premiums with Renewal:

Renewing a term life insurance policy after the initial term expires often results in higher premiums, especially as the insured ages, potentially becoming less affordable over time.

No Payout if Outlive Policy:

If the insured survives the policy term, there is no payout or return of premiums, which may lead to a sense of financial loss if no benefits are received after the policy expires.

So, to summarise, while term life insurance offers affordable protection and flexibility in coverage duration, it lacks cash value accumulation and may result in financial uncertainty if policyholders outlive the term or face increasing premiums upon renewal. You should assess your individual needs and financial goals when considering the suitability of term life insurance.

What is the bottomline?

By now you know a great deal about Term Life Insurance policy, its types, advantages and disadvantages. But what is the key takeaway for you here? Should you go for a Term Life Insurance Policy?

If you are in your 20s, term life insurance offers a great opportunity to secure substantial coverage at lower premiums. At this stage, you’re likely to be in good health, which can translate to even more affordable rates. By getting coverage early, you lock in lower premiums for the duration of the term, providing financial security while you build your career and assets.

As for individuals in their 30s, term life insurance becomes increasingly essential, especially as they start families and take on more financial responsibilities. With dependents relying on your income, having a term life policy ensures they’re protected if something unexpected happens. It’s a proactive step to safeguard your loved ones’ financial future during this pivotal life stage.

This should give you a good picture of whether you should go for a Term Life Insurance Policy. If you want to make sound financial decisions, you should keep an eye on NewsCanvass where you find the best educational content on finance.