Term Plan With Return of Premium: Top 5 Banks Offering TROP

Term Plan with Return of Premium (TROP) is a unique life insurance plan, different from your regular term plans. It brings together health coverage and the survival benefit.

This means that unlike your regular term plans, TROPs allow return of premium if the policyholder survives the term. So, what is TROP? Why should you opt for it? What are the benefits of TROP? Which are the best options for TROP?

What’s in for you?

- Term Plan With Return of Premium: What is it?

- What Are the Benefits of Term Plan With Return of Premium (TROP)?

- Tax Benefits

- Death Benefits

- Return of Premium (ROP)

- How Does Term Plan With Return of Premium (TROP) Work?

- Who Should Opt For TROP?

- What Are The Features of TROP?

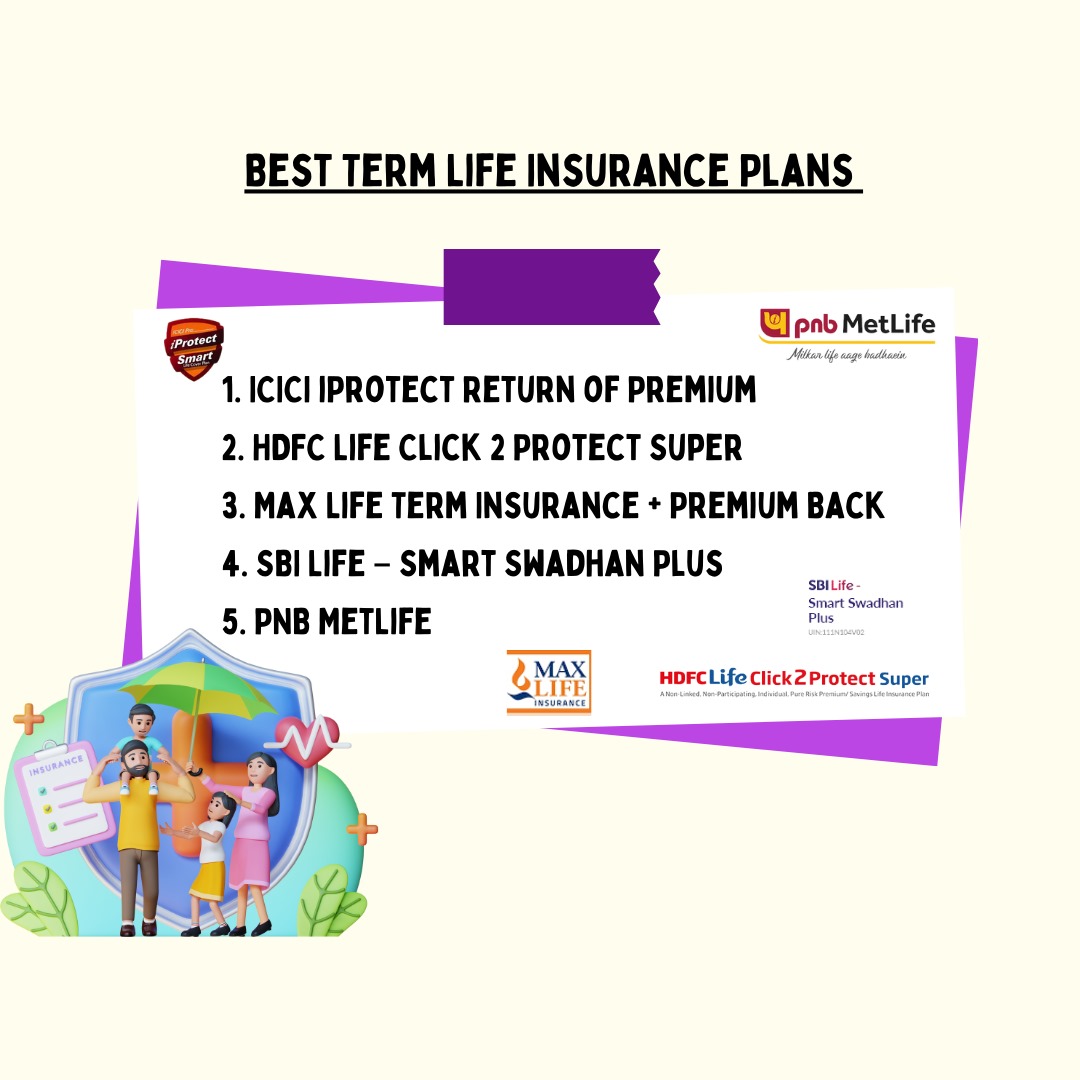

- Best Options For Term Plan With Return of Premium

- ICICI iProtect Return of Premium

- HDFC Life Click 2 Protect Super

- Max Life Term Insurance + Premium Back

- SBI Life – Smart Swadhan Plus

- PNB Mera Term Plan +

Term Plan With Return of Premium: What is it?

Term Plan With Return of Premium (TROP) is the type of insurance plan in which the policyholder gets his/her premiums back after maturity (on outliving the term of the plan). But if he/she dies during the term of the policy, the nominee will get the total sum of money involved.

As is the norm, premiums need to be paid on a regular basis (monthly, quarterly, or yearly) upon the period of time specified in your plan (you can pay with Credit Cards, check out the linked article to discover your best credit card options to pay insurance premium).

The benefits of TROP include tax benefits, death benefits, and guaranteed return of premium.

Let’s look at each of them!

What Are the Benefits of Term Plan With Return of Premium (TROP)?

Term Plan With Return of Premium offers a host of benefits:

1. Tax Benefits: If you opt for TROP, you become eligible for tax benefits according to the prevailing laws of taxation. Section 80C and 10 (10D) says that the premium you pay towards the term plan and the benefit amount are free of taxes.

2. Death Benefits: Life coverage is one of the major benefits of TROP. In case the policyholder passes away, the family can find themselves in a situation of financial stability with the assured sum received by the nominee.

3. Return of Premium (ROP): The maturity benefit feature helps policyholders stay assured that in case they outlive their term, they’ll receive returns of their premiums.

With clarity on TROP’s benefits, let’s see how TROP works.

How Does Term Plan With Return of Premium (TROP) Work?

Before you opt for TROP, you should know how exactly it works. To understand this, let us take an example.

Preeti is a 26-year-old healthy woman looking to invest in health insurance. Being blessed with a body devoid of any health complications, she’s looking for a coverage option that comes with the guaranteed benefit of returns. This is when she decides to opt for a Term Plan with Return of Premium and selects a sum assured of Rupees Fifty Lakhs (Rs. 50,00,000).

After selecting this plan, she has to pay a yearly premium of Rs.12,718 for 40 years till the policy matures.

With TROP, two situations may arise:

1. If Preeti passes away during the term of her life insurance, the sum of Rs. 50 Lakhs will be paid to her nominee.

2. If she outlives the term of her life insurance, she will receive the maturity benefit and will be entitled to a sum of Rs. 5,08,720 (12718 x 40) upon maturity of the policy.

Now you know how TROP works. But should you opt for it? Let’s find out!

Who Should Opt For TROP?

Choosing a term life insurance policy is a crucial decision for anyone trying to tread carefully on their financial investment journey. Whether you should go for regular term insurance plans or for the premium return feature within these plans depends on several factors such as your age, expenditure, number of dependents, sources of income, and your medical profile.

Term Plan With Return of Premium (TROP) is a considerable option for you if you fall under any one of these categories:

1. Unmarried: If you’re not married, then TROP might be the right plan for you. It is likely that you have the financial responsibility of your parents. In an unfortunate situation of your death within the term, investing in TROP can help your parents feel financially secure with the death benefit as they’ll receive the assured sum of money. But in a situation where you outlive the term, your parents will receive maturity benefits making them feel financially secure in the general sense of the term.

2. Married: Equally as much as for married people, Term Plan With Return of Premium is a qualitative option. This is especially true if your spouse is financially dependent on you. You can secure their financial future with the maturity payout towards the end of the term. And as mentioned before, in the unfortunate case of your untimely death, your spouse will be entitled to the large sum of assured money.

3. Married With Children: If you are married and have children, then you have multiple financial responsibilities. It might not be a cakewalk for you to spare large amounts of money due to supporting your children (and possibly your spouse). In such a situation, setting a premium amount aside with a promise of guaranteed returns (in case the policyholder outlives the term) is a good option for you to consider.

What Are The Features of TROP?

When considering TROP, be mindful of these two features:

1. Slightly Higher Premiums: While the premiums of TROP might come across as slightly higher than usual life insurance premiums, the maturity benefit feature acts as a soother. The advantage of being tax free will make it all the more worth it for you to pay higher premiums.

2. Options for Paying Premium: There are several ways in which you can pay your premium for TROP. The first option is to pay your premium in one go without spreading it over a long span of time. The second option is to pay premiums throughout the term at regular intervals – annual, half-yearly, quarterly, or monthly, premium payment options. The third option is to pay till 60 years as the plan extends up to 85 years of your age.

Best Options For Term Plan With Return of Premium

Last but not the least, find out the top 5 picks for TROP, and make a decision today!

1. ICICI iProtect Return of Premium

Includes protection from illnesses such as cancer and heart attacks, with an optional critical illness benefit. While terms and conditions will apply, it covers all types of death and offers four plan options with a monthly premium choice.

2. HDFC Life Click 2 Protect Super

This plan will adapt to your changing needs by offering flexible coverage. If you survive the policy term, you get back 100% of your premiums. If something happens to you, your nominee receives the assured sum. Key features include a 5% online purchase discount, two plan options (Life and Life Plus), and affordable premiums starting at Rs. 2709 per month, including taxes.

3. Max Life Term Insurance + Premium Back

With this term plan featuring a return of premium, you can pay premiums until you’re 60, and the coverage continues until you’re 85. If you meet specific conditions, you have the option to receive all the premiums you paid at a certain point during the policy term, and this comes at no extra cost.

4. SBI Life – Smart Swadhan Plus

SBI Life-Smart Swadhan Plus is an individual, non-linked, non-participating life insurance and savings product that includes a return of premium features. It provides affordable life cover with the added benefit of getting 100% of the total premiums paid as maturity benefit. You have the flexibility to choose the policy term and premium payment options that suit your needs.

5. PNB Mera Term Plan +

You can choose PNB Mera Term Plan + for your family’s future. If you live through the policy, you get your premium back. It covers your child’s education, protects against critical illnesses, and gives you tax benefits. It’s a smart and simple way to secure your loved ones and plan for the unexpected.

These best options on Term Plan with Return of Premium should give you clarity. A life insurance policy is always a prudent choice for a rainy day, but it becomes more desirable when clubbed with guaranteed returns. Here, you’ve learnt what TROP is, its benefits, 5 best options, and much more. This should help you navigate your decision making better. Watch this space for more helpful guides!