Types of General Insurance: Check Out These Top 10 Coverage Options

Uncertainty is a part of human life. From loss of life to the loss of employment, unexpected events can creep in anytime. To have a solid financial risk management plan, you should go for general insurance. It is a tool to protect your assets against damage or loss. Sometimes called non-life insurance, it provides payment based on financial loss incurred on an asset.

But the term “asset” is a broad one. Which type of asset is covered by general insurance? A home? A factory? To have clarity on the kind of asset being dealt with, different types of general insurance are classified. You need to know about each of them to decide which one you should go for.

Let’s examine all types of general insurance with a close up lens.

What’s waiting?

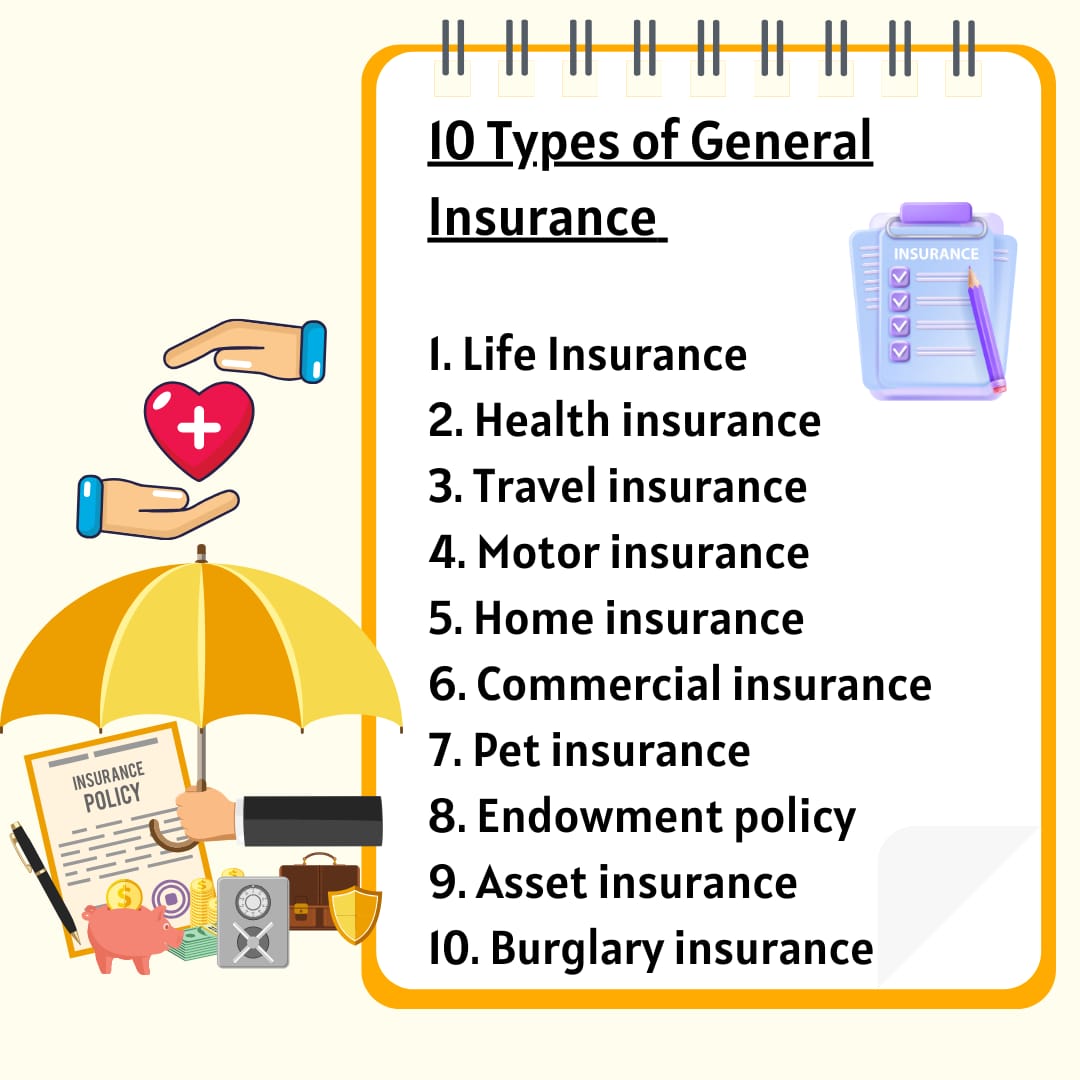

10 Types of General Insurance

- Life Insurance

- Term Life Insurance

- Permanent Life Insurance

- Health insurance

- Travel insurance

- Motor insurance

- Home insurance

- Commercial insurance

- Pet insurance

- Endowment policy

- Term Endowment

- True Endowment

- Quasi Endowment

- Asset insurance

- Burglary insurance

Types of General Insurance

Without any ado, let’s start with the first major type of general insurance.

1. Life Insurance

The first among the types of general insurance is life insurance. It is like a promise between you and a life insurance company. You’re the policy owner, and they’ve got your back. The deal? They’ll pay a sum of money to your chosen beneficiaries when you pass away. In return, you pay regular premiums during your lifetime to keep that promise intact.

Life insurance comes in different types.

1. First up, there’s Term Life Insurance—it’s like a short-term lease on protection. You choose a duration (10, 20, or 30 years), and if something happens during that time, your loved ones get a payout. Simple and budget-friendly.

- Within Term Life, there’s “Decreasing Term” (coverage decreases over time), “Convertible Term” (flexibility to switch to permanent insurance), and “Renewable Term” (premiums increase annually, like a reverse Benjamin Button).

- Now, Permanent Life Insurance is the lifelong companion. Keep paying premiums, and it’s with you forever. A bit pricier, but think of it as a lifelong security blanket. Some policies even offer automatic premium loans if you miss a payment—because life happens.

Whether you’re into short-term security or a lifelong safety net, life insurance is your promise to protect what matters. It’s not just a policy; it’s securing a legacy for your loved ones amidst life’s uncertainties. Further, check out your best options for paying your premium with a credit card.

2. Health insurance

Now let’s look at health insurance (one of the most important amongst the types of general insurance)—it’s a mechanism where you pay a premium, and in return, it acts as your access pass to coverage in case you encounter an illness or an unforeseen accident.

Consider this: You’re covered for a range of expenses, from hospitalisation costs to swift day care procedures and unexpected challenges like critical illnesses. But there’s more to this health insurance narrative! It’s not just about handling the financials; it unfolds as a trove of advantages.

Ever heard of cashless hospitalisation? It’s like holding an exclusive pass to the medical realm—no need to bother with payments. The insurance company manages the intricacies directly with the hospital. And for an added benefit: complimentary medical check-ups!

So, health insurance transcends being just a policy; it serves as your defence against unforeseen health events. It’s your backstage ticket to tranquillity, enabling you to focus on your routine while your health insurance takes care of the logistical challenges. After all, a bit of extra support on the journey to maintaining health and happiness is always welcome!

3. Travel insurance

Next on the list among the types of general insurance is travel insurance. Consider this scenario – you’re gearing up for a trip. Everything’s sorted – tickets, hotel bookings, the whole deal. But upon arrival, whoops! Your luggage is off on its own adventure, or worse, you find yourself a victim of theft in a foreign land without your passport or any cash! Dealing with these tricky situations is a real hassle, especially when you’re in a country where you don’t speak the language. Enter travel insurance, the problem-solver!

Travel insurance is like a safety buffer for your journey, protecting you from unexpected twists that might pop up in unfamiliar places. It’s your financial backup in case things take an unforeseen turn while you’re on the go. From medical and dental emergencies to money theft, passport loss, flight cancellations, and the classic case of misplaced luggage – travel insurance has you covered.

Now, depending on your travel habits, destination, and the purpose of your journey, you can handpick a travel insurance plan that suits your style. If you’re more of a once-in-a-while explorer, a single-trip travel insurance plan is your answer, whether it’s for yourself or your family. For the frequent flyers out there, multi-trip or annual travel insurance plans are the smart picks, saving you the trouble of reapplying for coverage before each trip.

Coming up next from the list of types of general insurance is Motor Insurance.

4. Motor insurance

Motor or Vehicle insurance is a crucial protective layer for your wheels. It’s a specific type of coverage designed to provide financial assistance when unexpected events or accidents involving your vehicle occur.

In simple terms, you pay a regular fee to an insurance company, and in return, they commit to supporting you in case your vehicle faces trouble. This coverage goes beyond accidents; it also includes scenarios like theft or damages caused by natural disasters.

The process is streamlined these days—you can explore various insurance options online, compare them, and choose the one that suits your vehicle and needs. The essence is to have a reliable safety net that steps in when you need assistance, ensuring a smoother recovery and getting you back on the road.

Consider it as a responsible companion for your vehicle journeys, offering a level of preparedness for unexpected situations. So, when you embark on your travels, know that your vehicle is backed by the security of insurance, providing a sense of assurance for whatever challenges may arise on the road.

5. Home insurance

Getting home insurance is like installing a security system for your dwelling. Whether it’s your own house, a rented space, an apartment, or even a lavish mansion, home insurance has got you covered. This is why you need to know about this coverage option amongst the different types of general insurance. Here’s the rundown without the frills:

Home insurance, also known as property or homeowner insurance, covers not only the structure but also the contents of your home. Whether it’s the unexpected loss or damage caused by theft, natural calamities, a fiery accident, or more, your home insurance policy kicks in.

Home insurance isn’t just about coverage; it’s your lifeline during the rebuilding process after a setback. It ensures a smooth journey back to normalcy after unexpected events. But it’s not one-size-fits-all. You can go for a long-term policy, extending beyond one year, or opt for a shorter policy term, ranging from 1 to 10 years. The flexibility is there to match your preferences and needs.

So, you should get the right home insurance plan that fits snugly, offering comprehensive coverage for both the contents and structure of your home. It’s your safety net against unforeseen damage.

Remember that home insurance isn’t just one option from the types of general insurance; it’s your safety net, your rebuilding support, and your customised protection against life’s unexpected twists. So, whether you’re safeguarding your space for a year or a decade, home insurance ensures your haven stays safe and sound. It’s not just insurance; it’s practical peace of mind for your home sweet home.

6. Commercial insurance

Consider commercial insurance as the armour for businesses—also dubbed business insurance. Picture your regular business operations, cruising along, and suddenly unexpected events like lawsuits, natural disasters, or accidents throw a wrench in the works. That’s where commercial insurance steps in, acting as a shield against the uncertainties of the business landscape.

Now, commercial insurance is a customised suit tailored to protect businesses from various risks. Think of it as business armour, guarding against property damage, legal tangles, and employee-related risks, among other potential threats.

Companies play a strategic game when it comes to commercial insurance. They assess their needs based on the unique risks that might emerge—risks that can vary depending on the nature of the business and its surroundings. It’s like conducting a business health check-up to ensure you’re covered for whatever might come your way.

Commercial insurance is about ensuring that your business can weather any storm that comes its way. It’s your contingency plan, and your ally in the ever-changing landscape of business.

7. Pet insurance

Pet insurance is a safeguard designed for our non-human family members. As pet ownership transforms into a pet-parenting culture in India, there’s something to consider for the well-being of our furry companions.

Pet insurance serves as a tailored safety net for our animals, ensuring their health and overall well-being. It’s akin to the health insurance we secure for ourselves and our human family members, providing a financial cushion for our pets in case they require medical assistance or face unforeseen situations.

Being a pet parent doesn’t come cheap. Routine expenses like vaccinations, tick treatments, and grooming tally up to an annual cost ranging from Rs. 10,000 to Rs. 54,000. Amid these expenses, vet fees and subsequent medical or surgical treatments can be the heftiest.

Enter pet insurance—it’s not just a formality. A pet insurance is one of the most important types of general insurance policy which steps in when unexpected situations arise, ensuring your pets receive quality medical and legal support. It’s like having a safety net tailored specifically for the unique needs of your fur companions.

So, whether it’s routine care, unforeseen medical needs, or legal assistance, pet insurance is your way of saying, “I’ve got you covered, furry friend!” Because when it comes to our pets, nothing is too extravagant. They’re part of the crew, and the crew deserves top-notch care.

8. Endowment policy

Endowment policy is a financial maestro in the life insurance scene. An endowment policy is a unique life insurance contract designed to yield a lump sum after a specific term (reaching ‘maturity’) or in the event of death. Typically structured for ten, fifteen, or twenty years, up to a predefined age limit, some even throw in a bonus for critical illnesses, making it a versatile financial instrument.

Now, let’s break down the taxonomy of endowments according to the Financial Accounting Standards Board (FASB):

- Term Endowment:

Think of this as the time-bound player. Unlike most endowments, it’s not eternal. Structured for a specific duration—fixed years or until a particular event, like the donor’s demise. After the term concludes, the principal amount becomes available for operational funding.

- True Endowment:

This is the perpetual counterpart. When a donor injects funds, it’s explicitly specified for the long term, usually accompanied by a written agreement for authentication—a bona fide endowment.

- Quasi-Endowment:

Now, this one’s a bit of a shapeshifter. The board of directors in an endowment fund can opt to tap into reserve funds, unrestricted gifts, or financial windfalls within the endowment, labeling them as quasi-endowments. However, whether they assimilate into the true endowment portfolio is at the board’s discretion. A new board might choose otherwise, making it a non-guaranteed path to the true endowment league.

Endowment policies function as financial orchestrators in the life insurance spectrum, offering options tailored to your temporal and financial aspirations. Whether a limited-time commitment or an enduring alliance, there’s an endowment policy ready to align with your financial cadence.

9. Asset insurance

Among the last two types of general insurance is Asset Insurance. Let’s break down the basics of asset insurance for businesses—it’s like a robust shield for all the valuable stuff a company owns, also tagged as possessions insurance. This coverage kicks into gear when things go haywire—picture fire, theft, or nature deciding to stir up some trouble. It’s a no-nonsense protection plan, especially handy for businesses with a stash of physical assets.

Now, here’s a nugget for you: Did you know that if your company tends to flood the market with products during certain seasons, you can be savvy and opt to insure that inventory specifically for those peak times? It’s like tailoring your insurance game to sync up with the ebb and flow of your business, ensuring your assets are locked and loaded with protection when they’re in high demand.

So, imagine this—your company is like a fortress, and asset insurance is the quiet guardian. When unexpected challenges roll in, be it a blaze, a sneaky heist, or nature deciding to throw a wild card, your assets stay covered. And here’s the slick part: if your business has its highs and lows throughout the year, you can fine-tune your insurance to match those peaks. It’s like having a strategic defense system for your inventory, ready to roll when it matters most.

Asset insurance is the hero of business risk management, making sure a company’s possessions are shielded from the unexpected. So, whether you’re warding off flames, outsmarting thieves, or navigating the unpredictable twists of nature, asset insurance ensures your business fortress stands tall. It’s not just a safety net; it’s a calm in the storm of business uncertainties.

10. Burglary insurance

Burglary insurance is a safeguard for your property that adds an extra layer of resilience. Whether it’s your home, office, factory, or godown, this insurance has got you covered, protecting against unlawful damages and unexpected misfortunes to your assets like furniture, machinery, and equipment inside your business premises.

It isn’t just a standalone policy; it often comes bundled with fire insurance, creating a robust shield against a variety of perils. This includes damages from fire, explosions, lightning, theft, storms, cyclones, typhoons, terrorist acts, riots, and more.

Think of an unwelcome entry, an attempted theft, or an armed robbery. Burglary insurance steps in to provide coverage for theft by persuasive, violent, or fierce entry. It’s like having a financial safety net when faced with unexpected challenges.

Burglary insurance is a pragmatic ally in times of unexpected challenges. Whether it’s emotionally devastating or financially draining, a break-in can be overwhelming. But with burglary insurance, you gain the support needed to navigate through such incidents. It’s not just risk mitigation; it’s a practical safety net for your property.

From pet insurance to motor insurance, you now have an idea of all types of general insurance available. Now on the basis of your requirements and long-term goals, you can take a call on which insurance you want to select. But just know, that insurance is always thought to be a wise financial choice – make your decision accordingly. For more actionable articles, keep checking out this space!