Best Credit Card For Insurance Payment: Your 5 Best Options

Does the thought of shelling out a gigantic amount of insurance payments (premiums) every year haunt you? You’re not alone.

Insurance is crucial for financial security during emergencies, but the ongoing premiums are a concern for many. Depending on the family size, insurance payments can reach lakhs or even five digits annually.

Some credit cards offer enticing deals on premium payments, providing a way to earn substantial reward points. That’s why using them for insurance premiums makes sense. However, finding the best credit card for insurance payment is not a cakewalk.

In this guide, we will comprehensively cover how to use your credit card to make insurance payments, pros and cons of using credit cards for insurance payments, and your top 5 options.

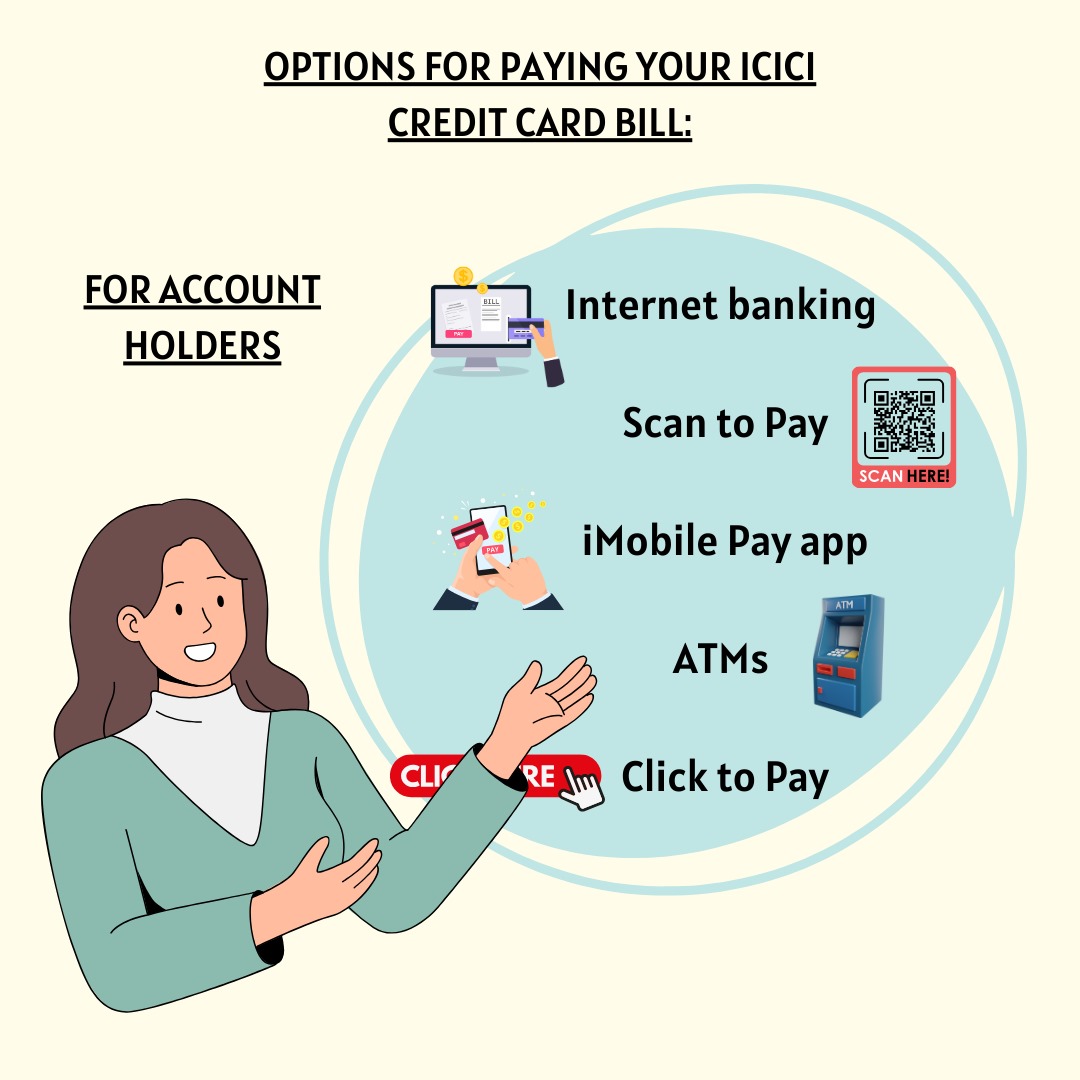

How to Use Your Credit Card to Make Insurance Payments?

It’s pretty simple – just share your credit card info with the insurer, and they’ll bill your card for the premium.

Plus, if you’re rocking a rewards credit card, you can snag cashback, points, or other cool perks with your insurance payments. Now let’s get to what you should use credit card for insurance payment.

Why Should You Use Credit Card For Insurance Payment?

Using your credit card to pay for insurance is like hitting two birds with one stone. Not only do you get your coverage sorted, but you also earn cool rewards or cash back. It’s like getting a bonus for being responsible!

Now, here’s a nifty trick – some folks buy Amazon vouchers with their credit cards at a sweet discount. So, when it’s time to pay the insurance premium, they use these vouchers and score some savings. And then we have Payzapp, that gives you extra rewards if your insurer plays along.

So, if you have to pay directly on the insurance company’s website, no worries. Just use a credit card that gives you rewards for doing so. It’s like turning a regular expense into a little treat for yourself.

Before we get to the best credit card for insurance payment, you need to know the benefits and disadvantages of credit cards.

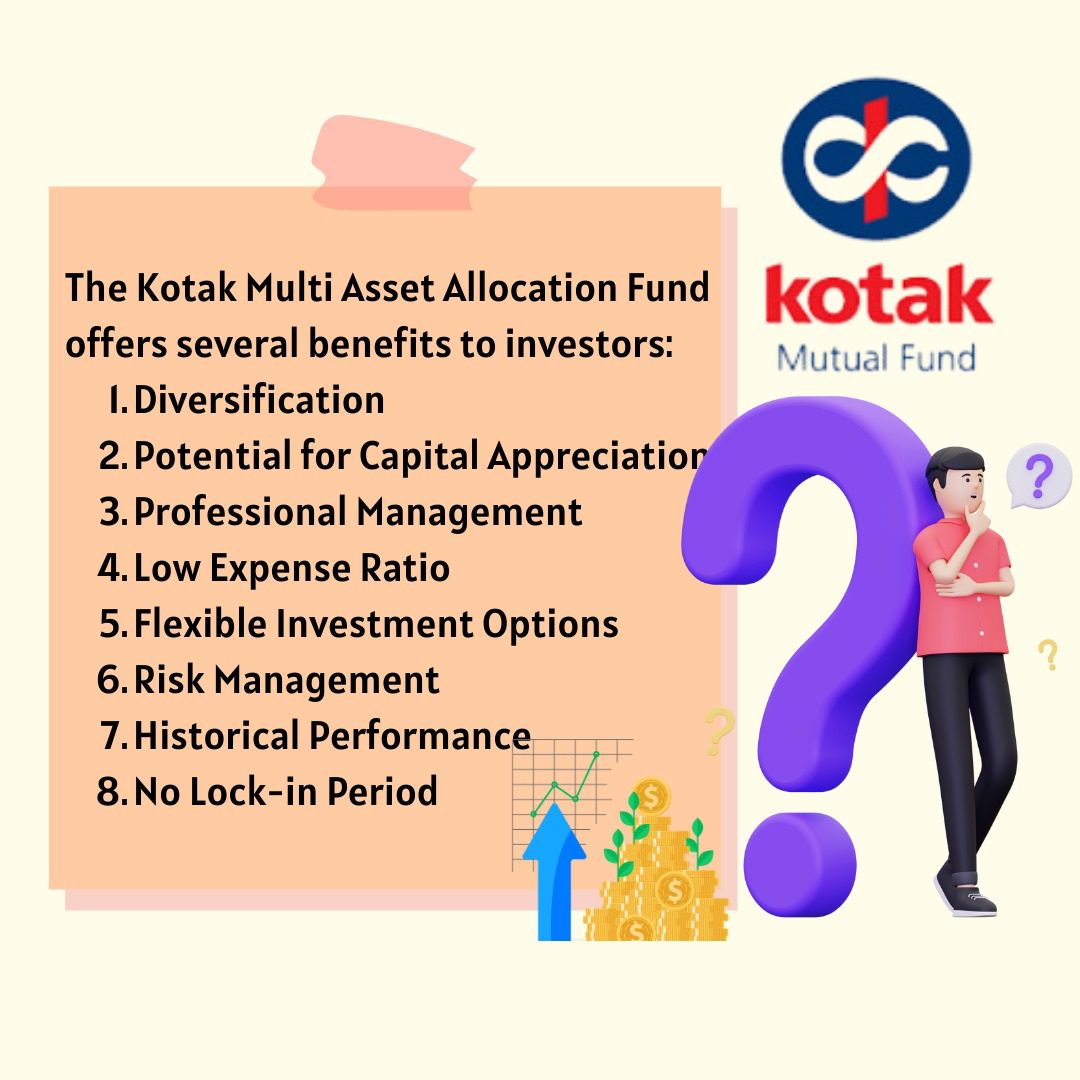

Benefits of Using Credit Cards to Pay Insurance Premiums

As touched upon before, rewards and cashbacks are one of the more obvious benefits of using credit cards to pay insurance premiums. But these are accompanied by a host of others benefits. Have a look:

1. Enjoy the ease

With credit cards, bid farewell to writing cheques or making trips to the insurance company’s office. Pay your premiums conveniently from the comfort of your home, using your computer or mobile device.

2. Feel secure

Credit cards provide fraud protection, ensuring your payment information remains safe and giving you confidence in every transaction.

3. Earn rewards

Many credit cards offer perks like cashback or rewards on your purchases, allowing you to accumulate benefits when paying insurance premiums or making other transactions.

4. Smart financial management

Opting for credit card payments for insurance premiums enables better financial control. Set up automatic payments to eliminate worries about bad financial planning.

5. Boost your credit score

Settle your insurance premiums using a credit card to build or enhance your credit score. Demonstrating responsible credit card use by paying the balance in full and on time showcases your reliability to lenders.

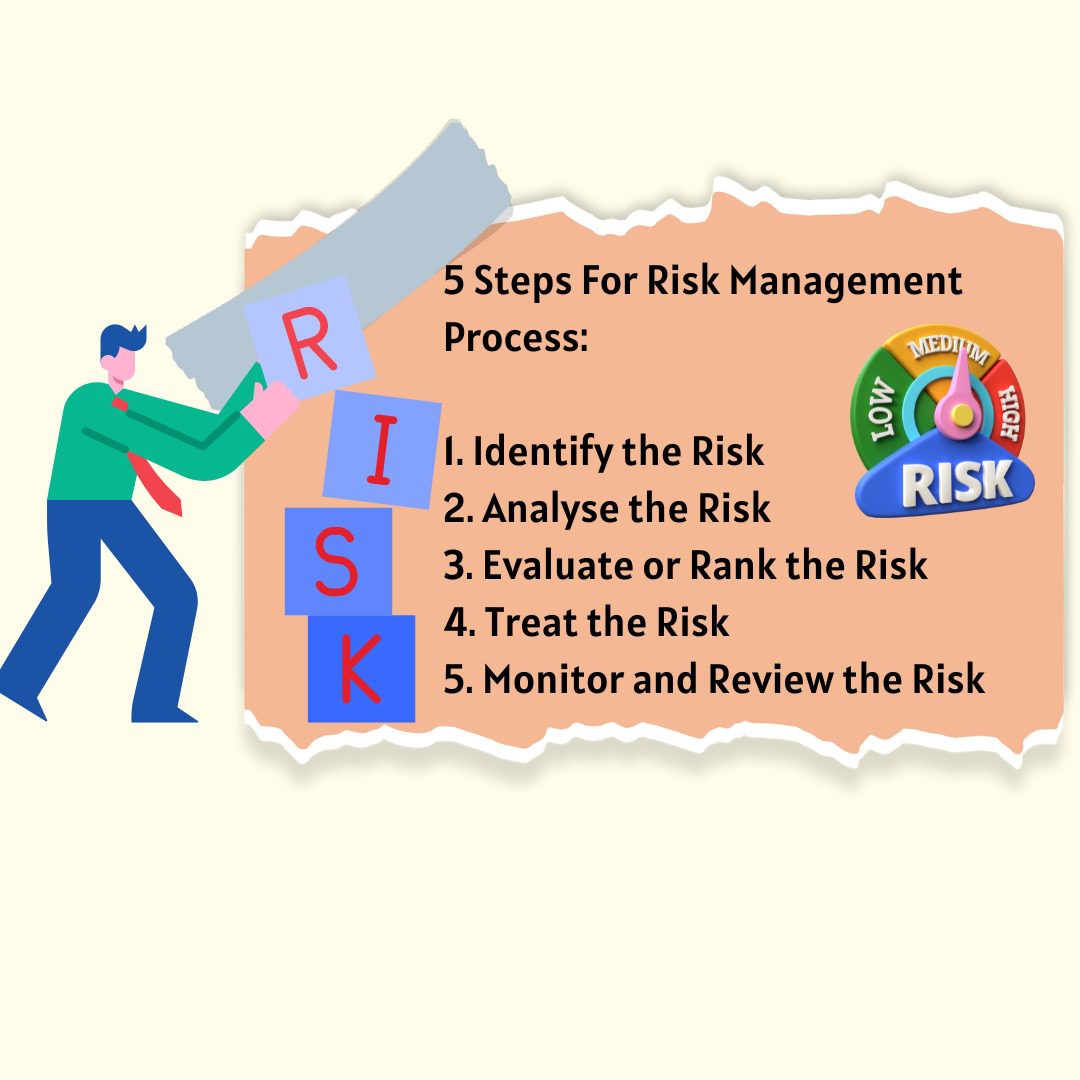

Disadvantages of Using Credit Cards to Pay Insurance Premiums

Paying your insurance with a credit card has its ups and downs. On the bright side, you might get some rewards. But watch out for extra fees – those can add up over time.

If you’re not quick to pay your credit card bill, you might end up owing more due to interest, putting you in a bit of a money bind. Even if you pay on time, your credit score might be affected if your card balance changes.

On the flip side, if you’re prompt with payments and clear the bill, using a credit card can be super convenient and even score you some extra perks. Just be sure to think about the good and bad points before deciding what’s best for you.

5 Best Credit Card For Insurance Payment

Now, let’s get to (probably) the most awaited part of this guide – best credit card for insurance payment. The top picks based on factors such as reward rates, bonus rewards, and specific benefits offered by each card are:

- Vistara Co-Brand Credit Card

- HDFC Tata Neu Infinity Credit Card

- Amex MRCC Credit Card

- Amex Platinum Travel Credit Card

- HDFC Infinia and Diners Black Credit Cards

Vistara Co-Brand Credit Cards

The Vistara co-brand credit cards present a range of attractive reward rates (2% to 7%) on insurance premium payments, dependent on spending levels.

Noteworthy options include Axis Vistara Infinite, offering over 8% reward rate for annual premiums of 12lk. These cards provide a substantial incentive for those with varying insurance payment amounts, making them stand out as competitive choices for insurance premium payments.

HDFC Tata Neu Infinity Credit Card

Considered one of the best Rupay credit cards in the country, the HDFC Tata Neu Infinity Credit Card offers a notable 10% reward rate on the Tata Neu app.

This extends to 5% on utility bill payments and 5% on insurance premium payments through the app. The card provides a straightforward cashback option for those not interested in airline miles or hotel loyalty.

The earned Neu coins can be utilized across the Tata ecosystem, covering various brands from BigBasket to Taj Hotels. With a 5% cashback on insurance premiums, the Tata Neu Infinity Credit Card emerges as an appealing choice for those seeking simplicity in their credit card benefits.

Amex MRCC Credit Card

The Amex MRCC Credit Card from American Express offers a solid 4% reward rate on insurance premiums. This versatility stems from bonus rewards, providing 1000 bonus points for four monthly transactions of at least 1500 and an additional 1000 bonus points for a 20k monthly spending.

Valuing 1MR at 40p, the 2000 bonus points amount to a minimum worth of 800. The potential for an increased reward rate, depending on redemption preferences, positions the Amex MRCC Credit Card as one of the top choices for insurance payments.

Amex Platinum Travel Credit Card

The Amex Platinum Travel Credit Card stands out with its unique approach, offering a remarkable 7% reward rate on insurance payments. By spending 4lks annually, cardholders receive 40k MR points and a valuable 10K Taj voucher.

What sets this card apart is its inclusive milestone, allowing rewards on various expenses like fuel, insurance, or tax payments. With each MR point valued at least 40p, the accumulated 40k MR points translate to a minimum worth of 16k.

The combination of reward points and vouchers makes the Amex Platinum Travel Credit Card an excellent choice for insurance premiums, with a potential to surpass the 7% reward rate depending on redemption choices.

HDFC Infinia and Diners Black Credit Cards

HDFC’s Infinia and Diners Black Credit Cards offer a reliable base reward rate of 3.3% on various spending categories, including insurance premiums. For Diners Black, monthly spends exceeding 80k result in an additional 1k vouchers, elevating the reward rate to around 4.3%.

These cards provide a hassle-free and straightforward option for earning rewards on insurance payments. It’s worth noting the daily cap of 5,000 points for insurance payments, emphasizing the need for strategic planning when using these cards for insurance premiums.

So, when it comes to choosing the best credit card for insurance payment, keep in mind the following points:

- Opt for a card with great rewards for insurance payments.

- Look for cards offering extra rewards or bonuses.

- Choose a card with simple and fitting reward redemption options.

- Consider fees, charges, and any limits on rewards to ensure a favorable balance

Now you know the best credit card options for insurance payment, and also the factors you need to consider while making the best choice for yourself.

With the balanced view of the pros and cons of credit cards for insurance premiums, go ahead and pick your preferred credit card today!