Best Term Life Insurance Policy in India: Your Complete Guide

Are you confused with the multitude of options claiming to be the best term life insurance policy in India? If yes, you’re in luck.

Here, we’ll systematically look at the factors you should consider before picking the perfect term life insurance policy in India, followed by the top 5 picks.

But first let’s discover what exactly is a term life insurance policy?

What is a Term Life Insurance Policy?

A term life insurance policy is a life insurance deal where if something unexpected happens during the policy term, the person you’ve chosen (nominee/beneficiary) gets the guaranteed sum.

These plans offer extensive coverage without breaking the bank. Curious about the top ones in India and their perks? Let’s look at the best term life insurance policy in India.

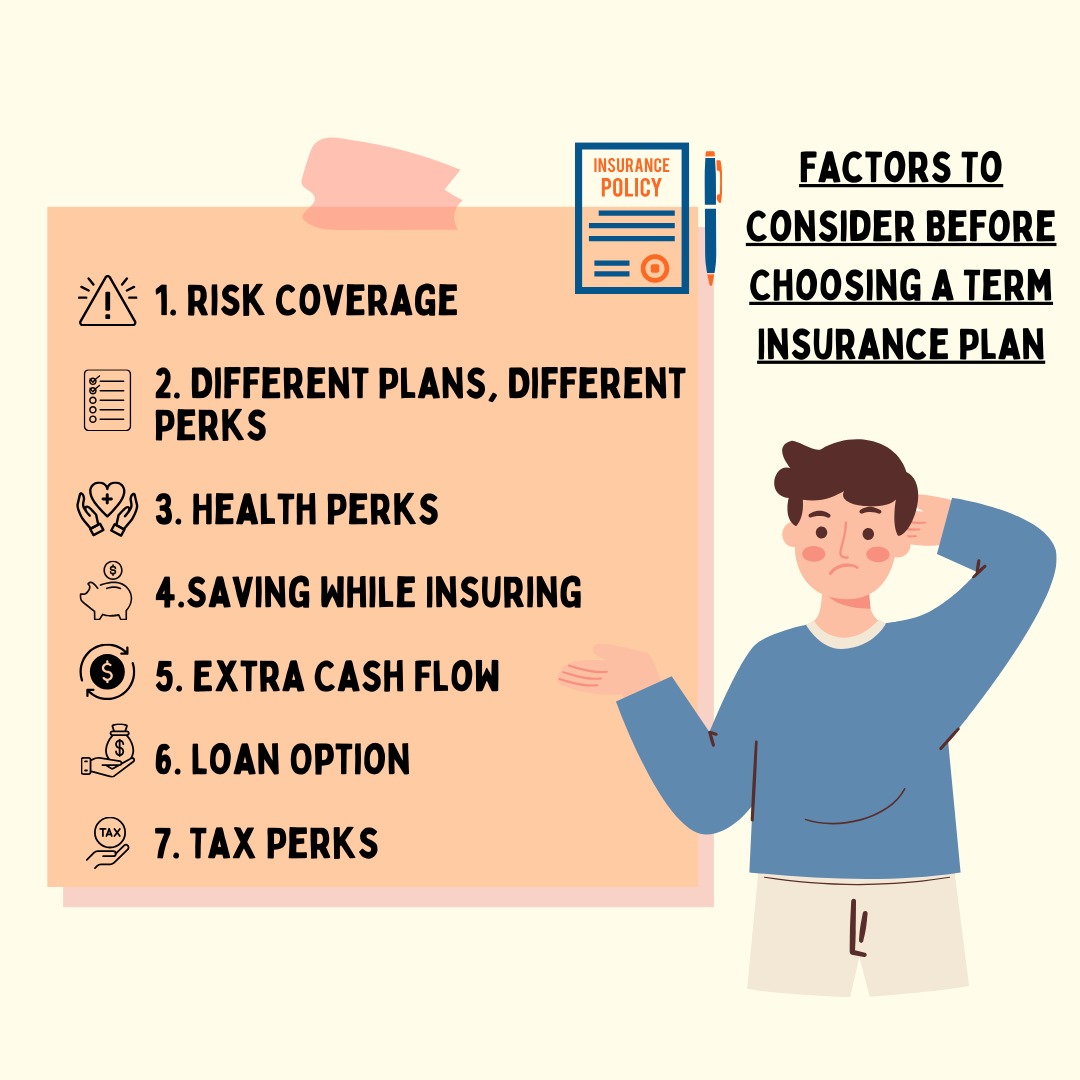

Factors To Consider Before Choosing a Term Insurance Plan

Before you can pick a term insurance plan, and be confident about the same, there are some factors you need to consider while choosing a term insurance plan. Let’s take a closer look at them:

1. Risk Coverage

The main deal with insurance is covering risks. If something happens to you, the insurance company helps out your family financially. It’s like a safety net.

2. Different Plans, Different Perks

Insurance companies have a variety of plans. Pay more, get more. It’s like choosing the features on a new phone – customize it to fit your needs.

3. Health Perks

Good news – insurance can handle those big hospital bills or expenses from a major illness. It’s like having a health backup plan.

4. Saving While Insuring

Some insurance plans also let you save money. It’s like a two-in-one deal – protect yourself and build up some wealth. Smart, right?

5. Extra Cash Flow

Imagine this: guaranteed income when things go south. With certain plans, you or your family get a sum of money regularly. It’s like having a financial cushion.

6. Loan Option

Need a little financial boost? Some policies let you borrow money. Think of it like a trusty friend lending you a hand when you’re in a pinch.

7. Tax Perks

The cherry on top – getting tax benefits. Having insurance can actually help you save on taxes. It’s like a little bonus for being responsible.

So, when you’re eyeing a term insurance plan, consider these factors.

Top 8 Term Life Insurance Policies in India

Now that you know the factors that you need to consider while choosing a term life insurance policy in India, you’re ready to go through these top 8 picks for term life insurance policies in India.

Here are your 8 best options:

1. ICICI Prudential iProtect Smart

– Easily secure one of India’s best term insurances online.

– Enjoy comprehensive coverage for terminal illness, death, and disability.

– Exclusive premium rates for non-tobacco users.

– Choose your payment plan: single pay, regular pay, or limited pay.

– Select from three benefit payout options: monthly income, lump sum, or a combination.

2. HDFC Life Click 2 Protect Super

– Secure your family’s financial future with this hassle-free online term insurance.

– Get all your premiums back with the Return of Premium option.

– Pick from three plan options tailored to your needs.

– Add Waiver of Premium Benefits for Critical Illness and Total and Permanent Disability.

3. Max Life Smart Secure Plus

– Affordable online term plan with flexible payment terms.

– Enjoy extra rider benefits to enhance policy coverage.

– Benefit from a 30-day free-look period.

4. Bajaj Allianz eTouch Online Term Plan

– Easily purchase one of India’s best term insurances online.

– Guarantee annual pay-out to the family for 15 years in case of demise.

– Choose between two different payout options.

– Maximum maturity age capped at 70 years.

– Avail of a 15-day free-look period.

5. PNB Metlife Mera Term Plan Plus

– Comprehensive term insurance with online purchasing option.

– Extend coverage to the spouse under the same plan.

– Flexibility to enhance coverage through Step-Up Benefit, Life Stage Benefit, and Child Education Support Benefit.

– Maximum maturity age extended to 75 years.

– Three life benefit options with additional riders included.

6. Canara HSBC Young Term Plan

– Receive premiums back on policy survival.

– Exit early and get back all premiums paid.

– Premium waiver on diagnosis of covered critical illness or accidental total permanent disability.

– Block premium rate at purchase and increase cover up to 100%.

– Cover your spouse within the same plan.

7. Kotak e-Term Plan

– Low-cost insurance with high coverage.

– Enhance cover at special life events through the step-up option.

– Three payout options and three plan choices.

– Add rider benefits like accidental death, total permanent disability, and critical illness.

8. Aegon Life iTerm Prime

– Life cover with lump sum payout on demise.

– Affordable premium rates throughout your earning period.

– Special exit feature to receive all premiums back if coverage is no longer needed.

– Flexible premium payment modes.

– Option to add Critical Illness or Accidental Death riders for increased coverage.

– Tax benefits as per prevailing ITA, 1961 laws.

So, to conclude, choosing the best term life insurance policy in India involves considering crucial factors like risk coverage, plan perks, health benefits, savings, extra cash flow, loan options, and tax perks.

Now armed with this knowledge, explore the top 8 picks, each offering unique features to safeguard your family’s future. Whether it’s ICICI Prudential’s comprehensive coverage or HDFC Life’s hassle-free options, there’s a plan tailored to your needs.

Make an informed decision, secure your loved ones, and enjoy the peace of mind that comes with a well-chosen term life insurance policy.