What is SIP Investment: What Is It, Types, Benefits, How It Works (Ultimate Guide)

What’s it like to step into the fascinating world of finance, where building wealth is an exciting adventure open for everyone?

Well, you’re in for a treat because that’s precisely what Systematic Investment Plans, fondly known as SIPs, offer.

Whether you’re learning investing for beginners or seeking a new perspective, we’re about to uncover what is SIP investment, diving into the different flavours they come in, discovering their multitude of benefits, and unveiling the inner workings of this financial marvel.

So, are you ready to take that first step towards financial prosperity? Are you ready to learn what is SIP investment?

Here’s a summary of what you’re about to explore:

- What is SIP Investment?

- How Do SIP Investments Work?

- When to Start Investing in SIP?

- Types of SIP Investments

- Benefits of a SIP Investments

What is SIP Investment?

SIP, short for Systematic Investment Plan, is your secret key to the mutual fund universe. Picture SIP as a structured, disciplined method to grow your wealth.

With SIP, you pick a mutual fund scheme that aligns with your financial dreams, and then, at regular intervals, you invest a fixed amount.

Instead of a hefty lump-sum investment, SIP encourages small, consistent contributions. This smart strategy acts as a shield against market volatility while potentially delivering substantial returns over time.

Now that you know what is SIP Investment, let’s get to how do SIP Investments work.

How Do SIP Investments Work?

SIPs operate seamlessly, making the investment journey smooth and hassle-free.

Here’s how it works: once you’ve selected one or more SIP plans that match your financial aspirations, the process is straightforward. Your predetermined SIP investment amount is automatically debited from your bank account at regular intervals.

These funds are then invested in the mutual fund of your choice. The number of units allocated to you depends on the Net Asset Value (NAV) of the chosen mutual fund.

This process ensures that you incrementally build your investments, where each contribution increases your stake in the mutual fund, potentially leading to significant returns.

Let’s bring this concept to life with a practical example.

Imagine you’re eager to invest a substantial sum, perhaps one lakh rupees, in a mutual fund.

You have two options: a one-time lump sum investment or the systematic approach of an SIP.

Opting for SIP, you start with a set amount, let’s say, 500 rupees.

This sum is debited from your bank account every month and automatically credited to your chosen mutual fund. This practice continues for your chosen tenure, helping you accumulate wealth in a systematic and disciplined manner.

When to Start Investing in SIP?

SIP investments offer the luxury of flexibility. You can initiate your SIP at any time, minimizing your risk exposure.

However, to maximize the potential of your SIP investment plan, it’s essential to align it with your long-term financial goals. The beauty of SIPs is that there’s no one-size-fits-all timeframe for starting your journey.

The key is to kickstart your SIP adventure as early as possible. The sooner you begin, the more time your investments have to grow and flourish.

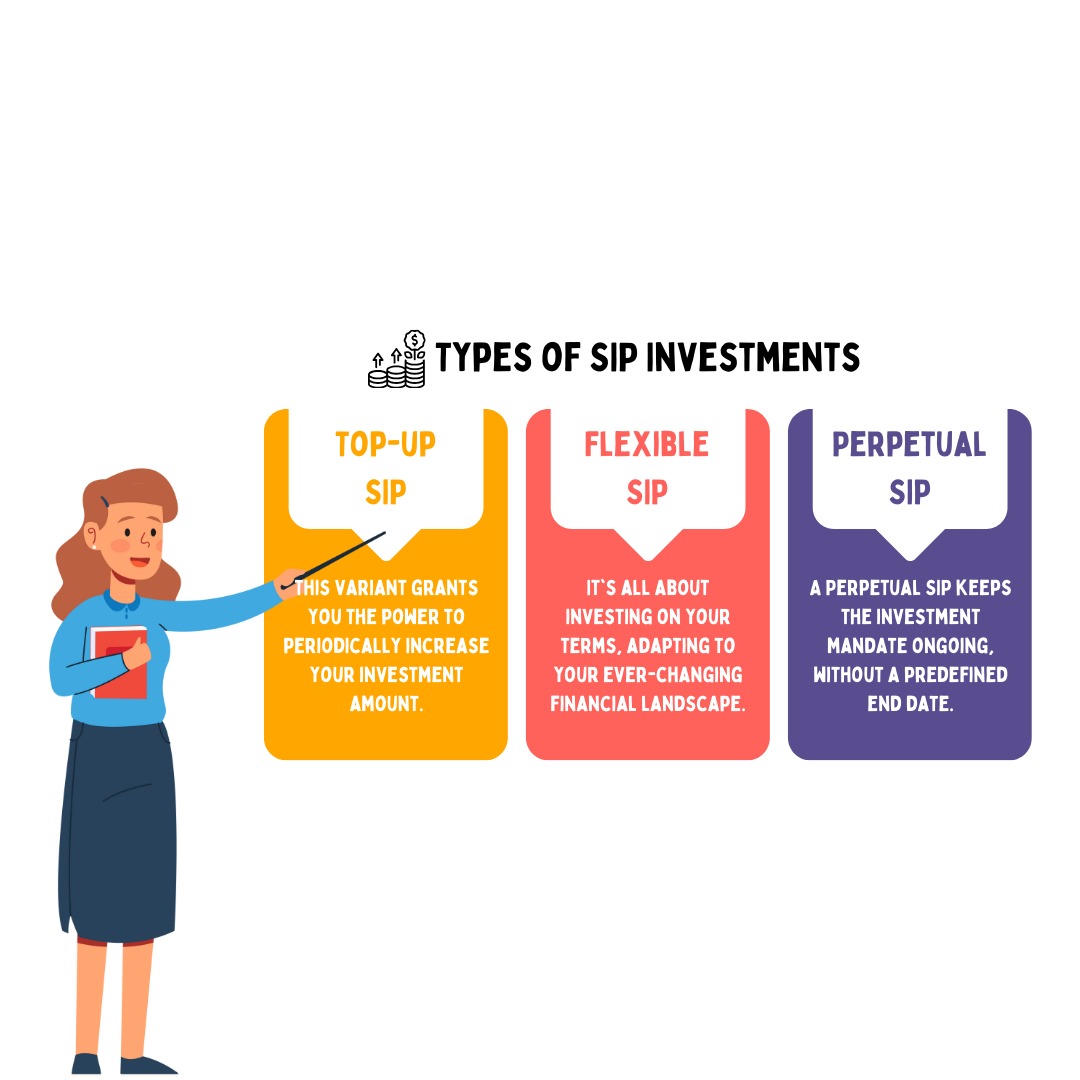

Types of SIP Investments

Knowing what is SIP Investment is not enough, you must know the types of SIP Investments which are sufficiently covered here:

SIP investments come in various flavours, allowing you to tailor your investment strategy to your unique financial objectives. These are the various categories of SIP:

1. Top-up SIP

This variant grants you the power to periodically increase your investment amount. It’s a strategic way to leverage the best-performing funds at regular intervals, especially when you have higher income or available funds to invest.

2. Flexible SIP

As the name implies, Flexible SIP empowers you to adjust your investment amount according to your cash flow or preferences. It’s all about investing on your terms, adapting to your ever-changing financial landscape.

3. Perpetual SIP

A Perpetual SIP keeps the investment mandate ongoing, without a predefined end date. While regular SIPs often have end dates like 1 year, 3 years, or 5 years, a Perpetual SIP provides the freedom to withdraw your investments as per your financial goals.

This sums up the types of SIP Investments available at your disposal.

Benefits of SIP Investments

SIP investments hold a treasure trove of advantages over lump-sum investments, making them an irresistible choice. Here are a few of the convincing advantages:

1. Discipline Amplified

SIP investments transform you into a disciplined investor, even if you don’t possess an in-depth understanding of market dynamics. You no longer need to obsessively monitor market trends or second-guess the right time to invest.

With automatic deductions from your bank account, you can confidently make progress toward your wealth-building goals without breaking a sweat.

2. The Magic of Rupee Cost Averaging

SIP investments introduce you to the concept of rupee cost averaging. Your consistent investment amount effectively averages out the cost of each unit you purchase.

This means you can acquire more units when the market is down and fewer when it’s up, ultimately lowering your average cost per unit and potentially enhancing your returns.

3. The Wonders of Compounding

SIP is your gateway to the mesmerising world of compounding. By adhering to a disciplined investment schedule, your wealth keeps growing over the years.

Your small daily contributions gradually amass into a substantial corpus, benefiting from the enchanting power of compounding.

To illustrate the potency of SIPs, let’s peer into a practical example.

Suppose you contribute 1000 rupees monthly, with an assumed average return of 10%. After 20 years, your total amount is projected to reach an impressive 7,18,259 rupees. This growth is fueled by the compounding effect, turning small but regular contributions into a substantial financial achievement.

Ready to Begin Your SIP Journey?

SIP investments offer a straightforward and hassle-free approach to building wealth. All you need to do is submit an application to initiate an auto-debit system or provide post-dated cheques for your chosen SIP amount.

Depending on your financial goals, you can select the appropriate amount to start your SIP investment. With SIP, you enter a realm of practicality, discipline, and prosperity, where your financial goals are within reach.

The world of finance might seem vast and complex, but SIP investments simplify the path toward your financial aspirations. SIPs bring discipline, the advantage of rupee cost averaging, and the magic of compounding into your financial journey.

By sticking to your SIP plan, you can confidently stride toward a prosperous financial future.

The journey to financial prosperity begins with your very first SIP investment. So start today!

Also Read: How to Invest in Stock Market for Beginners: Your 7-Step Guide For a Head Start