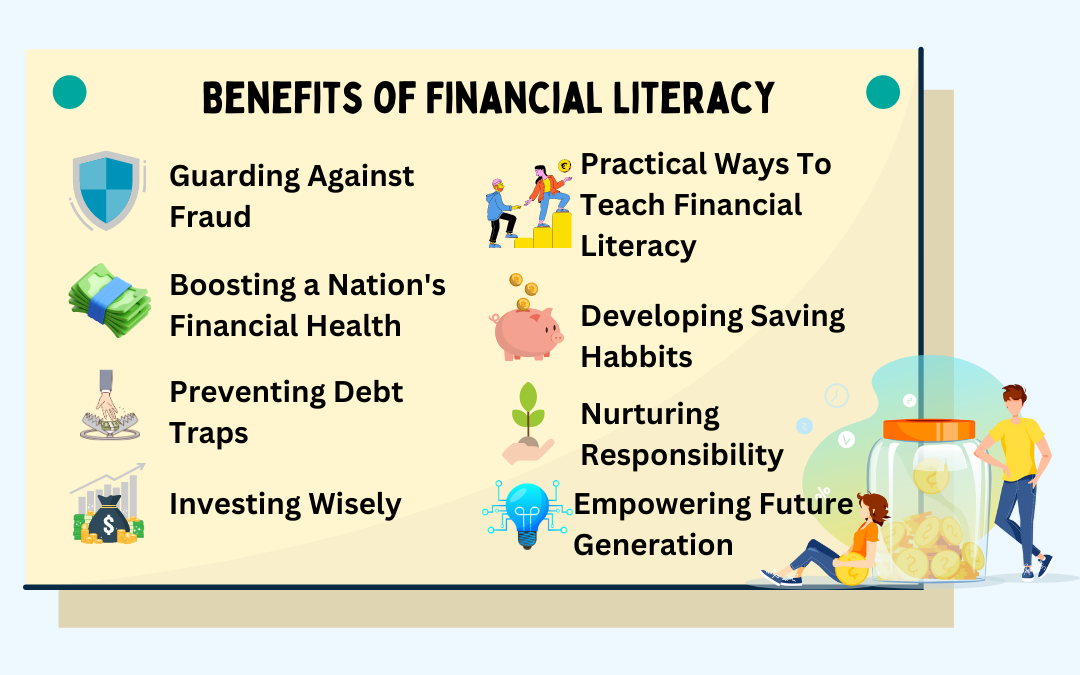

Financial Literacy for Students: 8 Ultimate Skills To Win At Life

Financial literacy for students is often overlooked but remains a critical life skill, especially for students. As they step into adulthood, equipped with knowledge about money management,

youngsters can navigate the complex financial landscape more effectively. From avoiding

fraud traps to making informed investment choices, financial literacy for students empower them with real-life skills that are essential to succeed in today’s world.

1. Guarding Against Fraud

First Step Towards Financial Literacy For Students

By introducing students to monetary matters from a young age, they develop an innate

skepticism towards potential frauds. This early exposure helps them recognize warning signs

and be cautious about sharing personal information like passwords with strangers. This

foundational understanding can prevent them from falling victim to scams and protect their

financial interests.

2. Boosting a Nation’s Financial Health

A lack of financial literacy for students not only affects individuals but also impacts a nation’s economic stability. When people, including adults, lack basic financial knowledge, they become

susceptible to financial fraud, leading to monetary losses that ripple through the economy.

By equipping students with financial literacy, we contribute to a financially healthier society

where informed decision-making helps minimize such losses.

3. Preventing Debt Traps

One of the most significant benefits of financial literacy for students is the prevention of debt. Many individuals find themselves in debt due to poor financial planning. Teaching students how to create and stick to a budget, save money, and make wise spending choices can ensure they

develop sound financial habits early on. This knowledge equips them to handle emergencies

without falling into crippling debt.

4. Investing Wisely

Financial literacy for students goes beyond teaching students how to manage money; it also introduces them to the world of investing. Students learn about different investment avenues, such as savings accounts, stocks, and government schemes. This knowledge empowers them to make informed decisions about their money, fostering a culture of responsible investment.

5. Practical Ways to Teach Financial Literacy

Making financial education engaging is crucial to capturing students’ interest. This can be

achieved by incorporating games, stories, and interactive methods into the learning process.

Parents and educators can also involve students in real-world scenarios, like sending them

to buy items from a store or giving them monthly pocket money with clear guidelines on

spending and saving.

6. Developing Saving Habits

Teaching saving habits can start early with concepts like piggy banks and minor accounts.

These tools introduce students to the value of setting aside money for future needs.

Furthermore, introducing students to investment platforms, like the stock market and

government schemes, helps them understand how their money can grow over time.

7. Nurturing Responsibility

Financial literacy for students also teaches students the value of hard work and delayed gratification. Assigning them household chores and rewarding them with a small amount of money helps them understand that earning money requires effort.

This practice cultivates a sense of responsibility and a deeper understanding of the connection between work, money, and financial well-being.

8. Empowering the Future Generation

The impact of financial literacy goes beyond individual students; it has the potential to

influence entire families and communities.

Students who learn about financial matters are likely to share their knowledge with their parents and guardians, creating a ripple effect of informed decision-making. This not only benefits the students themselves but also contributes to a financially resilient society.

In a rapidly evolving financial landscape, financial literacy is not just a useful skill—it’s a

necessity. As the prevalence of various financial products and services continues to grow,

the ability to understand and navigate these offerings becomes paramount.

Lacking financial literacy can lead to devastating mistakes, as seemingly simple decisions can have profound and long-lasting financial implications. By teaching financial literacy for students about compound interest, budgeting, debt management, and investment principles, we equip them with tools that can shape their financial future.

With the increasing complexities of the financial world, financial literacy acts as a protective shield against scams and frauds. Moreover, it empowers students to make informed choices, whether it’s about purchasing a product, saving for the future, or planning for retirement.

So, the benefits of financial literacy for students extend far beyond the classroom. It

prepares them to navigate the real world with confidence, ensuring they can make sound

financial decisions and avoid common pitfalls.

As financial literacy becomes an integral part of their education, students are better equipped to handle the challenges and opportunities that come their way. By arming the younger generation with these essential skills, we’re setting them up for a lifetime of financial success.