Fixed vs Floating Interest Rate: Which One Should You Go For?

Do you look for stability or dynamism when it comes to making financial choices? Your preference for either will directly affect whether you go for fixed interest rate or floating interest rate.

Fixed vs Floating Interest Rate – Each option comes with its set of advantages and disadvantages, and understanding the nuances can significantly impact your financial journey.

If you’re comfortable with taking risks in your financial choices, you should go for floating interest rates since they fluctuate with the market rates.

But if you are more inclined towards security and predictability, you should opt for fixed interest rates.

Whichever way you go, making a sound choice is important for you.

Fixed vs Floating Interest Rate

What is Fixed Interest Rate?

Fixed interest rates offer a sense of financial security and predictability. Just as dropping an anchor stabilizes a ship amidst the waves, opting for a fixed interest rate ensures that your interest payments remain constant over the loan tenure.

When you lock in a fixed interest rate, you essentially “freeze” the interest percentage for the entire loan period. This provides borrowers with a clear picture of their financial obligations, making budgeting and planning more straightforward.

Whether you’re financing a home, car, or education, fixed rates shield you from market fluctuations, providing a steady, unchanging repayment environment.

How Does Fixed Interest Rate Work?

Fixed interest rates are good for people who don’t want their interest rates to change during their loan. This helps avoid the risk of having higher interest costs and mortgage payments. When interest rates are low, it’s a good time to choose a fixed rate. Even if rates go lower later, the cost is still lower than when rates are high.

Fixed rates are usually higher than adjustable rates. Adjustable rates might have lower initial rates, making them more attractive when interest rates are high. The Consumer Financial Protection Bureau provides information on interest rates based on location, credit score, down payment, and loan type, helping borrowers compare fixed and adjustable rates.

How to Calculate Fixed Interest Rate?

Finding out how much interest you’ll pay on a loan is quite easy. Just gather the loan amount, interest rate, and the time you’ll take to repay. Keep in mind that your credit scores and income can affect the rates, whether you go for a fixed or variable option. Online calculators can assist in figuring out fixed interest costs for personal loans, mortgages, and other credit lines quickly.

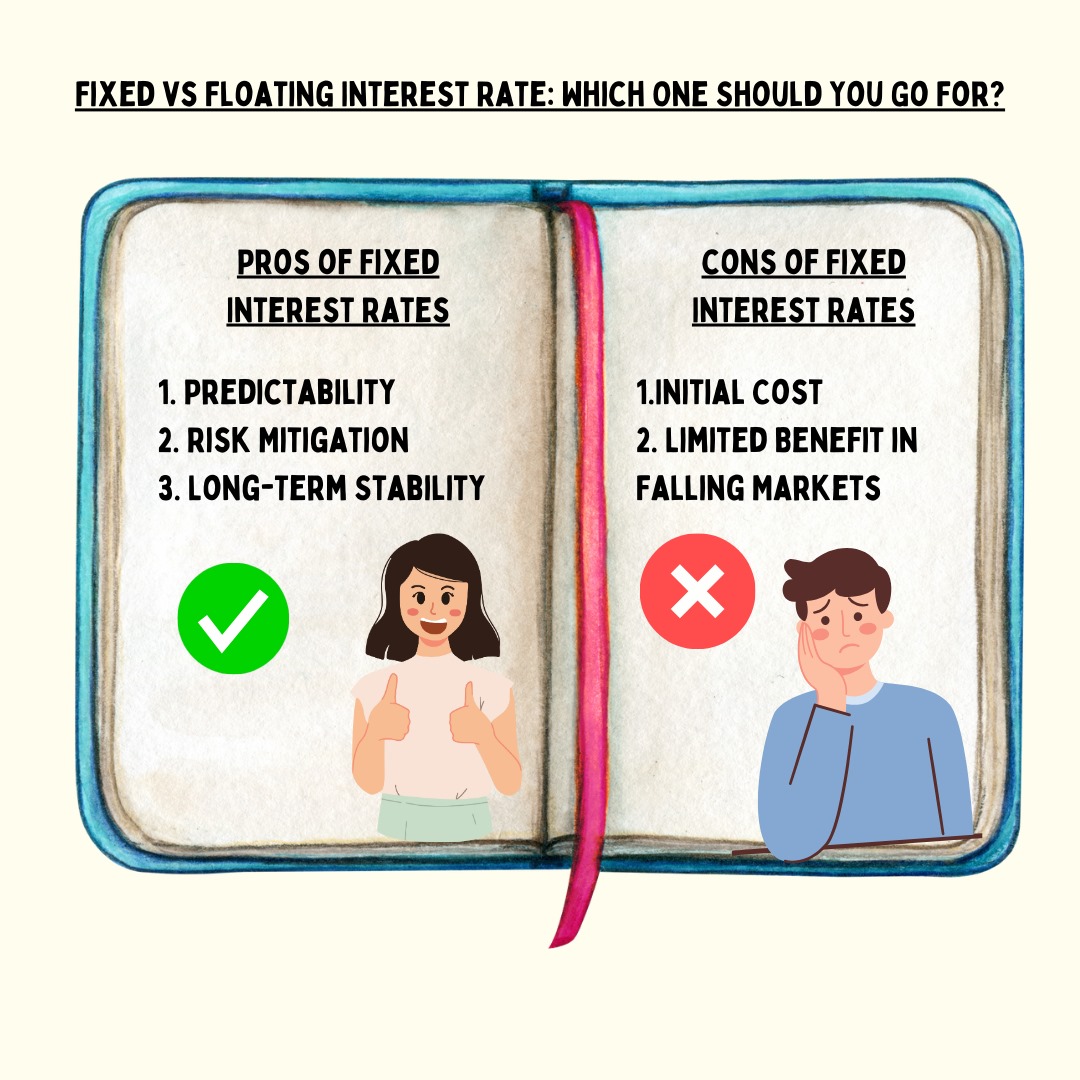

Pros of Fixed Interest Rates

In the debate of fixed vs floating interest rate, you must take note of the pros of fixed interest rates. Let’s get to it:

- Predictability: With fixed rates, you can anticipate your monthly payments accurately, facilitating better financial planning.

- Risk Mitigation: Market volatility won’t impact your interest payments, offering a shield against economic uncertainties.

- Long-Term Stability: Ideal for those seeking a stable financial journey, especially when rates are expected to rise.

Cons of Fixed Interest Rates

Now that you know about the bright side of fixed interest rates, it’s important for you to take a look at the cons of fixed interest rates. For a holistic understanding of fixed interest rates, read ahead:

- Initial Cost: Fixed rates might be higher initially, reflecting the stability they provide.

- Limited Benefit in Falling Markets: If market interest rates decrease, you won’t benefit from lower rates, as your interest is already fixed.

What is Floating Interest Rate?

Contrary to fixed rates, floating interest rates are dynamic, fluctuating with market conditions. Picture a ship navigating the open sea, adapting to the rise and fall of waves. Similarly, borrowers with floating rates experience changes in their interest payments as market rates shift. Click here to find out how you can manage interest rate risk.

Floating rates are typically tied to benchmark interest rates, such as the prime rate or the London Interbank Offered Rate (LIBOR). As these benchmarks change, so does your interest rate. While this variability introduces an element of uncertainty, it also opens the door to potential savings if market rates decrease.

Pros of Floating Interest Rates:

Floating interest rates have their own pros and cons. Take a look at the pros of floating interest rates:

- Initial Affordability: Floating rates may start lower than fixed rates, making them attractive during periods of low market interest rates.

- Potential for Savings: If market rates decrease, borrowers with floating rates can benefit from lower interest payments.

Cons of Floating Interest Rates:

As with fixed interest rates, it’s crucial for you to know the cons of floating interest rates. Take a closer look at the cons of floating interest rates:

- Uncertainty: Monthly payments can vary, making budgeting and financial planning more challenging.

- Exposure to Market Volatility: Economic fluctuations can lead to increased interest rates, potentially impacting your repayment amounts.

Choosing the Right Path: Factors to Consider

Deciding between fixed and floating interest rates requires a careful examination of your financial situation and preferences. Here are key factors to consider:

- Market Conditions:

– Fixed Rate Preferred in Rising Markets: If market indicators suggest an upward trend in interest rates, opting for a fixed rate can protect you from increased costs.

– Floating Rate Advantage in Falling Markets: In a market where interest rates are expected to decrease, a floating rate might offer potential savings.

- Risk Tolerance:

– Stability vs Potential Savings: Evaluate your comfort with fluctuating payments. If you prefer stability, a fixed rate is suitable. If you’re open to market changes for potential savings, a floating rate might be more appealing.

- Loan Duration:

– Short-Term vs Long-Term Considerations:

For short-term loans, a fixed rate provides predictability. Long-term loans may benefit from floating rates if market conditions are favorable.

- Economic Outlook

– Consider Future Market Trends: Assess economic forecasts to gauge whether interest rates are likely to rise, fall, or remain stable. Make your decision based on your expectations.

Navigating Your Financial Journey

In the journey of financing, the choice between fixed and floating interest rates is a pivotal decision. Like a skilled captain navigating a ship through diverse conditions, borrowers must weigh the pros and cons, considering their financial goals, risk tolerance, and market dynamics.

Choosing a fixed interest rate is like steering your financial ship into calm waters, providing stability and predictability. On the other hand, opting for a floating rate is akin to setting sail on the open sea, ready to navigate the waves of market fluctuations in pursuit of potential savings.

As you stand at the helm of your financial vessel, analyze the market compass, understand fixed vs floating interest rate, and set a course that aligns with your financial objectives. Whether you choose the steadfastness of fixed rates or the adaptability of floating rates, your decision will shape the trajectory of your financial voyage. Smooth sailing!