SBI ATM Card: Apply Online, Fees & Charges, Helpline, And More

State Bank of India has been the first choice of many Indians for decades. Not only are the services top-notch, the plastic money of SBI comes with unparalleled security and a host of benefits.

However, users have complained of not having enough comprehensive guides on how to apply for an SBI ATM card, its fees and charges, and beyond.

To quell any concerns you might have about SBI ATM cards, we have brought to you an all inclusive guide aimed to make the process of getting an SBI ATM card simple. Let’s get to it!

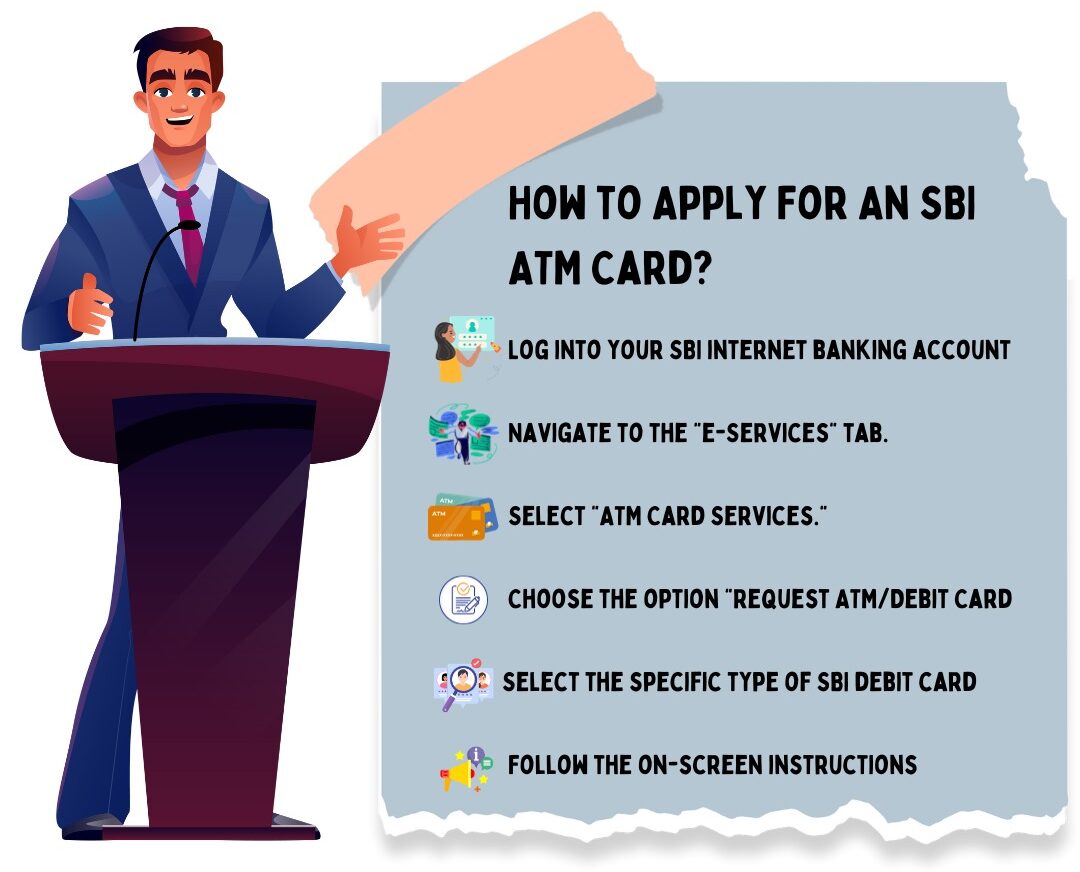

How to Apply For An SBI ATM Card?

To apply for an SBI ATM card online, follow these steps:

- Log into your SBI internet banking account.

- Navigate to the “e-Services” tab.

- Select “ATM Card Services.”

- Choose the option “Request ATM/Debit Card.”

- Select the specific type of SBI debit card you wish to apply for based on your needs.

- Follow the on-screen instructions to complete the application process.

Alternatively, you can also apply for an SBI debit card online by sending an email request to [email protected].

Once your request is processed, you will be notified regarding the dispatch of your new SBI ATM card, and you can then activate it following the provided instructions.

Helpline

The SBI ATM Card Helpline Number is available 24×7 for cardholders seeking assistance related to SBI ATMs and card-specific information.

You can reach them through these toll-free numbers:

- 1800 1234

- 1800 2100

- 1800 425 3800

- 1800 11 2211

Additionally, there’s a toll number you can use: 080-26599990. If you prefer to contact them via email, you can reach them at [email protected].

SBI ATM Card: Charges & Fees

If you want to know about SBI Debit Card charges and fees, find them here:

- Annual/Renewal Fee: Varies from card to card.

- Replacement Charges: Rs. 300 plus GST.

- Debit Card Issuance Charges: Rs. 100 – Rs. 300.

- Foreign Currency Transaction Charges: Rs. 100/- min. + 3.5% of the Transaction Amount + GST.

- Balance Enquiry charges outside India: Rs. 25 plus applicable taxes.

This is all you need to know about SBI ATM card charges and fees. But when it comes to SBI Cards, Debit or ATM cards is not the only thing users enquire about.

Many queries are raised about SBI credit cards. To quell any questions about SBI credit cards, read the following text.

SBI Credit Card

SBI Card, a prominent credit card issuer in India, provides a diverse range of credit cards tailored to various needs.

Popular choices like SBI Simply Save, SBI Simply Click, Cashback SBI Card, SBI Card ELITE, and BPCL SBI Card cater to distinct preferences, from shopping to travel and fuel to groceries.

This variety can make choosing the right card a bit overwhelming.

With SBI credit cards, you can earn rewards, cashback, and access perks like complimentary lounge visits and discounted movie tickets.

There’s also a range of other SBI credit cards, from entry-level to premium, such as the Air India SBI Card Platinum and Yatra SBI Credit Card.

Benefits of SBI Credit Card

Common benefits across SBI cards include add-on cards, instant cash through Encash Facility, flexible EMIs with Flexipay, and balance transfers.

Additionally, SBI cards offer features like overlimit spending, automated utility bill payments, and even insurance coverage for premium cards.

Fees & Charges of SBI Credit Card

When it comes to fees and charges, they vary between card types, but you can expect annual fees, finance charges, and late payment fees.

Eligibility criteria encompass an age range of 18 to 60 years, with options for both salaried and self-employed individuals.

Applying for an SBI Credit Card

Applying for an SBI Credit Card is straightforward, and you can compare options based on your eligibility and preferences. Plus, SBI regularly offers promotions and discounts through various partners, making their cards more rewarding.

Managing your SBI credit card is convenient through the SBI Card Mobile App or online portal, enabling bill payments, checking statements, and accessing additional services.

So, SBI Credit Cards offer a wide array of options to suit your specific lifestyle and financial needs, whether it’s for everyday expenses, travel, or shopping.

It’s essential to explore the various card types and their features to find the one that best aligns with your preferences.

If you want more valuable guides like these, keep checking out this space.