Sudden increase in prices? Financial planning looking tricky? Purchasing power going down? This is all a sign of inflation – a phenomenon common in most economies around the world. Although the rate of inflation and its impact can vary from country to country, it is something that deeply affects each individual.

Since inflation affects your everyday life, it is very important for you to understand its in and out. Here we will discuss all the information you require.

What’s here for you

Inflation Meaning

Types of Inflation

Pros and Cons of Inflation

Causes of Inflation

Effects of Inflation

Worst Cases of Inflation

How to Stay Ahead of Inflation

Inflation Meaning

Inflation means prices going up over time, so when you buy things, you might notice that your money doesn’t stretch as far as it used to. It’s like your purchasing power is shrinking. The rate of inflation shows how much prices are going up, usually shown as a percentage. So, if inflation is 3%, it means that on average, prices are 3% higher than they were before.

This affects everything you buy, from groceries to clothes to gas. When prices keep rising, your money doesn’t buy as much as it did before. Inflation is the opposite of deflation, which is when prices go down and your money can buy more.

Now that you know inflation meaning, let’s take a look at its types.

Types of Inflation

If you know about different types of inflation, it will help you see how prices can change and what it means for the economy and your money.

Here are the four main kinds you need to be aware of.

Creeping Inflation

Prices go up slowly over time. It’s not too worrying and helps keep the economy stable.

Walking Inflation

Prices rise up to 10%. It’s faster than creeping inflation and warns us about galloping inflation.

Galloping Inflation

Prices jump by 10% or more quickly. Your money loses value fast, and it’s hard to keep up with rising prices. The economy gets out of balance, and strict measures are needed to control it.

Hyperinflation

Prices shoot up more than 50% in just one month! It’s rare and really bad for the economy. It happens when there’s too much money but not enough growth. Hyperinflation causes chaos and big problems for everyone.

Knowing these types of inflation helps you understand how prices can change rapidly and how it affects your money and the country’s economy.

Now let’s get to the pros and cons of inflation.

Pros and Cons of Inflation

By now you know inflation meaning. But do you know that Inflation has its pros and cons that affect both individuals and the economy as a whole?

Pros:

1. Higher Asset Value

If you own things like property or stocks, inflation can raise their prices. This means you could sell them for more money later on.

2. Encourages Spending

Some inflation is good because it encourages people to spend their money instead of just saving it. When money loses value over time, there’s more reason to spend it now rather than later, which can boost economic activity.

Cons:

1. Higher Costs for Buyers

When prices go up, you have to spend more money on products and services. This means you might not be able to buy as much with the same amount of money.

2. Increases Prices in the Economy

Inflation makes everything more expensive, which can be tough for businesses, workers, and consumers. It introduces uncertainty because people might not know how much prices will rise in the future.

3. Uneven Price Increases

Inflation doesn’t affect everything at once. Some prices go up first, and others follow later. This can lead to distortions in the economy, making it harder for businesses and individuals to plan for the future.

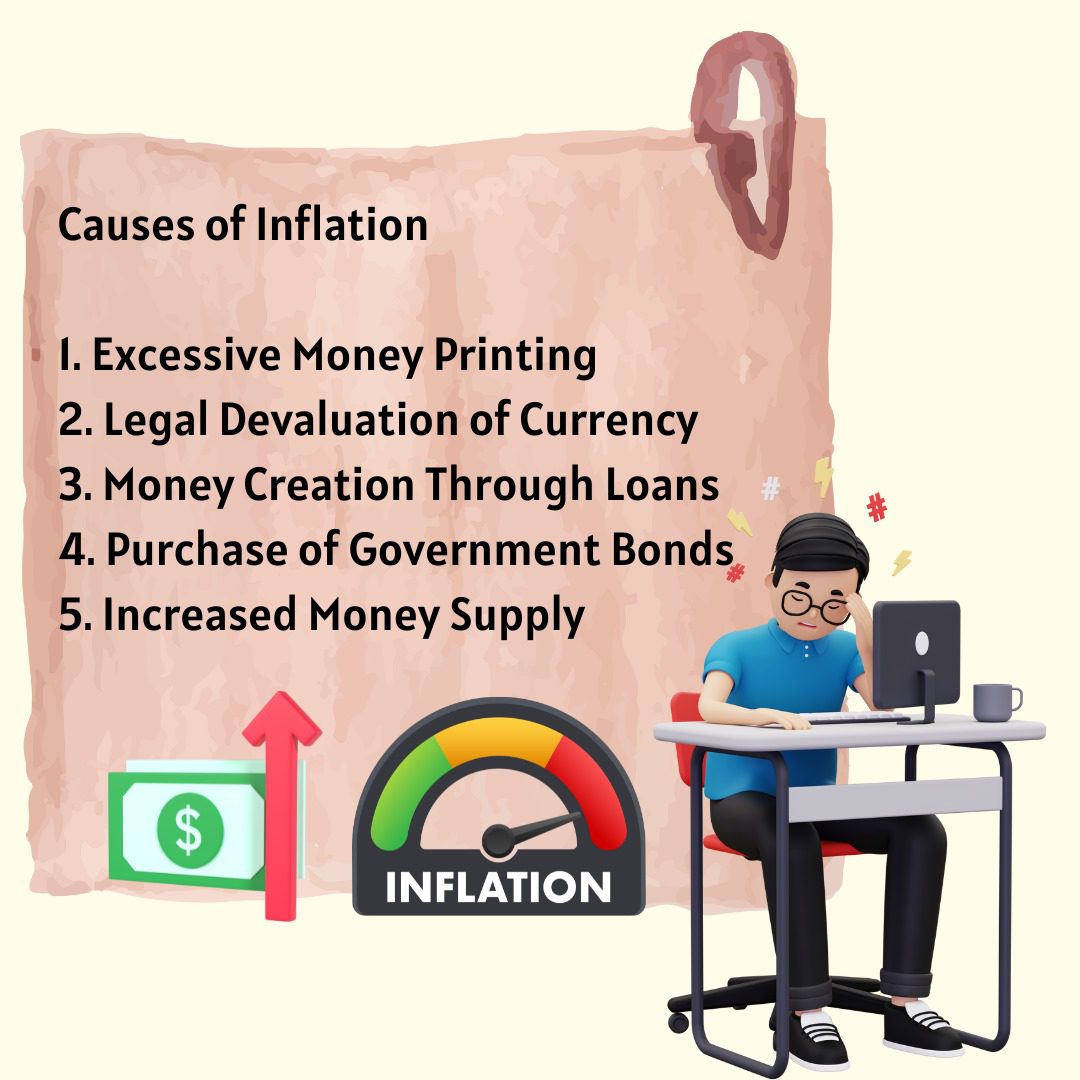

Causes of Inflation

After knowing the pros and cons of inflation, the next most logical thing to look at is causes of inflation.

Inflation happens for different reasons, and understanding these causes can help you make sense of how prices change:

1. Demand-Pull Inflation

When there’s a lot of demand for goods and services but not enough of them being made, prices go up. For example, if oil-producing countries cut down on oil production, there’s less oil available, and its price goes up, causing inflation.

- Cost-Push Inflation

Sometimes, it costs more to make things. When businesses have to pay more for things like wages or raw materials, they raise prices to keep making a profit. If the cost of milk goes up, the cost of your morning coffee might go up too.

3. Built-In Inflation

This happens when workers ask for more pay to keep up with higher living costs. Then, businesses raise prices to cover the higher wages they’re paying. It becomes like a cycle where one thing leads to another, and prices keep going up.

4. Exchange Rates

If the value of your country’s money drops compared to other countries, imported goods become more expensive, leading to inflation. Conversely, a weak currency can make exports cheaper for other countries.

5. Money Supply

When there’s more money floating around than there are things to buy, prices go up. If the amount of money grows faster than the economy, prices rise.

6. National Debt

If a country has a lot of debt, the government might raise taxes or print more money to pay it off. Both ways can lead to inflation: higher taxes mean businesses raise prices, and printing more money makes money worth less, causing prices to rise.

These are the main reasons prices go up, and they all affect how much things cost and how far your money goes.

So now you know what leads to inflation. But do you know what it affects? Let’s take a look.

Effects of Inflation

Inflation affects you and everyone else in many ways:

Decreased Purchasing Power

When prices go up, the money you have can’t buy as much as it used to. You might find it harder to afford the same things you used to buy.

Cost of Living Increases

As prices rise, the cost of everyday items like food, housing, and transportation goes up. This means you have to spend more of your money on basic necessities.

Impact on Savings

If the interest you earn on your savings doesn’t keep up with inflation, the real value of your savings decreases over time. In the future, your money won’t purchase as many things as it does currently.

Uncertainty

Inflation makes it hard for businesses to plan for the future and can create uncertainty in the economy. You might feel unsure about your job security or your ability to afford things in the future.

Income Inequality

Inflation can widen the gap between rich and poor. People with fixed incomes or low wages may struggle to keep up with rising prices, while those with investments or assets may see their wealth grow.

If you know the effects of inflation helps you prepare for changes in prices, you’ll be able to plan your finances wisely, and advocate for policies that promote economic stability and fairness.

Worst Cases of Inflation

Inflation is not great for commoners. But it can get worse in some situations. Let’s take a look at how.

Some of the worst cases of inflation show how money can lose its value very quickly, causing big problems for everyone involved. In the early 1920s, the German Weimar Republic faced hyperinflation, which means prices shot up super fast.

After World War I, Germany had to pay huge amounts of money to other countries as reparations. But instead of having enough valuable money, they printed a lot of paper money, which made it less valuable. People realised their money was losing its worth, so they rushed to spend it before it became even more worthless.

This flooded the economy with more money, making its value drop even more. People ended up using the money for things like wallpaper because it was worth so little. Similar situations happened in Peru in 1990 and in Zimbabwe between 2007 and 2008.

In these cases, inflation got so out of control that money lost its value almost completely, causing chaos and hardship for everyone. Understanding these extreme cases shows how important it is to manage inflation carefully.