North vs South Fund Fight: Karnataka leaders Stages Protest in New Delhi over Unfair Tax Devolution

On Wednesday, several prominent Karnataka leaders, including Chief Minister Siddaramaiah, staged a protest in New Delhi’s Jantar Mantar, accusing the Union government of discriminating against the southern states with respect to Tax Devolution.

What is Tax Devolution?

Tax devolution involves the distribution of tax revenues between the central and state governments. The tax revenues shared with the state government will help the state governments to spend on development, welfare, and priority-sector projects and schemes.

According to Article 280(3)(a) of the Indian Constitution, making recommendations regarding the distribution between the Union and the states of the net proceeds of taxes is a core task of the Financial Commission.

The Issue

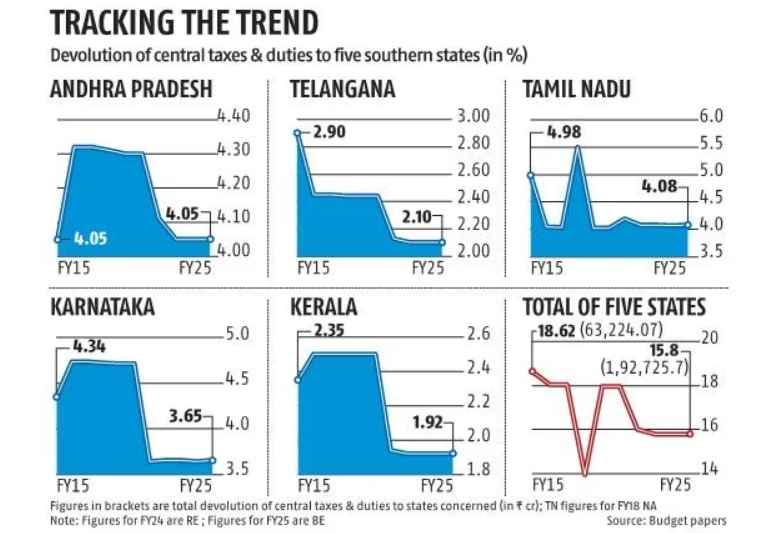

The devolution of central taxes to southern states namely, Andhra Pradesh, Telangana, Tamil Nadu, Karnataka, and Kerala, has witnessed a decline. Their combined share decreased from approximately 18.62 percent in 2014-15 to 15.8 percent in the period of 2021-22 to 2024-25, influenced by the recommendations of the 15th Finance Commission.

Population Parameter Controversy

Fiscally robust southern states express discontent over the 15th Finance Commission’s decision to base population parameters on the 2011 census, contrary to previous commissions using the 1971 census. This shift raised concerns among these states, which have historically controlled population growth better.

Weighted Considerations in Devolution

The 15th Finance Commission introduced weighted considerations, allocating 15 percent for population parameters and 12.5 percent for demographic performance in determining states’ shares in central taxes. While some states maintained their shares, Karnataka and Kerala experienced reductions.

Implication on the Southern States

Southern states, notably Karnataka, Kerala, and Tamil Nadu expressed concerns over declining shares in tax devolution despite their economic contributions. The discrepancy between

contributions and returns escalated fiscal challenges for these states. The reassessment of the devolution matrics might improve the situation.

Current State of Tax Devolution

India Ratings and Research identifies a substantial gap between actual tax devolution to states and the 15th Finance Commission’s recommendations. Despite the Commission’s suggestion of 41 percent, the Union government aims to share only 35.5 percent of the divisible tax pool in FY25. This declining trend in states’ share from central taxes, averaging 35.4 percent during FY21-FY25BE, reflects growing concerns.

Challenges and Concerns: Insights from RBI

The Reserve Bank of India underscores the challenge posed by increasing cesses and surcharges, shrinking the divisible tax pool despite the recommended increase in tax devolution. The reliance on these additional levies affects the actual funds available for states, necessitating a focus on enhancing states’ fiscal capacity.

Prime Minister Narendra Modi’s Response to the Karnataka Leaders protest in Delhi

During the motion of thanks in Rajya Sabha on Wednesday, PM Modi accused the Congress of trying to drive a wedge between the northern and southern states and said the opposition party’s government in Karnataka was trying to create a narrative that would jeopardize the country’s future.

Union Finance Minister Nirmala Sitharaman’s Critique of Karnataka Leaders’ Protest

Finance Minister Nirmala Sitharaman responded to the protest led by Karnataka leaders in Delhi by criticizing the Congress government in Karnataka. She said, ‘Using taxpayer’s money the government has given a full page advertisement on national paper. The advertisement has six claims, however, two are false claims.”

Way Forward

As the debate intensifies, the formulation of the 16th Finance Commission becomes significant. With Arvind Panagariya leading the commission, the focus shifts to formulating a fair and balanced formula for tax revenue sharing. Addressing disparities in tax devolution, especially concerning population dynamics and economic contributions, will be central to ensuring equitable fiscal federalism in India.