Axis Bank Credit Card Score: Why It’s Important and How You Can Find It

Imagine having a statement of trustworthiness. Something that proves that you have good financial behaviour. Well, this is exactly what your credit score does. If you are a user of Axis credit card, you will know that Axis bank credit card score is a powerful tool that evaluates your creditworthiness and financial behaviour.

It’s like a report card for your financial health, helping banks decide whether to approve your credit card application and what interest rate to offer. So, why is it important? Well, a good credit card score means easier access to credit, better interest rates, and perks like higher credit limits and rewards.

Let’s make Axis Bank credit card score easy for you here.

What’s in Here For You?

1. What is Credit Score

2. Factors Influencing Credit Score

3. Importance of Maintaining a Good Credit Score

4. Steps for Axis Bank Credit Card Score

What is Credit Score

Your credit score is similar to a report card that shows how reliable you are when you borrow money. It’s a number that lets lenders, such as banks or credit card companies, know if you’re likely to pay back what you borrow. If your credit score is high, it’s easier for you to get loans or credit cards with good terms.

But if it’s low, it can be harder to borrow money, or you might have to pay more in interest. So, it’s important to keep an eye on your credit score and try to improve it by paying bills on time and managing your debts responsibly.

Factors Influencing Credit Score

There are 5 most influential factors that impact your credit score. From payment history to credit usage, let’s take a look at each of them:

Payment History

This is about how good you are at paying your bills on time. If you consistently pay your bills when they’re due, it helps boost your credit score. But if you miss payments or pay late, it can lower your score.

Credit Utilization

This shows how much of the credit you can use, you’re actually using. If you’re using a lot of your available credit, it can indicate that you might be overextended financially, which can lower your score. Keeping your credit card balances low compared to your credit limits is better for your score.

Length of Credit History

The longer you’ve been using credit responsibly, the better it is for your credit score. If you’ve had credit cards or loans for a while and managed them well, it shows lenders that you’re dependable and can improve your credit score.

Types of Credit

Having a mix of different types of credit, like credit cards, loans, and mortgages, can be beneficial for your credit score. It demonstrates that you’re good at managing different kinds of credit in a responsible way. But opening too many accounts at once can hurt your score.

New Credit Inquiries

When you request new credit, it causes a thorough check on your credit history. Having lots of requests for credit in a short time might make lenders worry about you being risky, especially if you’re trying to get many new credit accounts all at once. So, it’s important to be mindful of how often you’re applying for new credit.

These are 5 of the most important factors that impact what your credit score looks like. Now is a good time to see why it’s important to maintain a good credit score in the first place.

Importance of Maintaining a Good Credit Score

Maintaining a good credit score is crucial because it gives you easier access to loans and credit cards, lowers your interest rates, improves housing and employment opportunities, allows for higher credit limits, and reduces insurance premiums and utility deposits, ultimately saving you money and providing financial flexibility.

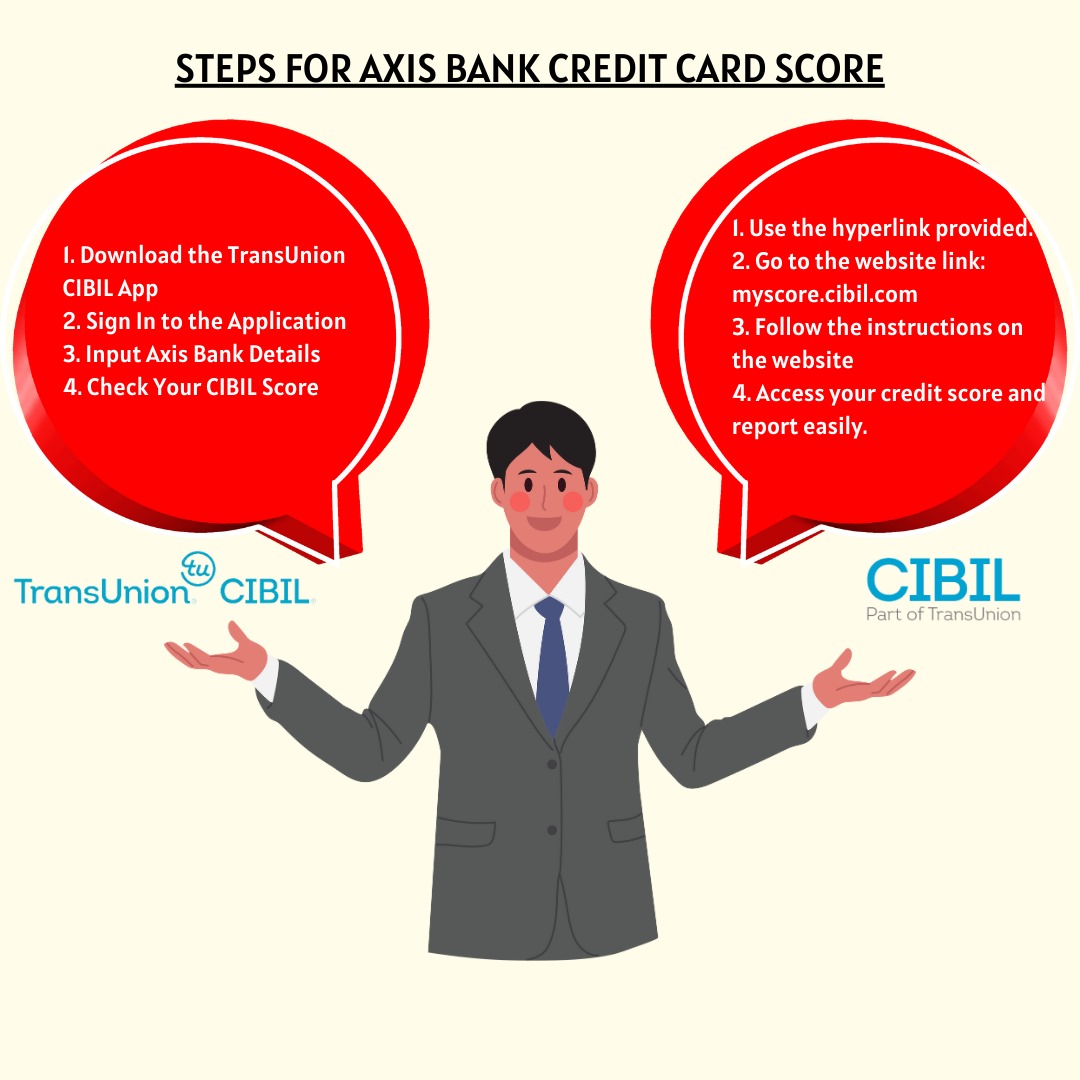

Steps for Axis Bank Credit Card Score

You just need to follow 4 simple steps to check your Axis Bank credit card score. Do not miss any step and execute each of them with precision.

1. Download the TransUnion CIBIL App:

– Open the Google Play Store on your phone.

– Search for the “TransUnion CIBIL” application.

– Proceed to download and install the application on your device.

- Sign In to the Application:

– Launch the TransUnion CIBIL app.

-Type in your username and password that you previously set up.

– Click on the Sign In option to gain access to the application.

- Input Axis Bank Details:

– Within the application interface, find the section for inputting bank details.

– Provide the necessary information related to your Axis Bank account as prompted.C

4. Check Your CIBIL Score:

– Once you’ve entered your Axis Bank details, proceed to check your CIBIL score through the application.

Alternative Method:

– If you prefer an alternative approach, you can utilize the provided hyperlink:

– Visit the website link provided (https://myscore.cibil.com/CreditView/login.page?enterprise=AXIS).

– Follow the instructions provided on the website to easily access your credit score and report.

6 Things to Keep in Mind Regarding Your Credit Score

Just knowing your credit score is not enough, you need to understand what best you can do with this score and how. Remember these 6 things.

1. Regularly Assess Your CIBIL Score

– It is crucial to periodically review your CIBIL score to comprehend your creditworthiness.

– Regular monitoring facilitates taking necessary actions to uphold or enhance your credit score.

2. Employ Insights from Your Credit Score

– Utilize the insights derived from your CIBIL score to make well-informed financial decisions.

– Promptly address any discrepancies or issues identified in your credit report.

3. Maintain Optimal Credit Health

– Practice responsible financial habits to ensure a favorable credit profile.

– Timely repayments, prudent credit utilization, and effective debt management contribute to sustaining a healthy credit score.

4. Seek Assistance as Needed

– Should you encounter challenges or have inquiries regarding your credit score, seek assistance from Axis Bank or pertinent financial entities.

5. Stay Informed

– Stay abreast of fluctuations in your credit score and credit report to remain financially informed.

– Regular monitoring aids in identifying and rectifying any factors impacting your creditworthiness.

6. Utilize Available Educational Resources:

– Take advantage of educational resources offered by Axis Bank and credit bureaus to deepen your understanding of credit scoring and financial well-being.

By now, you have a deep understanding of how to figure out Axis Bank credit card score. From knowing the simple steps to find it to knowing the importance of a good credit score, you have all the information you need. If you need more such insightful articles on the difference between credit score and CIBIL score, how to keep a good credit score, and more, keep checking out this space.