Car Insurance Premium Calculator Oriental Insurance: 5 Simple Steps to Use

For everything good in life, there’s a price (and that also includes insurance). In return for protection, peace of mind, and financial security, you have to pay a premium to your car insurance company.

But how much money do you have to pay? What factors determine your premium? These questions get people biting their nails. Now if you’re an Oriental Insurance user, you don’t have to go through the drill because you have the – Car Insurance Premium Calculator Oriental Insurance.

Here, we’ll cover everything you need to know about this calculator.

What is Car Insurance Premium Calculator Oriental Insurance?

The Car Insurance Premium Calculator offered by Oriental Insurance is a user-friendly tool designed to help estimate the cost of car insurance premiums. It considers several factors (which we’ll discuss ahead).

By entering relevant information such as the vehicle’s registration number, users can obtain an approximate premium amount.

The calculator takes into account the following key factors:

Insured Declared Value (IDV): Represents the maximum sum assured in case of total loss or theft of the vehicle.

Coverage Type: Determines the level of protection offered by the insurance policy.

This tool empowers individuals to make informed decisions regarding their car insurance policies by providing transparency and clarity regarding expected premium costs.

The best part? Users can tailor their insurance plans according to their budget and coverage needs, ensuring they have adequate financial protection against unforeseen events such as accidents or thefts.

So you know what Oriental Insurance’s Premium Calculator is, but do you know how to use it?

Let’s see right through it.

How to Use Car Insurance Premium Calculator Oriental Insurance?

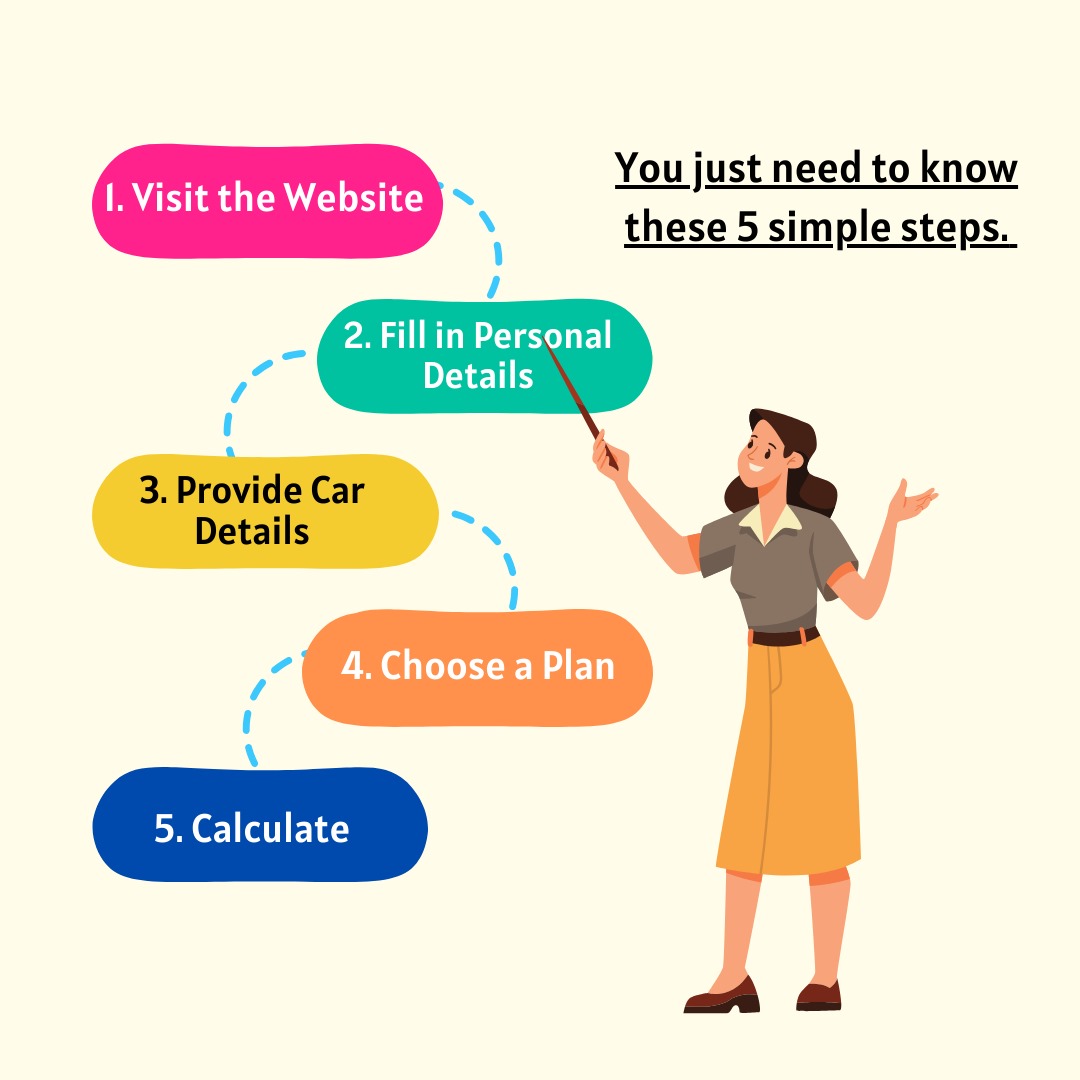

Using Oriental Insurance calculator is not a complex process. You just need to know these 5 simple steps.

- Visit the Website

Go to the Oriental General Insurance Company website and navigate to the premium calculator page.

- Fill in Personal Details

Enter your name, contact information including phone number and email ID, along with your residential address.

- Provide Car Details

Select your car’s make and model, input the manufacturing year, and specify the location of the Regional Transport Office (RTO) where your car is registered.

- Choose a Plan

Decide on the insurance plan you wish to purchase based on your coverage needs.

- Calculate

Press the “Calculate” button to start the computation process. The calculator will then display the estimated premium amount for your selected insurance plan.

That’s all, these 5 steps are all that you need to know to calculate the premium of your oriental car insurance. But do you wonder how this premium exactly works? Let’s see.

How Does Oriental Car Insurance Premium Calculator Work?

The Oriental Car Insurance Premium Calculator works like this: It checks lots of factors (as discussed above) to figure out how much your car insurance should cost.

It looks at stuff like when your car was made, what kind of car it is, if you’ve got any No Claim Bonus, what fuel it uses, how big the engine is, and more. Plus, it also checks if you want a basic plan or a fancy one. If you go for the fancy one, you’ll pay more.

You can also tweak your insurance plan. If you don’t like what’s included, you can add extras like engine protection or roadside help, but you’ll have to pay extra for those.

Before giving you the final amount to pay, the Oriental calculator thinks about all these things. The formula it uses is: (Own Damage Premium + No Claim Bonus) + Liability Premium.

You know almost the in and out of Car Insurance Premium Calculator Oriental Insurance now.

But another important bit to consider is the benefits of the Oriental Car Insurance Premium Calculator.

Benefits of Oriental Car Insurance Premium Calculator

Although we’ve briefly touched on them, the following 3 are the top benefits of Car Insurance Premium Calculator Oriental Insurance.

- Accurate IDV Calculation

The premium calculator ensures precise estimation of the Insured Declared Value (IDV). IDV represents the coverage amount you receive in case of total loss or theft, ensuring transparency and confidence in your insurance coverage.

- Cost-effective Planning

Use the Oriental premium calculator to gain insights into estimated premium costs. Make informed decisions regarding your car insurance, ensuring you opt for a plan that’s not only cost-effective but also provides comprehensive coverage tailored to your needs.

- Convenient and Seamless Process

No need to rely on third-party agents. Assess various insurance plans from the comfort of your home. Visit the Oriental General Insurance Company’s official website, select a plan, and calculate the estimated premium effortlessly on your laptop or device. This streamlined process puts you in control, saving time and offering convenience.

These are some of the many ways in which you’ll be benefited with Oriental Car Insurance calculator.

What Factors Decide Your Car Insurance Premium?

From manufacturing year to the brand, make and model of your car, everything affects your Car Insurance Premium.

- Manufacturing Year

The year your car was made plays a crucial role in determining your insurance premium. Newer cars generally incur higher premiums compared to older ones.

- Insured Declared Value (IDV)

The IDV represents your car’s current market value and the compensation you’d receive in case of total loss or theft. Opting for a higher IDV increases your premium.

- Brand, Make, and Model

Luxury vehicles command higher premiums than budget cars due to their higher market value and repair costs.

- Engine Power

Cars with more powerful engines typically have higher maintenance costs, leading to increased insurance premiums.

- City of Registration

Surprisingly, your city of residence influences your premium. Tier 1 cities generally have higher premiums compared to Tier 2 or 3 cities.

- Add-on Cover/Riders

If the standard coverage of your insurance plan doesn’t meet your needs, add-ons provide extra protection but come at an additional cost to your premium.

So, now you know that a mix of factors influence your car insurance premium.

This is everything you needed to know about Car Insurance Premium Calculator Oriental Insurance. Gaining knowledge on the factors that influence your premium to take a step-by-step approach to calculating your premium, you are now fully equipped to handle all-things premium with your car insurance. For more such value-packed financial guides, keep checking out the NewsCanvass space.