Commercial Vehicle Insurance: Know The Top 6 Benefits

Do accidents come knocking at anyone’s door? If not, why do we become complacent when it comes to insuring our commercial vehicles? Why do we ignore that insurance is a social security tool?

In an accident involving commercial vehicles, not only are the vehicles highly likely to be damaged but also the goods and cargo being carried, drivers, and passengers in the vehicle, and more.

In such high risk, the best way to cover liabilities for bodily injury or property damage, as well as other risks like theft, vandalism, and collision is: Commercial Vehicle Insurance.

To help you understand how commercial vehicle insurance works,

Commercial Vehicle Insurance

Commercial vehicle insurance is a customised insurance plan that protects commercial vehicles from damage. It covers both parties involved in an accident for injuries or death and also provides coverage for losses from natural disasters, fires, and other incidents. Business owners with vehicles like auto-rickshaws, trucks, cabs, and buses should ensure coverage.

What is Covered Under Commercial Vehicle Insurance?

Commercial vehicle insurance protects business vehicles. It covers things like damage, accidents, theft, and medical costs. It’s crucial for businesses that use vehicles for work purposes, like transporting goods or people.

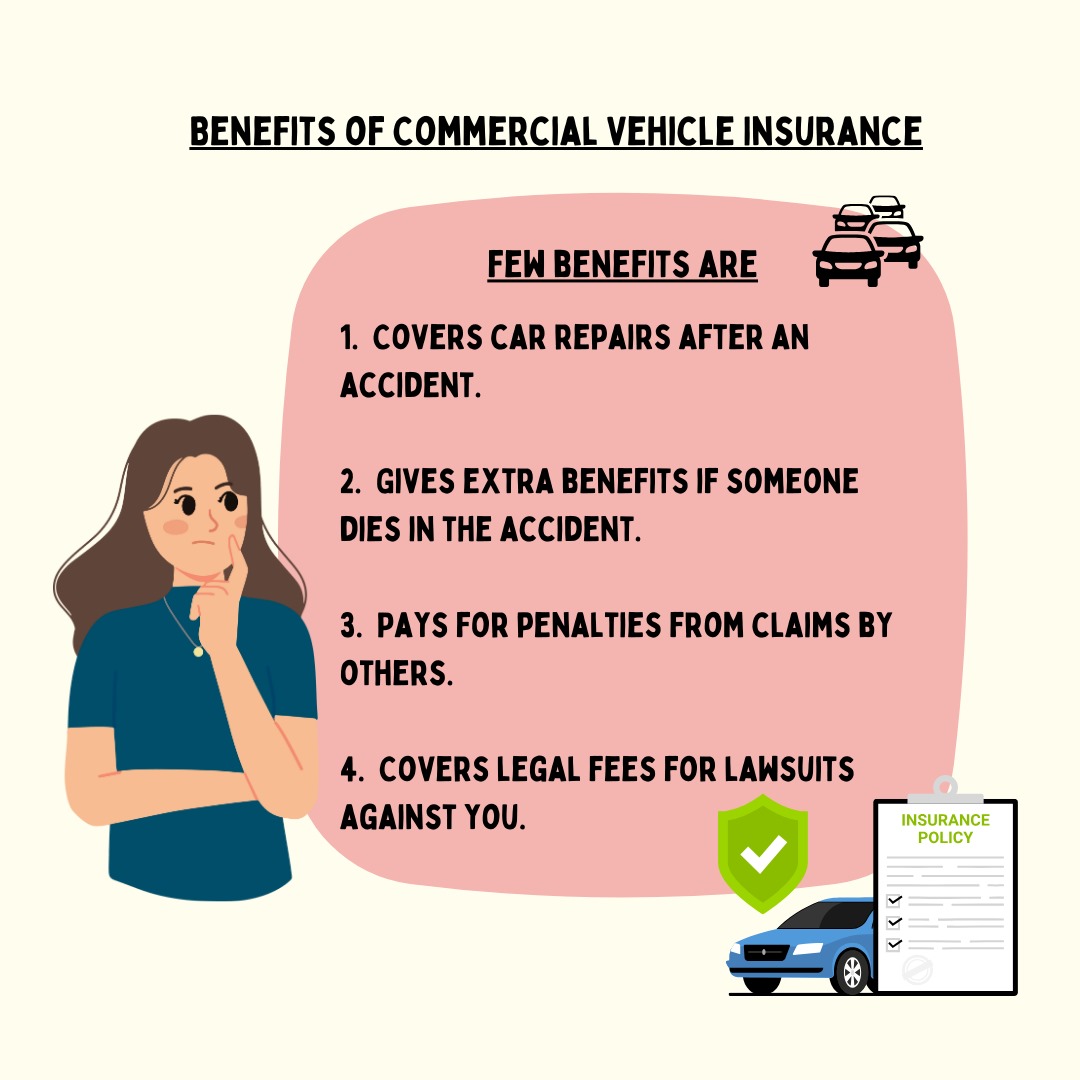

Benefits of Commercial Vehicle Insurance

Commercial vehicle insurance provides important benefits for businesses:

- It shields your business vehicles from damage, accidents, and theft, preventing financial losses.

- Many places require businesses to have insurance for their vehicles. It helps you comply with legal regulations.

- Knowing your vehicles are covered brings peace of mind, letting you focus on running your business without worrying about unexpected costs.

- In case of accidents, insurance helps cover repair costs or replacement, saving your business from significant financial setbacks.

- It includes coverage for injuries or damage to others, safeguarding your business from potential lawsuits.

- With insurance, your business can recover more quickly after an unfortunate event, reducing disruptions to daily operations.

Now that you know the benefits of commercial vehicle insurance, let us try to understand the factors to consider while choosing commercial vehicle insurance.

Factors to Consider While Choosing Commercial Vehicle Insurance

The following factors need to be considered while choosing commercial vehicle insurance:

- Assess the specific needs of your vehicle. Consider factors like the type of vehicle, its purpose, and the level of coverage required.

- Understand different policy types such as liability, comprehensive, and collision. Choose one that aligns with your coverage needs.

- Determine a budget for insurance costs. Compare quotes and find a balance between coverage and affordability.

- Decide on the deductible amount you’re comfortable with. Higher deductibles often mean lower premiums, but consider what you can afford to pay out of pocket.

- Ensure the policy provides adequate coverage limits for potential liabilities. Assess your business’s risk exposure and choose limits accordingly.

- Research the ease and efficiency of the insurer’s claims process. A smooth claims experience is crucial during stressful situations.

- Check reviews and the reputation of insurance providers. Opt for a reliable company with a good track record in handling claims and customer service.

- Inquire about available discounts or incentives. Some insurers offer discounts for safe driving records, multiple vehicles, or bundling policies.

- Choose a policy that can adapt as your business grows or changes. Flexibility is key to ensuring your coverage remains suitable over time.

- Consider the quality of customer support. An attentive and supportive customer service team has the potential to greatly enhance your overall satisfaction.

By considering these factors, you can tailor your vehicle insurance policy to meet the unique needs of your business, providing both protection and financial stability. And if you want to keep yourself on the top of your insurance validity period, the process is pretty simple.

Factors that Influence the Premiums of Commercial Vehicle Insurance

Several factors influence the premiums of commercial vehicle insurance. Check them out here:

1. Vehicle Type

The type of commercial vehicle influences premiums. Larger or specialised vehicles may have higher premiums due to increased risks.

- Usage Patterns

How your vehicles are used matters. Higher mileage or specific business uses can impact premiums.

- Driving History

The driving records of your drivers affect premiums. A clean record often results in lower premiums.

- Coverage Limits

Higher coverage limits typically lead to higher premiums. Evaluate the level of coverage needed versus the associated costs.

- Deductibles

Opting for higher deductibles can lower premiums. Consider how much you can afford to pay out of pocket in the event of a claim.

- Business Location

The location where your vehicles operate can influence premiums. Areas with higher accident rates or crime may have increased costs.

- Safety Measures

Implementing safety measures, such as installing security systems or training drivers, can lead to lower premiums.

- Claims History

Regularly filing claims in the past can lead to increased insurance premiums. Insurers assess your claims record to determine risk.

- Driver Training Programs

Participating in driver training programs can demonstrate a commitment to safety, potentially reducing premiums.

- Vehicle Age and Condition

Older vehicles or those in poor condition may have higher premiums due to increased risk of breakdowns or accidents.

- Business Industry

Different industries may face varying risks. Insurers consider the specific risks associated with your business type.

Understanding these factors can help you make informed decisions to manage and potentially reduce your commercial vehicle insurance premiums.

In conclusion, accidents can happen anytime, so it’s vital to protect our commercial vehicles. Commercial Vehicle Insurance does more than just cover vehicle damage – it also keeps drivers, passengers, and cargo safe. This insurance is like a customized shield, taking care of accidents, theft, and medical costs. For businesses using vehicles, it’s not just a smart move but often a legal must-do, offering benefits from financial protection to following the rules.

Picking the right insurance means thinking about things like the type of vehicle, how much coverage is needed, budget, and finding a trustworthy insurer. Knowing what affects the cost, like how vehicles are used or safety measures in place, helps businesses make smart choices that fit their needs.

In a world where surprises can happen, commercial vehicle insurance is like a dependable friend, making sure everything stays safe and stable when unexpected things pop up. Using this essential protection lets businesses keep growing with confidence.