Credit Card vs Debit Card: Explanation and Comparison (Ultimate Guide)

Credit card vs debit card which is better? Credit card vs debit: what’s the difference? You might have these questions just like an overwhelming majority of people do.

Though, credit cards and debit cards are two of the most frequently used financial instruments in your wallet, there’s a possibility of you still trying to get in grips with a well-rounded understanding of the same.

Besides, the variety of benefits and drawbacks of the two may leave you confused and overwhelmed. And to add insult to injury, there aren’t enough guides that comprehensively cover the difference between the two.

To make this situation better for you, we’ve covered the basics of credit card and debit card here. After this guide, so that you don’t face any trouble making the right choice for yourself.

Credit Card vs Debit Card Difference

Let’s answer once and for all as to what the difference between credit card and debit card is. Some metaphors are on your way followed by textbook definitions for the full understanding of credit card vs debit card difference.

Think of credit cards as a versatile box of tools. It’s as if you have a toolkit with different gadgets – from a basic tool with no fees to a deluxe one with perks like a personal assistant and cashback rewards.

Using these tools (credit cards) responsibly can be like building a good reputation in a magical land where lenders keep an eye on your deeds (what’s called a credit score in the real world).

But beware, like a double-edged sword, they can lead you into the tricky waters of debt if you’re not careful.

In opposition, debit cards are like a direct connection to your bank account, acting like a key to your personal treasure chest. They don’t come with extra tools but are reliable and won’t demand any annual fees.

Using them means you won’t find hidden gems with your tools (unlike credit cards), but you won’t have to worry about the gold in your personal treasure chest (in the case of debit cards).

So, in conclusion, credit cards are versatile tools with the potential for great rewards and protection, but they come with the danger of falling into a debt trap.

Debit cards, on the other hand, are like straightforward keys to your own treasure, offering simplicity and security but without the added perks and recognition.

Now that you’ve seen the metaphors about credit card vs debit card difference. Let’s also take a look at the textbook definitions for a sound understanding.

Also Read: Pros and Cons of Credit Cards: Ultimate 7 Benefits & 5 Drawbacks!

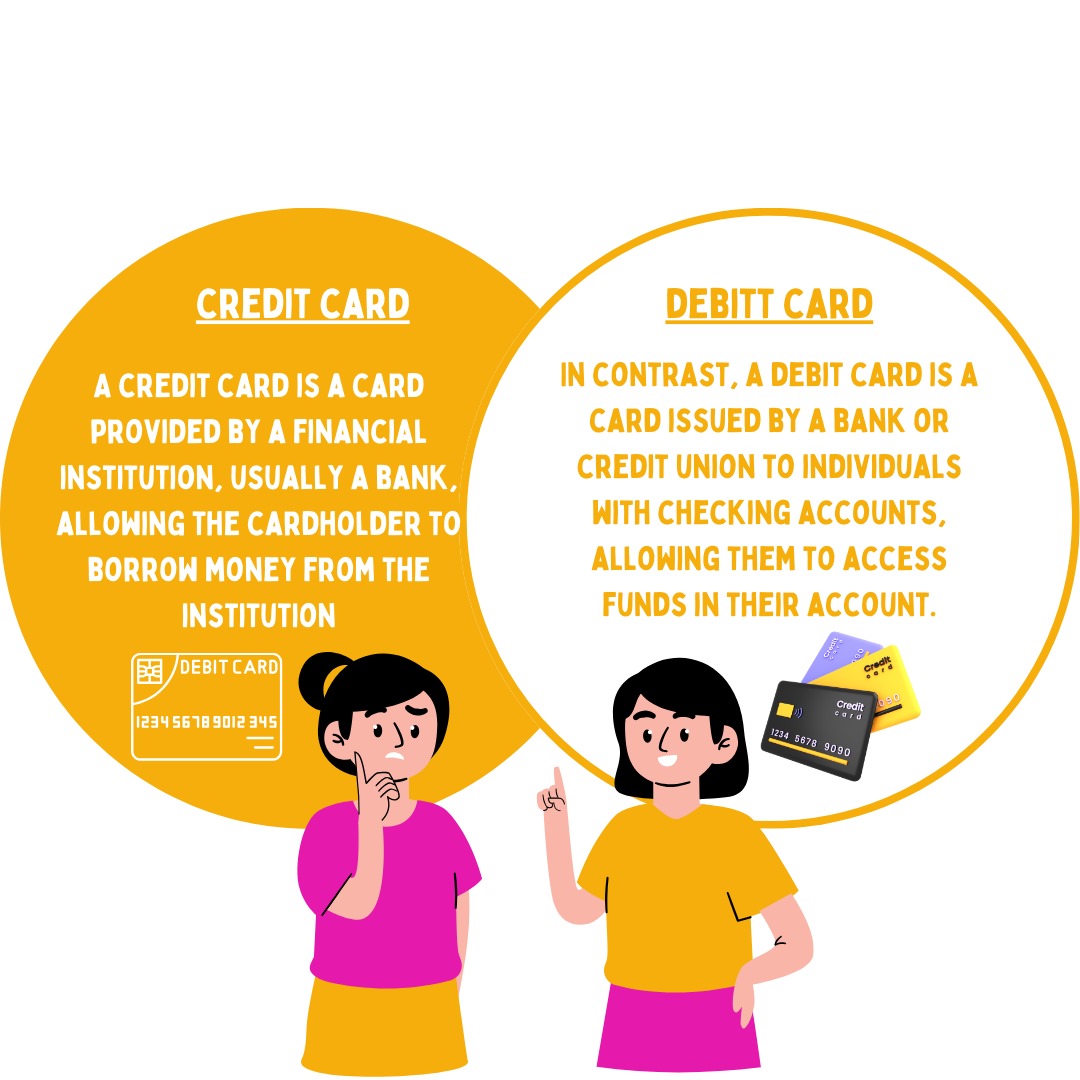

Credit Card Definition

A credit card is a card provided by a financial institution, usually a bank, allowing the cardholder to borrow money from the institution.

The cardholder commits to repay the borrowed amount with interest based on the institution’s conditions.

Debit Card Definition

In contrast, a debit card is a card issued by a bank or credit union to individuals with checking accounts, allowing them to access funds in their account.

A debit card can be used to withdraw cash from ATMs or make purchases of goods and services.

Credit Card vs Debit Card Which is Better?

Credit cards and debit cards, though they may appear similar, cater to different financial needs and goals. The choice between them depends on your financial priorities and spending habits.

If you’re keen on building credit and enjoying rewards, credit cards can be an excellent choice. They offer an array of consumer protections, including robust fraud protection, purchase warranties, and the ability to dispute unauthorised charges. However, the potential for debt and associated costs like interest and fees are important factors to consider.

On the other hand, if you’re committed to avoiding debt, debit cards offer a more disciplined approach to spending.

They provide fraud protection, often with zero liability, and do not come with annual fees. Yet, they lack the rewards and credit-building potential of credit cards.

Also Read: HDFC Debit Card: Types, Eligibility Criteria, Features, Benefits, and More

Ultimately, the choice between credit and debit cards should align with your financial goals and your ability to manage your finances responsibly.

Whichever you choose, being aware of the associated fees and protections is crucial. So, whether you reach for your credit or debit card, do so with a keen understanding of the financial tool you’re wielding.

So to conclude, the world of personal finance is filled with choices, and credit cards and debit cards are fundamental tools that shape our financial lives.

By understanding the key differences, advantages, and disadvantages of these two financial instruments, you can make more informed decisions about your spending habits.

Whether it’s the allure of credit card rewards or the discipline of debit card spending, the choice ultimately lies in your hands.

So, remember to use your financial tools wisely, and they will serve you well on your journey to financial well-being topics.

Additionally, if you want to equip yourself with the knowledge of more such topics, then you must follow NewsCanvass!