ICICI Credit Card Payment in 5 Easy Steps

Want to easily manage and track your expenses, avoid late fees, and maintain a good credit score? All of this is possible with ICICI credit card payment. With ICICI’s flexible payment options, you can stay in control of your finances and enjoy the benefits of responsible credit card usage.

ICICI Credit Card Payments aren’t just about settling bills; they’re about managing your finances with ease and convenience. Whether you prefer online payments, mobile apps, or traditional methods, ICICI offers a range of options to suit your preferences.

So if you want to know everything about ICICI credit card payment, read ahead with precision.

Let’s start with the basics.

What is Credit Card Payment?

Credit card payment is a way of buying things without using cash. Instead of paying with physical money, you use a special card called a credit card. When you buy something with a credit card, the money doesn’t come directly from your bank account.

Instead, the credit card company pays for the purchase on your behalf, and you agree to pay them back later. You usually have to pay back the money you spent, plus any extra fees or interest charges, depending on the terms of your credit card agreement.

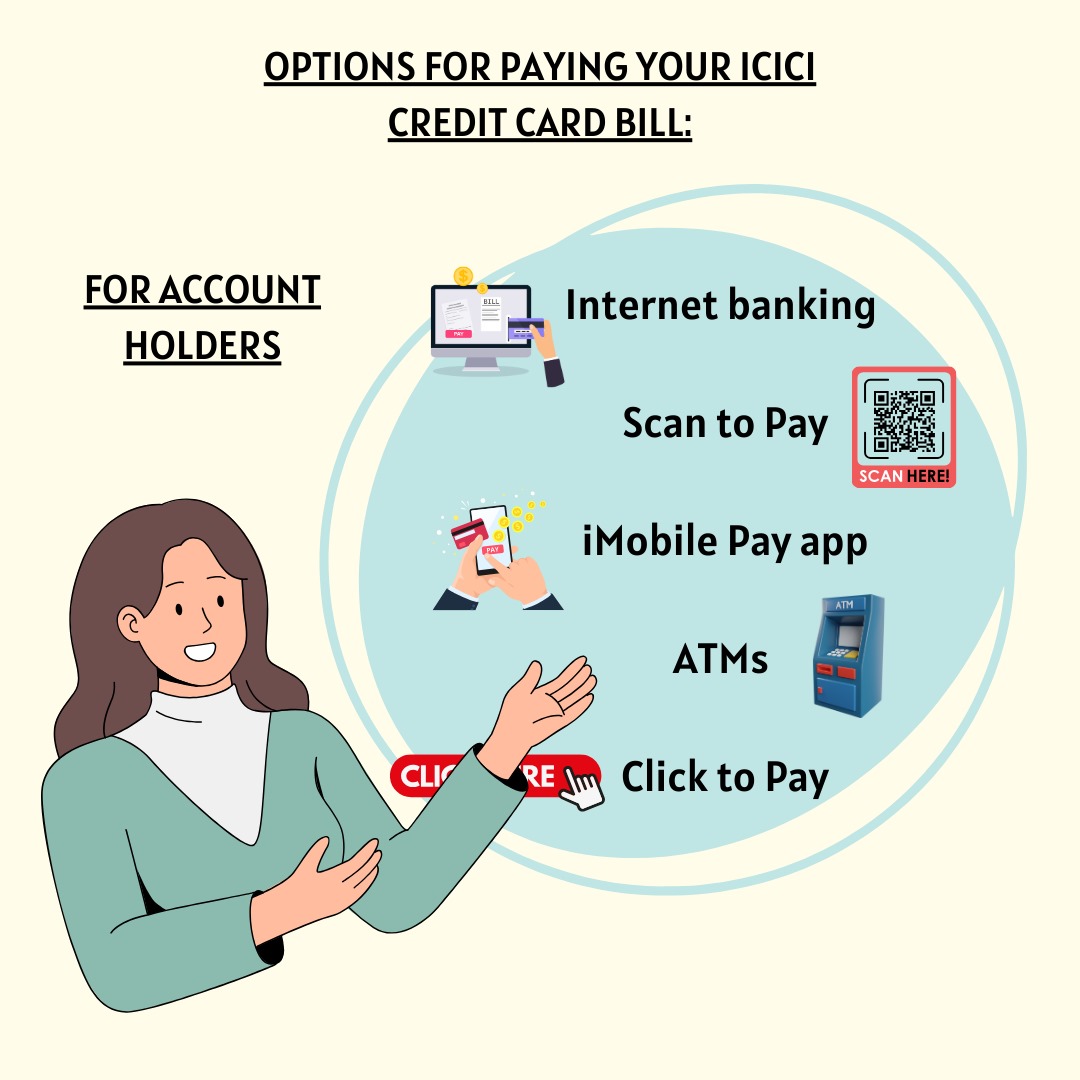

What Are Your Options for paying your ICICI Credit Card Bill?

Now that you know what credit card payment is, let’s take a look at what are the options for ICICI Credit Card Bill.

1. Internet banking

Log in to your ICICI Bank account on the internet. Then, you can pay your bill online easily.

2. Scan to Pay

Use your smartphone to open a payment app and scan the QR code provided. Then, you can enter the amount and complete the payment.

3. iMobile Pay app

Download the iMobile Pay app from ICICI Bank on your smartphone. After logging in, find the option to pay your credit card bill. Simply do what the instructions say to finish paying.

4. ATMs:

Visit any ICICI Bank ATM, insert your debit card, enter your PIN, and select the option to pay your credit card bill. Just follow the instructions on the screen to finish the payment.

5. Click to Pay

Log in to your ICICI Bank internet banking portal. Then, look for the option to “Click to Pay” your credit card bill. Just follow what the directions tell you to finish making the payment.

These are the options you have for paying your bill of ICICI Credit Card. Now let’s take a look at options for non-ICICI bank account holders.

What Are the Options for non-ICICI Bank Account Holders?

These are the three options for non-ICICI bank account holders:

1. NEFT

Log in to your other bank’s internet banking portal. Add your ICICI credit card as a beneficiary and transfer the amount due using NEFT. Enter the required details and confirm the payment.

2. Click to Pay

Log in to your other bank’s internet banking portal. Find the option to pay bills or make transfers to another bank. Enter your ICICI credit card details and the payment amount. Make sure you agree to pay to finish everything.

3. Scan to Pay

Open a payment app linked to your bank account from another bank. Scan the QR code provided and enter the payment amount. Confirm the payment to complete the transaction.

These options for paying credit card bills works well for non-ICICI account holders.

Now, let’s take a look at what are the steps you can follow to pay your credit card bill.

Steps to Make ICICI Credit Card Payment

The steps to make ICICI credit card payment are not hard to follow. Check out the 5 important steps:

1. Choose your bank through the ICICI online service page

First, you need to select your bank from the dropdown menu provided. This is the bank account from which you’ll be making the payment for your ICICI Bank Credit Card dues. The list includes banks that have partnered with ICICI for this service.2. Pick your credit card type and enter its number

After selecting your bank, you’ll need to specify the type of ICICI credit card you have. Then, enter either the 15-digit or 16-digit number found on your credit card. This helps ensure that the payment is correctly directed to your account.

3. Decide how much you want to pay

Now, you need to decide the amount you want to pay towards your credit card bill. Enter this amount into the designated field. This could be the full outstanding amount or a partial payment, depending on your preference or financial situation.

4. Confirm your payment with your bank details

To complete the payment, you’ll be asked to provide authentication details specific to your bank. This might include your user ID and password for accessing your bank’s internet banking service. Once you’ve provided these details, confirm the payment amount. The specified amount will be instantly debited from your bank account.

5. Get a Transaction Reference Number for confirmation

After successfully completing the transaction, you’ll receive a confirmation in the form of a Transaction Reference Number. This serves as proof that your payment has been processed. Keep this number handy for your records and as a reference in case of any future inquiries or issues regarding the payment.

That’s all there is to it! By following these steps, you can easily pay your ICICI Bank Credit Card bill without any hassle. With this, you now have a fair idea of how credit payments work. If you like such practical guides, follow NewsCanvass.