Risk Management Process: 5 Steps You Need to Follow

Do you make investments to achieve your financial goals? If yes, you must learn about Risk Management Process. Because if you don’t know it, your assets might be in danger.

Risk management process is nothing but taking steps to identify, assess, and handle potential risks that could affect your financial goals.

In your financial planning journey, you must know about how to protect your assets. To help you, we’ll cover everything about the risk management process here.

First, let us start off with what is risk management process.

What is Risk Management Process?

Risk management process is like a safety plan for your money. First, you figure out what things could go wrong with your investments. Then, you come up with ways to lessen the chances of those bad things happening.

Next, you decide what you’ll do if those bad things actually do happen. Finally, you keep an eye on everything to make sure your plan is still working and update it if needed. It’s like having a backup plan to protect your savings.

Now that you have a fair idea of what Risk Management Process is, let us take a look at the benefits of risk management process.

Why are the benefits of Risk Management Process Important?

From protection to long-term success, there are many benefits of the risk management process. Let’s take a look at them one at a time:

Protection

It helps protect your money and investments from unexpected losses.

Control

It gives you more control over your financial future by identifying potential risks.

Security

It provides a sense of security and peace of mind knowing that you have a plan in place to deal with potential setbacks.

Stability

It helps maintain stability in your financial portfolio by minimising the impact of adverse events.

Long-term success

By managing risks effectively, you increase the likelihood of achieving your long-term financial goals.

Decision-making

It assists in making informed decisions about where to invest and how much risk to take on.

Adaptability

It allows you to adapt to changing market conditions and unforeseen circumstances more effectively.

Confidence

It boosts your confidence in your financial decisions and reduces anxiety about potential losses.

These are some of the top benefits of Risk Management Process.

Now that you know how you could benefit, let us take a look at the process that will help you reap these benefits.

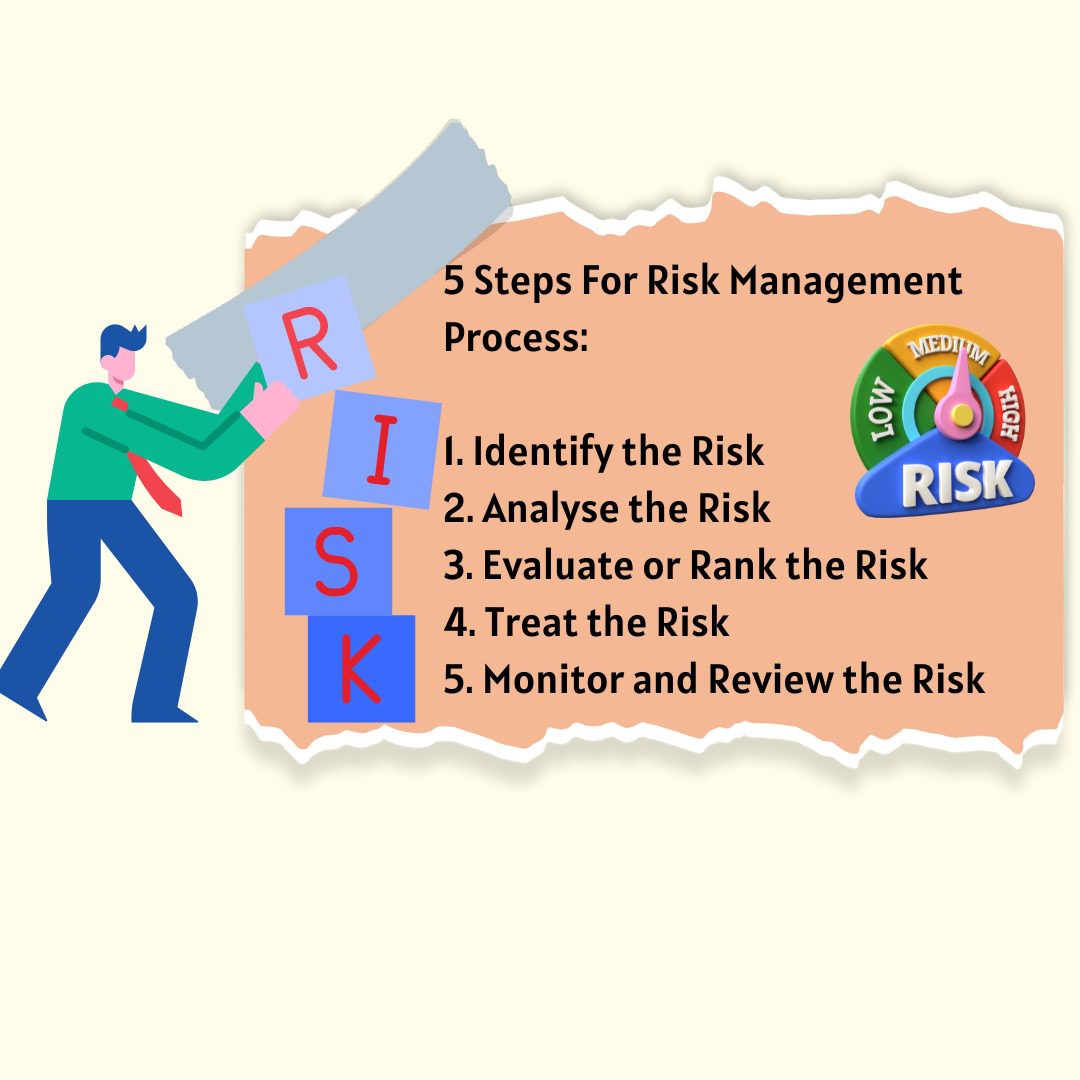

5 Steps For Risk Management Process

Risk Management process is a 5-step process. Let us take a close look at each step.

1. Identify the Risk

This means finding out what bad things could happen to your business. It’s like making a list of all the problems you might face, such as getting sued, losing money in the stock market, or having a fire in your office.

2. Analyse the Risk

Once you know what problems might happen, you need to understand them better. You look at each problem closely to see how likely it is to happen and how much damage it could cause. It’s like trying to figure out how big a storm might be and how much it might flood your house

- Evaluate or Rank the Risk

Now that you understand each problem, you decide which ones are the most serious. Some problems are really bad, like if your entire business could shut down. Others are not so bad, like if you just lose a little bit of money. You put the problems in order from the worst to the least bad.

- Treat the Risk

Once you know which problems are the most serious, you need to do something about them. You try to find ways to either stop the problems from happening or to make them less harmful if they do happen. It’s like fixing a leaky roof before it gets worse and causes more damage to your house.

- Monitor and Review the Risk

Even after you’ve tried to fix the problems, you still need to keep an eye on them. Some problems might come back, or new problems might show up. So, you check regularly to make sure your fixes are still working and that you’re ready for any new problems that might come along. It’s like checking the weather forecast regularly to see if any storms are coming your way.

These are the 5 steps you need to follow. If you execute each of these steps carefully, you will not face any trouble with your risk management process.

What is the Importance of Risk Management Process?

There are several strong reasons why the Risk Management Process is super important. Below are the main 5 reasons:

Identification of Risks

It helps a business spot potential problems or dangers that could harm it. By recognizing these risks, the business can be prepared to deal with them.

Mitigation of Risks

Once risks are identified, the business can take steps to reduce their impact. This might involve making changes to how the business operates or having plans in place to handle emergencies.

Enhanced Decision-Making

Risk management provides a solid foundation for making good decisions. When a business knows what risks it faces, it can make choices that will help it succeed despite those risks.

Preparation for Growth

Assessing and managing risks is like putting on armor before going into battle. It prepares the business for challenges that might come its way as it grows. By having strategies in place to handle potential threats, the business improves its chances of success.

Priority Handling of Risks

Not all risks are equal. Some can seriously harm the business, while others might not be as significant. Risk management helps prioritize which risks to focus on first, ensuring that the most critical ones are addressed promptly.

Now you know that from priority handling of risks to enhanced decision-making, there are several reasons why risk management process is important beyond belief.

With this now you’re fully equipped to manage risks. You don’t need to worry about how you will manage your assets. It will become a cake of walk with the 5 steps mentioned above. If you want more practical guides like these, keep checking out the NewsCanvass space.

How does a risk management system differ from traditional insurance?

While insurance provides financial protection against specific risks, a risk management system encompasses a broader set of processes and strategies aimed at identifying, assessing, and managing various types of risks, including those that may not be insurable.

What are some common components of an effective risk management system?

Common components include risk identification methods, risk assessment tools, risk monitoring mechanisms, mitigation strategies, contingency plans, and communication channels for stakeholders.

What role does technology play in modern risk management systems?

Technology plays a significant role in modern risk management systems by providing tools for data analysis, modeling, automation of processes, real-time monitoring, and enhancing communication and collaboration among stakeholders.

What are some challenges associated with implementing a risk management system?

Challenges may include resistance to change, inadequate resources or expertise, difficulty in quantifying certain risks, integrating risk management across departments, and maintaining a balance between risk mitigation and business objectives.