Life vs Health Insurance: Easiest Way to Choose Between Them

So many types of insurance, so little clarity?

How many times have you found yourself asking: are life insurance and health insurance the same? Do you need to go for both? How do the benefits of the two differ? These questions might bug you even if you understand what insurance is and how it is a social security tool.

We got you.

Here, we’ll remove all your doubts on life vs health insurance by looking at the core benefits of the two, types of plans, and types of covers of the two.

Let’s get right into it!

Life vs Health Insurance: What Are They?

Life insurance gives money to your loved ones if you die early. This money helps cover things like lost income, funeral costs, medical bills, and debts. It ensures your family doesn’t struggle financially without your income.

Health insurance, on the other hand, pays for medical expenses like doctor visits and hospital stays. It helps make sure you can afford medical care and stay healthy (besides, if you want to explore different types of general insurance, click on the link).

Many people actually need both types of protection, especially if they have dependents. It’s essential to choose coverage that fits your needs so you can afford both insurances.

Keep in mind that your insurance needs may change at different stages of life. What’s important for a parent might not be the same for a college graduate or a retiree.

Now that you know what life insurance and health insurance are, let’s take a look at the features of each of them.

Life vs Health Insurance: Features

To fully understand life vs health insurance, you must understand the difference between the features of the two.

Get yourself familiarised with the following table:

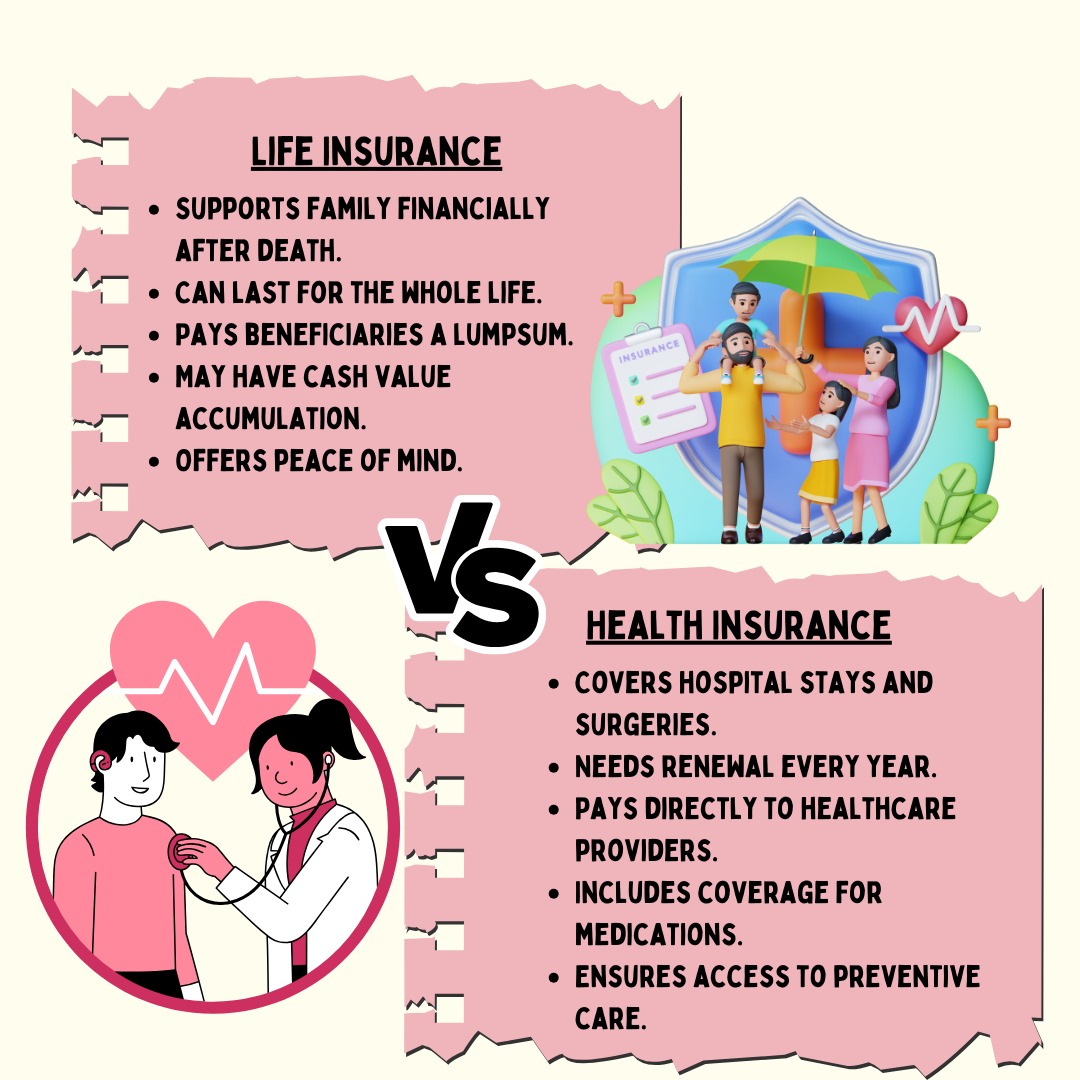

Life Insurance provides financial support for the family after the policyholder’s death, lasting a lifetime and paying a lump sum to beneficiaries.

In contrast, Health Insurance covers hospital stays and surgeries, requiring annual renewal and direct payments to healthcare providers. Health Insurance also includes coverage for medications and ensures access to preventive care, contributing to peace of mind for policyholders.

Since you now know the difference between the features of life insurance and health insurance, let’s look at the core benefits of the two.

Life vs Health Insurance: Core Benefits

The following are the core benefits of life insurance vs health insurance. Understanding this main benefit will help you take a call on what’s more suited for you:

1. Life Insurance: If someone passes away, the promised money goes to the person they chose to receive it. It’s a way to help their loved ones financially during a tough time.

2. Health Insurance: This covers all your medical expenses, but there’s a maximum amount it will pay and some rules to follow. It’s there to make sure you don’t have to worry too much about the costs when you need medical help.

Now, it’s the time for us to look at the types of covers available in life vs health insurance.

Life vs Health Insurance: Types of Covers

Another differentiating factor between life insurance and health insurance is the types of covers available under both.

Let’s have a look:

1. Life Insurance:

Individual Cover: This is just for one person. It gives money to their chosen person if they pass away.

Group Cover: This is for a bunch of people, like employees at a job. If someone in the group dies, money goes to their chosen person.

2. Health Insurance:

Individual: This is for one person. It helps with medical costs like doctor visits and medicines.

Family: This covers a whole family. It pays for medical expenses for everyone in the family.

Group Coverage: This is for a bunch of people, like at work. It helps with medical costs for the whole group.

Having understood life and health insurance, let’s see which one you should go for.

Life vs Health Insurance: What Should You Go For?

Insurance can be confusing. Wondering if life and health insurance are twins or distant relatives? Do you need both? Let’s simplify.

In the life vs health insurance debate, your choice should match your needs. Assess your lifestyle, tailor insurance to fit, and ensure a shield that suits you and your family. It’s not about similarity; it’s about securing a personalised safety net for your unique journey.

Let’s take a look at the last bit of information on whether you should have life insurance once you retire.

Do you have to keep life insurance once you stop working?

It depends. If you can comfortably handle your expenses in retirement, and your kids are independent, you might not need life insurance. However, if you still have debts or dependents, it’s a good idea to keep it.

If you own a lot and worry about estate taxes, putting life insurance in a trust might help move money out of your estate.

With this, you now know what the difference between the two is. At the end of the day, you need to introspect and see what you should go for in your financial planning journey! But the important thing is that life vs health insurance is clear for you. For more such actionable financial guides, keep an eye out on NewsCanvass’s Finance section.