IDBI Bank Disinvestment: LIC To Sell Stake In The Coming Months

Background:-

- LIC To Sell Stake In The Coming Months for IDBI Bank Disinvestment

- The Industrial Development Bank of India was established in the year 1964. The bank was founded by the Government of India by an act of parliament.

- The bank’s headquarters is based in Mumbai, Maharashtra, India.

- In the year 2019, Life Insurance Corporation of India bought a 51% stake in IDBI after getting permission from the Insurance Regulatory and Development Authority of India in 2018.

- IDBI bank is listed on the Bombay Stock Exchange and National Stock Exchange.

The bank offers wide range of products and services such as consumer banking, commercial banking, retail banking, investment banking, asset management, credit cards etc.

Linkages:-

Current Scenario:-

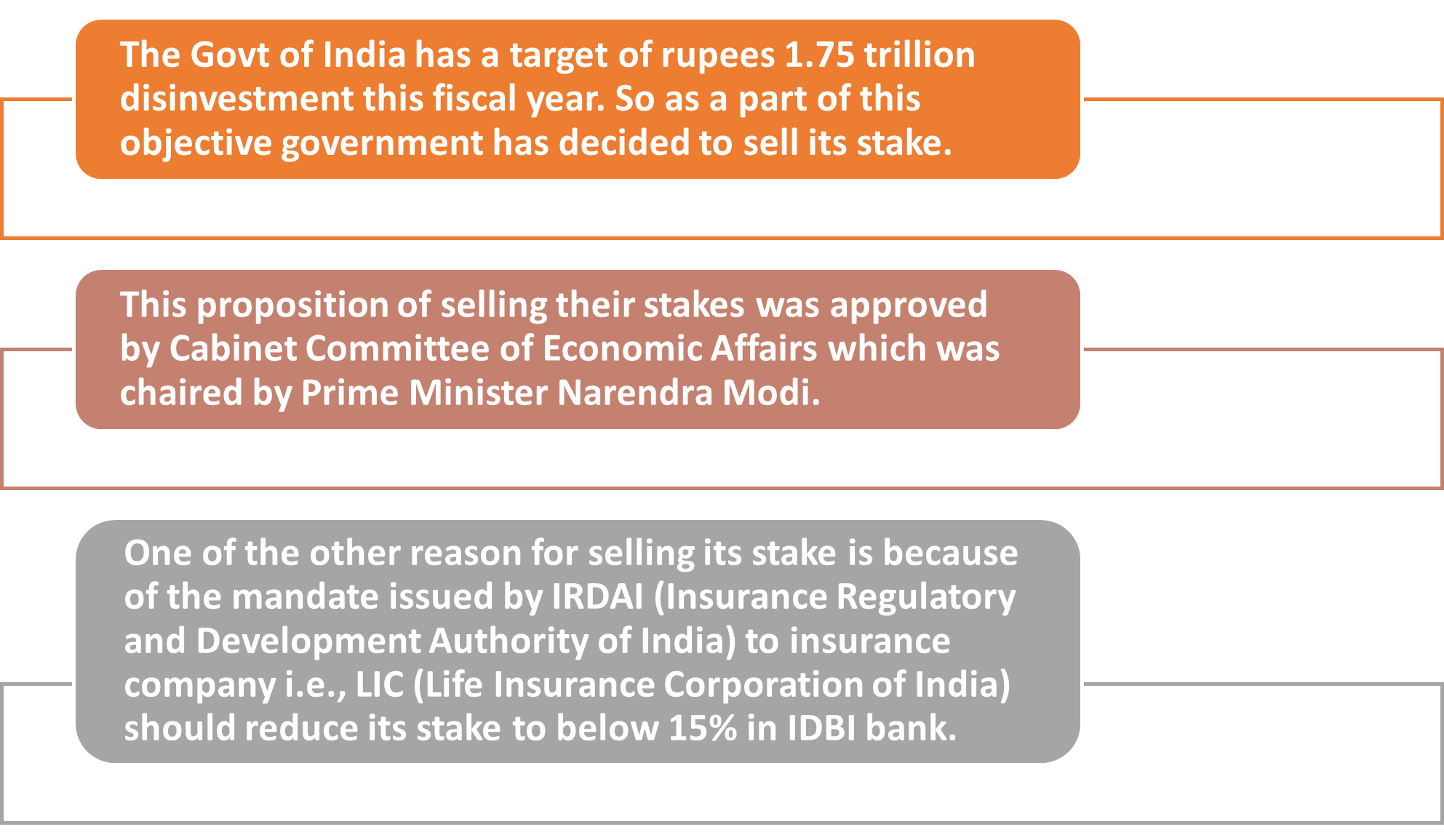

- The Union Govt and LIC together they both own more 94% stake in IDBI. LIC is currently promoter of IDBI as govt sold their majority of the stake in 2019.

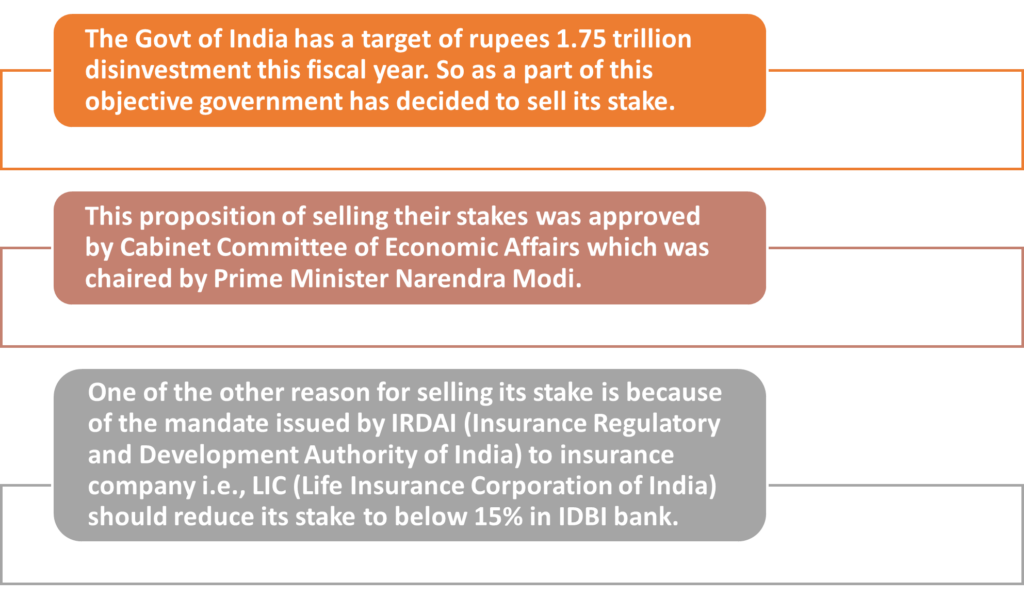

- The quantum of disinvestment that will happen from Govt of India and LIC will be decided after consultation with RBI.

- Expression of Interest will be issued in the coming days. Govt is planning to sell their stakes to retail/private/institutional investor through stock exchange.

- The IDBI reported a net profit of rupees 1359 crores in the financial year 2020-21 as compared to loss of rupees 12887 crores last year.

- The entity who would be buying stake in IDBI should not expect any kind of assistance from either Govt or LIC after completion of the deal.

- The entity should have sufficient resources of their own such as funds, technology etc to grow the business of IDBI.

IMPACT:-

Post disinvestment, economic growth of Central Public Sector Enterprises (CPSEs)/ financial institutions will be through infusion of private capital, technology and best management practices. Will contribute to economic growth and new jobs

Also lets further understand this by considering the positive impacts which will come in with the disinvestment of IDBI: –

Positive Impacts of IDBI Bank disinvestment: –

- It will bring in liquidity for the government to work on the development plans and fiscal deficit targets it has set.

- Disinvesting will also help the government fulfil its long-drawn plan of disinvesting its stake in public companies.

- It will boost the investor confidence into the economy as government can follow the fiscal consolidation path as planned if this disinvestment goes thru.

If the disinvestment goes as per plan, it will further accelerate the path for disinvestment in other government entities, which can help the country reduce its fiscal deficit thus reduce the burden of debt on the government budget.

But no decision is a cake walk each decision would have its pros and cons.

- Selling the stakes to private entity is likely to decrease employee morale. In govt entities an employee always boasts of the job security they hold in the society.

- Post disinvestment an employee would no longer have Job Security. They will have to constantly perform well, meet the goals set by the bank and then only they will be able to retain their jobs.

- Recruitment policy of the bank would be changed.

Important Concepts: –

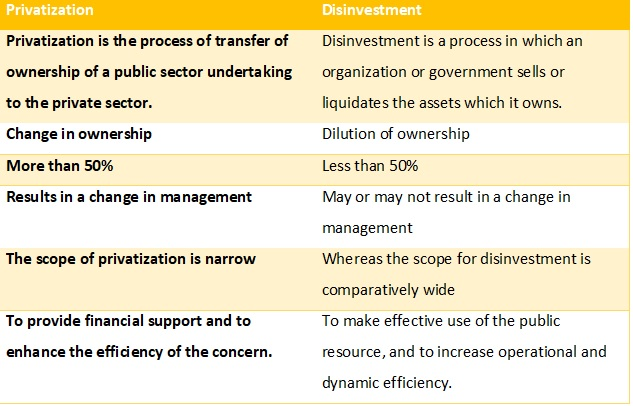

Disinvestment: –

- Disinvestment is when governments or organizations sell or liquidate assets or subsidiaries.

- Disinvestments can take the form of divestment or a reduction of capital expenditures (CapEx).

- Disinvestment is carried out for a variety of reasons, such as strategic, political, or environmental.

Privatization: –

- Privatization describes the process by which a piece of property or business goes from being owned by the government to being privately owned.

- It generally helps governments save money and increase efficiency, where private companies can move goods quicker and more efficiently.

- Critics of privatization suggest that basic services, such as education, shouldn’t be subject to market forces.

Difference Between Disinvestment and Privatization: –

Content Contributed by Rohit Jaiswal