ICICI Bank Tax Saver FD: What is it, Top 6 Benefits, Key Features, Eligibility

Are you cautious of high-risk investments and tax liabilities? ICICI Bank Tax Saver FD might be just the right fit for you! Although Fixed Deposits are often stereotyped as the investment option that leads to the least returns, Tax Saver Fixed Deposit proves that big savings can be done even with this investment alternative.

To make things clear as day for you, we’ll explore the details of this unique way of investing (if you’re new to the world of investing and want to learn, click on the linked article for finding a step-by-step guide).

What is a Tax Saver FD?

A tax saver FD has a tenure of 5 years. This tenure is fixed and although the interest on the Fixed Deposit (FD) amount is taxable, you can claim a tax deduction of up to Rs. 1.5 Lakh according to section 80 C of the Income Tax Act, 1961. A tax saver FD is a good option for you due to the tax-saving facility it provides. You should consider this option for boosting your financial planning journey.

What is ICICI Bank Tax Saver FD?

ICICI Bank Tax Saver Fixed Deposit (FD) is a prudent choice for your tax planning. This Tax Saver FD is a convenient way to save more as you secure your financial future with tax-free returns. For investors looking for low-risk returns and reduced tax liabilities, even a minimum investment of Rs. 10,000 is enough to kickstart. These investments can even lead to a saving of up to Rs 46,800 in taxes.

As you lock your money into this tax-free Fixed Deposit, you’ll see your savings grow. But this is just the tip of the iceberg of the benefits of a Tax Saving FD. Explore more in the next section!

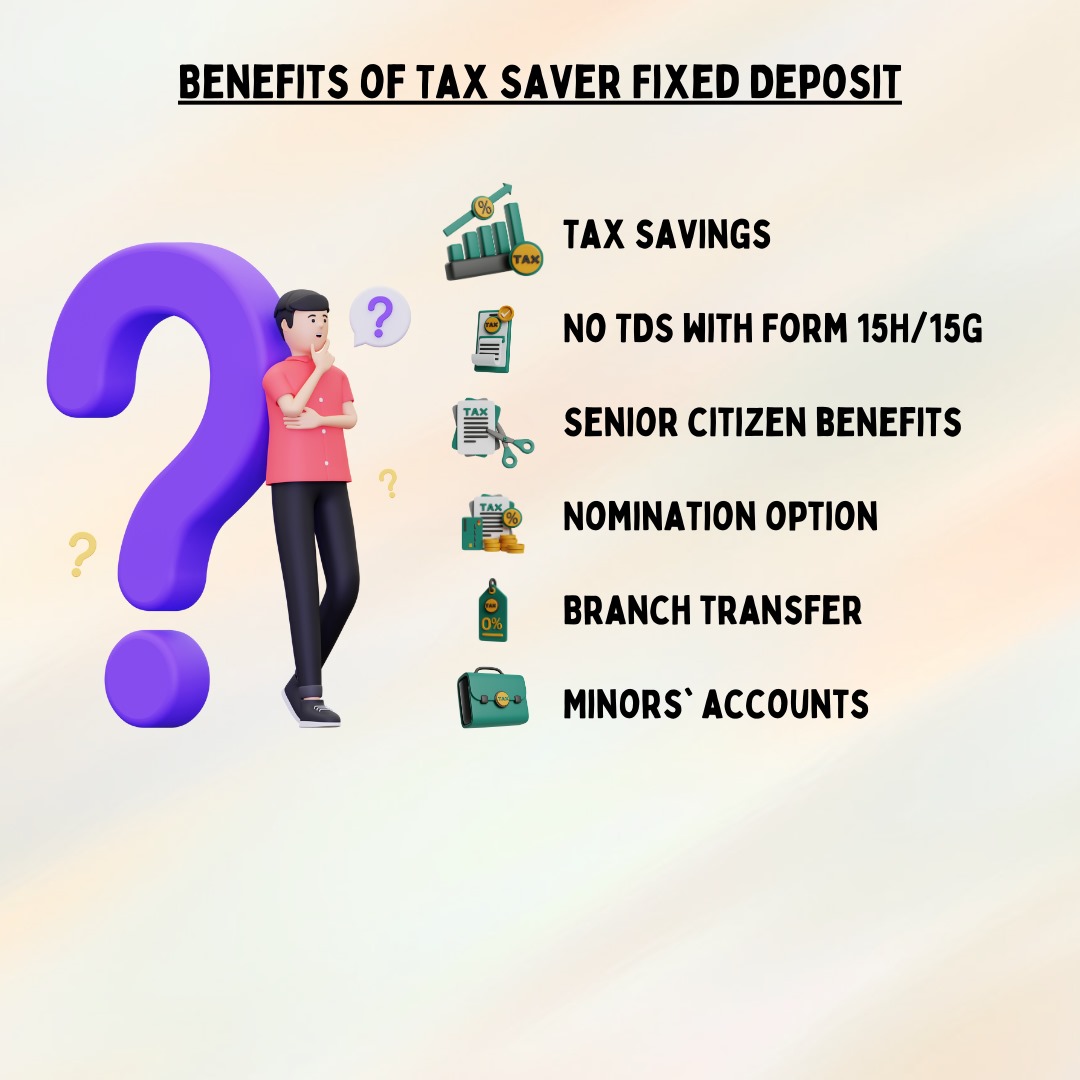

What Are the Benefits of Tax Saver Fixed Deposit?

Tax Saver Fixed Deposit is different from the regular Fixed Deposit option. It comes with a host of benefits and a lot of scope to save your money. Take a look at these benefits to know what it means:

1. Tax savings: When you invest money in a tax-saving Fixed Deposit (FD), the amount you invest can be subtracted from your taxable income, up to Rs. 1,50,000 per year, as per Section 80C of the Income Tax Act.

- No TDS with Form 15H/15G: Although the interest earned on this FD is taxable and subject to TDS rules, if you’re not liable to pay tax, submitting Form 15H/15G prevents the bank from deducting TDS on your interest.

- Senior citizen benefits: Senior citizens can enjoy a higher interest rate on these deposits, with Bank of Baroda offering an additional 0.5% over the regular tax-saving FD rates for deposits below Rs. 1 crore.

- Nomination option: You can designate a nominee for your tax-saving FD, ensuring a smooth transfer of benefits in case of unforeseen circumstances.

- Branch transfer: Customers can move their tax-saving FD from one branch to another by submitting a written request to the branch where the FD is held.

- Minors’ accounts: You can open a tax-saving fixed deposit for minors, providing a valuable tool for their financial planning.These benefits of tax saving FDs will give you clarity on whether you should go for this investment option.

What Are the Key Features of a Tax Saving FD?

Now that you know the benefits of tax saving FDs, let us take a look at the key features that might affect your decision of opting for ICICI Bank Tax Saver FD.

1. Eligibility: Only individuals and Hindu Undivided Families (HUFs) can open this tax-saving fixed deposit, either individually or jointly. According to Government of India rules, the tax benefits apply to the primary holder of the fixed deposit.

- Deposit Amount: You have the option to initiate your account with a starting deposit as low as Rs. 100, and subsequently, you can add multiples of Rs. 100. The highest permissible deposit within a financial year is Rs. 1,50,000.

- Deposit Tenure: The shortest time you must keep the tax-saving deposit is 60 months, and the longest is 120 months.

- Interest Payment: The interest on this FD is compounded quarterly and credited to the account at the end of each quarter, making it a beneficial feature of tax-saving deposits.

- Premature Closure: You cannot close this deposit before maturity unless it’s been 5 years, and the bank may decide at its discretion. If allowed, the bank pays interest 1% below the tax-saving FD rate. In case of the depositor’s death, premature withdrawal is permitted.

- Auto Renewal: While auto-renewal is an option for regular term deposits, it’s not applicable to tax-saving deposits. The deposit will be renewed as a standard term deposit for one year.

Apart from these key features, you must know about a few things to look out for when deciding for ICICI Bank Tax Saver FD.

What Are the Aspects of a Tax-Saving FD to Look Out For?

Keep an eye out on the following points when investing in a tax-saving FD:

- The duration of a tax-saving FD is five years.

- No loans or early withdrawals are allowed for tax-saving FDs.

- You can only open a tax-saving FD at a bank.

- The minimum deposit varies between banks.

- You can invest up to Rs. 1.5 lakhs in a tax-saving FD each financial year.

So, with this guide, it’ll be easy for you to make a well-thought-out judgement on whether you should go for ICICI Bank Tax Saver FD, or riskier options like Stocks or Trading.

Whichever way you go, make sure you play your cards right by researching on your own and having a holistic understanding of ICICI Bank Tax Saver FD. Keep looking here for more helpful guides!