LIC Endowment Policy Calculator: How to Use it (In Just 6 Steps)?

Think of the LIC Endowment Policy Calculator as a tool that solves half the problem for you. Without you having to do it, it determines premium charges and assured sums on life insurance. But does it just end there? No! There are a slew of other comforts that LIC Endowment Policy offers.

Before we get into those benefits or the step-by-step process of how to use the LIC Endowment Policy Calculator, it would be a wise idea to first see what LIC Endowment Policy is (click here to learn about the wide types of general insurance).

Let’s get right into it!

What’s in here for you?

- What is LIC Endowment Policy?

- What Exactly Is The LIC Endowment Policy Calculator?

- How is the Maturity Calculated in the LIC Endowment Plan?

- What are the Benefits of LIC Endowment Policy Calculator?

- How to Use LIC Endowment Policy Calculator (Step-by-Step)?

What is LIC Endowment Policy?

The LIC Endowment Policy is designed to be a well-rounded financial solution, blending savings and protection aspects. It serves as a reliable avenue for securing the financial well-being of your family while catering to unforeseen circumstances (click here to learn about Term Plan With Return of Premium).

But what is it that stands out about this policy? It’s its ability to offer a lump sum amount upon maturity, ensuring a significant financial cushion for the policyholder.

In addition to the maturity benefit, the LIC Endowment Policy also addresses the liquidity needs of the family by providing options for loans. This feature can be particularly beneficial during times when immediate financial assistance is required.

The policy is flexible and comes with various additional benefits that policyholders can take advantage of as per their individual needs and preferences.

Ultimately, the LIC Endowment Policy stands as a robust and versatile financial tool, offering a combination of long-term savings and protection, providing peace of mind and financial security for both the policyholder and their family.

Now that you have a good idea of what LIC Endowment Policy is, let’s take a look at what exactly is the LIC Endowment Policy Calculator.

What Exactly Is The LIC Endowment Policy Calculator?

The LIC Endowment Policy Calculator stands as a smart and user-friendly tool introduced by LIC, designed to empower customers in understanding the premium commitments and the assured maturity value of their chosen insurance plan.

It plays a crucial role in the decision-making process before one finalises a policy, providing a clear overview of both the maturity sum assured and the associated premium charges.

This handy tool is readily accessible to policy seekers, enabling them to explore LIC’s diverse range of products efficiently. The LIC calculator typically requests essential details to compute the maturity sum and premium charges accurately.

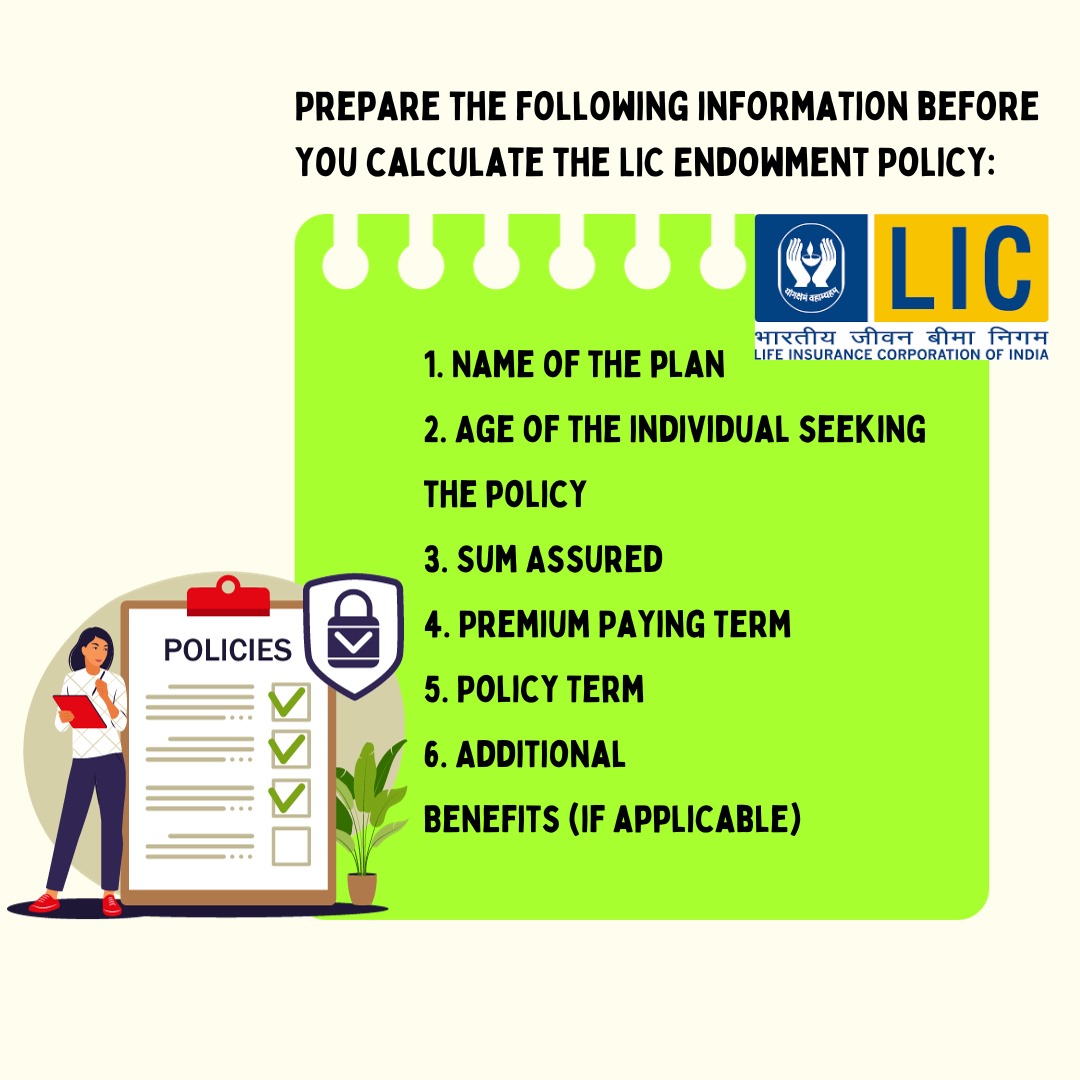

These details encompass the plan’s name, the age of the policy seeker, the sum assured, premium paying term, policy term, and additional benefits, if any.

The calculator simplifies the process of determining premium charges and maturity sums, making it a time-saving and straightforward method for policyholders to plan for the future and commit to a specific insurance plan.

Upon filling in the required information, the calculator generates an approximate value, providing customers with a rough estimate. It serves as a valuable reference point for reviewing and comparing various plans before making a purchase decision.

It’s important to note that the calculated charges are indicative, and the final value may vary based on a more detailed assessment of an individual’s background by the insurer.

How does the LIC Endowment Plan determine its maturity value?

In the LIC Endowment Policy Calculator, the maturity amount is determined through a process that considers the guaranteed sum at maturity, known as the Paid-Up Value. This value is calculated by adjusting the sum assured during the term maturity to a figure referred to as the Maturity Paid-Up Sum Assured.

The Maturity Paid-Up Sum Assured is determined by taking the basic sum assured at the time of maturity and multiplying it by the ratio of the total premium charges paid to the original tenure for which premium payments were initially supposed to be made.

In simpler terms, if we denote the basic sum assured as X, the periods for which premiums have been paid as ‘a’, and the original tenure of premium payments as ‘b’, then the Maturity Paid-Up Sum Assured would be X multiplied by (a:b).

For example:

Basic Sum Assured (X) = X

Periods Premiums have been paid (a) = a

Original Tenure of Premium Payments (b) = b

Maturity Paid-Up Sum Assured = X * (a:b)

Upon maturity, the insurer disburses the Maturity Paid-Up Sum Assured, in addition to any simple reversionary bonuses and final additional bonuses, if applicable.

This comprehensive payout, represented as the Total Maturity Amount, is the sum of the Maturity Paid-Up Sum Assured, simple reversionary bonuses, and final additional bonuses:

Total Maturity Amount = Maturity Paid-Up Sum Assured + Simple Reversionary Bonuses + Final Additional Bonuses (if any)

This substantial lump sum provided by the insurer proves to be an attractive feature for customers, serving as a valuable investment. The Maturity Amount becomes a financial resource that policyholders can utilise during unforeseen crises, enhancing their financial flexibility according to their needs.

What are the Benefits of LIC Endowment Policy Calculator?

The LIC Endowment Plan comes with a handy Maturity Calculator, offering several advantages for policyholders:

- Easily calculate your maturity amount without the hassle of manual calculations, saving time and effort.

- The calculator provides a quick and reasonably accurate maturity amount, aiding in effective financial planning for the future.

- Simplify the process of understanding policy details and benefits through the LIC Endowment Policy Maturity Calculator.

- Minimize the chances of errors associated with manual evaluations, ensuring precise and reliable results.

- Compare and contrast different LIC policies effortlessly, helping you make informed decisions based on your specific needs and preferences.

How to Use LIC Endowment Policy Calculator (Step-by-Step)?

To estimate the premium charges and maturity amount tailored to your unique circumstances with the LIC Endowment Policy, you can seamlessly navigate the process using the LIC Endowment Policy Maturity Calculator. Here’s a user-friendly guide:

- Begin your journey by visiting the official LIC portal at https://licindia.in/.

- In the portal, find your way to the “Customer Services” section.

- Look for the LIC Calculator within the customer services options.

- Input essential details such as the plan’s name, sum assured, policy term, and starting date to personalize your calculation.

- Once the information is entered, click the “Submit” button to initiate the calculation process.

- Voila! The calculator will promptly reveal the maturity value and premium charges tailored to your policy specifics.

Navigating the LIC Endowment Policy Calculator is your key to understanding the financial landscape of your policy – a personalized journey towards informed decisions.

So, that’s all you need to know about the LIC Endowment Policy Calculator. Remember, insurance is a social security tool. Whether it’s determining how maturity is calculated through this tool or figuring out how exactly this calculator works, you need to know the in and out to navigate your financial planning journey. For more such step-by-step guides like these, keep an eye out on this space at NewsCanvass.