Top 5 Motor Insurance Companies in India

Do you know how to choose the best motor insurance companies in India? It can get confusing for a lot of customers with a diverse range of options. That’s because to get a top-level experience with Motor insurance, you must select the company that is expected to deliver on your expectations in the best way possible. To help you with it, we’ve shortlisted 5 companies.

Before we reveal those 5 names let’s take a look at what is motor insurance? What are the types of car insurance policies in India?

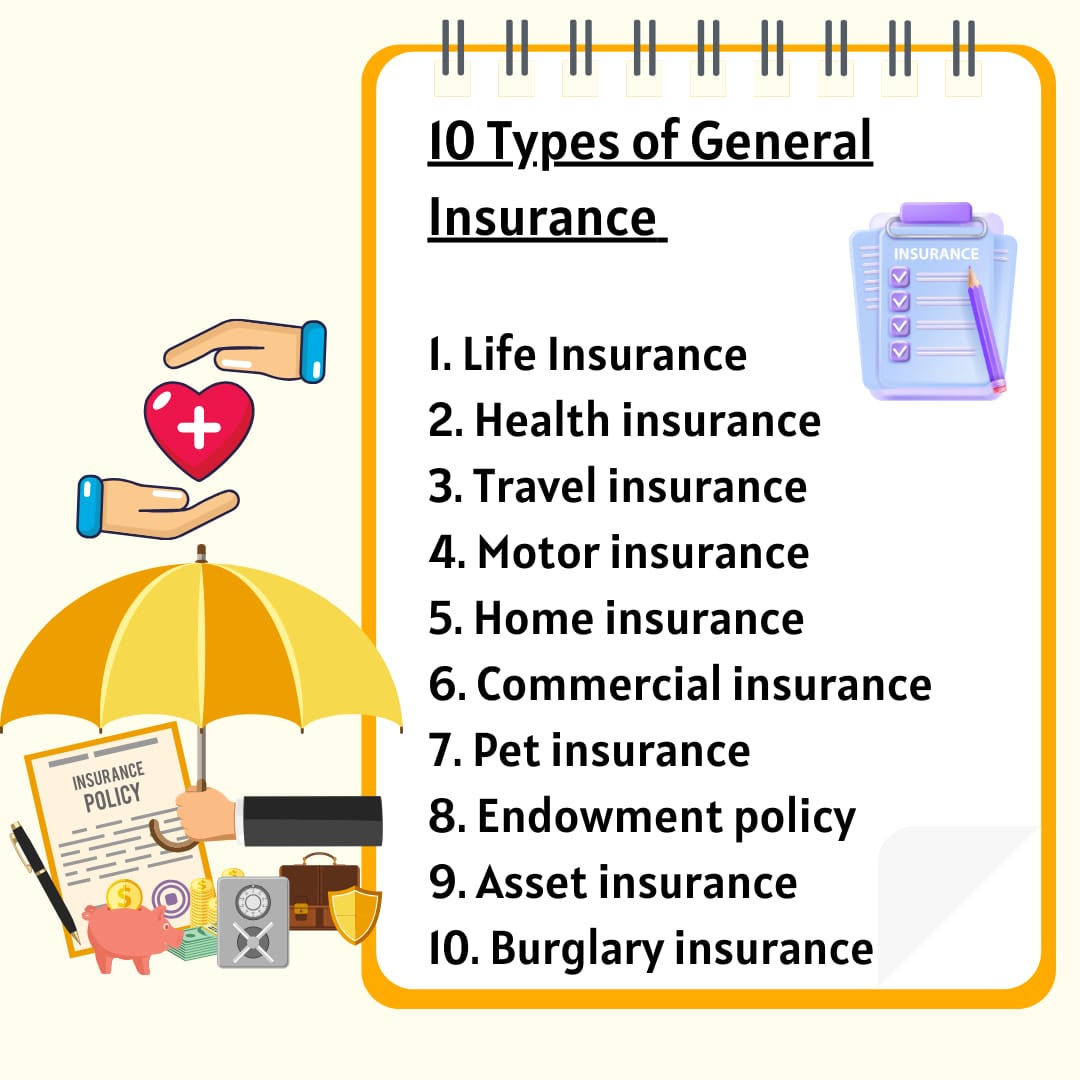

(And if you don’t know about the other types of general insurance besides motor insurance, take a glance at the linked article.)

What is Motor Insurance?

Motor insurance is like a safety net for your vehicle. It’s a type of insurance that protects you financially if your car gets damaged, or stolen, or if you accidentally damage someone else’s property or injure someone while driving. Basically, it helps cover the costs of repairs, medical bills, or replacements in case something goes wrong while you’re on the road.

If you want to understand Commercial Vehicle Insurance, click on the linked article.

Now that you know about what motor insurance is, let’s take a look at the types of car insurance policies in India.

Types of Car Insurance Policies in India

Keeping in mind what motor insurance means, take a look at the types of car insurance policies in India.

1. Third-party Car Insurance

Mandatory coverage as per Indian law, providing protection against third-party liabilities.

- Standalone Own Damage (OD) Cover

Offers coverage against damages/losses to your vehicle, excluding mandatory third-party coverage.

- Comprehensive Car Insurance

Combines third-party and own damage coverages, offering the broadest protection. It’s recommended for comprehensive coverage.

These are the 3 main types of car insurance available in India. With this now let’s take a look at the crux of the matter – 5 best motor insurance companies in India.

5 Best Motor Insurance Companies in India

Here are your top 5 Motor Insurance Companies in India:

1. HDFC ERGO General Insurance Co. Ltd.

With over 6,800 network garages and an impressive claim settlement ratio of 99.80%, HDFC ERGO is known for its reliability and extensive coverage.

2. Bharti AXA General Insurance Co. Ltd.:

Offering coverage through 5,200+ network garages with a remarkable claim settlement ratio of 97.35%, Bharti AXA provides comprehensive motor insurance solutions.

3. TATA AIG General Insurance Co. Ltd.:

With a wide network of 7,500+ garages and a commendable claim settlement ratio of 96.43%, Tata AIG is a trusted name in the insurance industry.

4. IFFCO TOKIO General Insurance Co. Ltd.:

With 4,300+ network garages and a high claim settlement ratio of 95.82%, IFCCO IFFCO TOKIO offers reliable motor insurance coverage.

5. New India Assurance Company Ltd.:

With over 3,000 network garages and a decent claim settlement ratio of 89.60%, New India Assurance provides reliable motor insurance options.

These are your top options for motor insurance companies. But how will you decide which one to go for? The next section will help you do it.

How to Pick the Best Motor Insurance Company?

There are certain parameters you need to have in mind before you can put a finger on a motor insurance company in India. Below are those parameters:

1. Assess Your Needs:

Before selecting a motor insurance company, it’s crucial to evaluate your specific requirements. Consider factors such as the type of coverage you need, whether you require additional add-ons like roadside assistance or zero depreciation cover, and determine your financial capacity to pay premiums comfortably. Understanding your needs helps you narrow down the options and choose a policy that aligns with your priorities and budget.

- Verify Authenticity:

Ensuring the authenticity of the motor insurance company is paramount. You can do this by checking the company’s IRDA Registration Number. The Insurance Regulatory and Development Authority of India (IRDAI) regulates insurance providers in India and grants registration numbers only to genuine insurers. Verifying this number helps you avoid fraudulent or unlicensed companies and ensures that you’re dealing with a reputable insurer.

- Check Financial Stability:

Assessing the financial stability of the insurance company is essential to ensure that they can fulfill their obligations, especially during claim settlements. Reviewing the insurer’s annual financial records and examining their solvency ratio provides insights into their financial health and ability to pay claims promptly. Opting for a financially stable company reduces the risk of encountering delays or complications during claim processing.

- Evaluate Add-on Covers:

While considering motor insurance policies, pay close attention to the available add-on covers. These additional benefits can enhance your insurance coverage and provide added protection against specific risks or incidents. Examples of add-on covers include engine protect cover, zero depreciation cover, and roadside assistance. Assessing and selecting relevant add-ons tailored to your needs can maximize the benefits of your insurance policy.

- Consider Claim Settlement Ratio (CSR):

The Claim Settlement Ratio (CSR) is a crucial factor to consider when choosing a motor insurance company. CSR represents the percentage of claims settled by the insurer relative to the total number of claims received. A higher CSR indicates that the company has a track record of promptly settling claims, which instills confidence in policyholders regarding claim processing efficiency and reliability.

- Assess Cashless Garage Network:

A wide network of cashless garages is advantageous for policyholders, as it ensures accessibility to repair services without the hassle of upfront payments. When evaluating motor insurance companies, consider the size and coverage of their cashless garage network. Opting for a company with an extensive network increases the likelihood of finding a nearby authorized garage for repairs, enhancing convenience and minimizing out-of-pocket expenses.

- Compare Online:

Utilize online platforms and tools to compare motor insurance policies offered by different insurers. Online comparisons enable you to evaluate various aspects such as coverage options, premium rates, and additional benefits in a transparent and efficient manner. By comparing policies side by side, you can make informed decisions and choose a policy that offers the best value and meets your specific requirements.

- Read Customer Reviews

Customer reviews provide valuable insights into the service quality, claim settlement process, and overall satisfaction levels with a motor insurance company. Take the time to read reviews and testimonials from existing policyholders to gauge their experiences and feedback. Favor companies with positive reviews and a reputation for excellent customer service, as it indicates reliability and responsiveness in addressing policyholder needs and concerns.

By considering these factors and thoroughly evaluating each aspect, you can make an informed decision and select the best motor insurance company that meets your needs and offers comprehensive coverage and reliable service.

By now, you’re well aware of your top 5 motor insurance companies in India. You’re also well-equipped to make a sound decision on your own. This will help to navigate the challenges in your financial planning journey without much hassles. If you want to continue getting actionable guides like these, keep an eye on the NewsCanvass space.