What is an Endowment Policy? | Everything You Need to Know

Do you ever feel fatigued with all the financial planning tools at your disposal? It’s okay if you do. Everyone is trying to carefully make their way through their financial planning journey. But it can get tiring.

Guess what? You don’t need to know about every financial policy or tool out there. You don’t need to stress yourself out. You need to know about only the best of them. One such policy is the endowment policy. To know about what is an endowment policy, its benefits, types, and more, keep reading!

What is an Endowment Policy?

An endowment policy serves as a unique blend of life insurance and long-term savings, presenting policyholders with a myriad of benefits that cater to their financial needs and future aspirations.

An endowment plan provides two main benefits:

1. In case of the policyholder passing away before the policy term ends:

The nominee or beneficiary receives the assured sum and any accumulated bonuses if the policyholder dies unexpectedly.

2. If the policyholder lives through the entire policy term:

The policyholder gets the assured sum and any bonuses that have accumulated over the term when the policy concludes.

This is the answer to what is an Endowment Policy. Now, let’s look at the benefits of an endowment policy in detail.

Benefits of an Endowment Policy

There are several benefits offered by an endowment plan (because only knowing about what is an endowment policy is not enough). Let’s look at them one by one!

1. An endowment policy acts as a safety net, providing a robust life cover to safeguard your loved ones in case of an unfortunate event.

Simultaneously, it serves as a reliable savings tool, ensuring that you accumulate a substantial financial corpus to meet your future needs.

2. The beauty of an endowment plan lies in its dual functionality. If, unfortunately, the policyholder passes away prematurely, the nominated beneficiary receives the sum assured, offering financial security during challenging times.

On the flip side, if the policyholder outlives the policy term, they are entitled to the accumulated savings corpus, including bonuses, providing a lump sum at maturity.

3. Recognizing the diverse financial situations of individuals, endowment plans offer flexibility in premium payment frequencies (check out the LinkedIn article to learn about Term Plan With Return of Premium).

Whether you prefer monthly, quarterly, half-yearly, or annual payments, the choice is yours. This flexibility ensures that the policy aligns seamlessly with your unique financial rhythm.

4. Endowment plans come with the added advantage of customization through riders. By incorporating riders such as total permanent disability, accidental death, or critical illness, you have the power to enhance your coverage based on your evolving needs and concerns.

5. The financial perks of an endowment policy extend to tax benefits. Enjoy the dual advantage of reducing your taxable income with premium payments eligible for deductions under Section 80C.

Moreover, both the maturity amount and death payout qualify for tax benefits under Section 10(10D) of the Income Tax Act, 1961, contributing to your overall financial wellness.

So, in short, an endowment policy emerges as a comprehensive financial solution, offering the reassurance of life cover coupled with a robust savings strategy.

Now that you know the benefits of an endowment policy, let’s take a look at the types of endowment policy at your disposal.

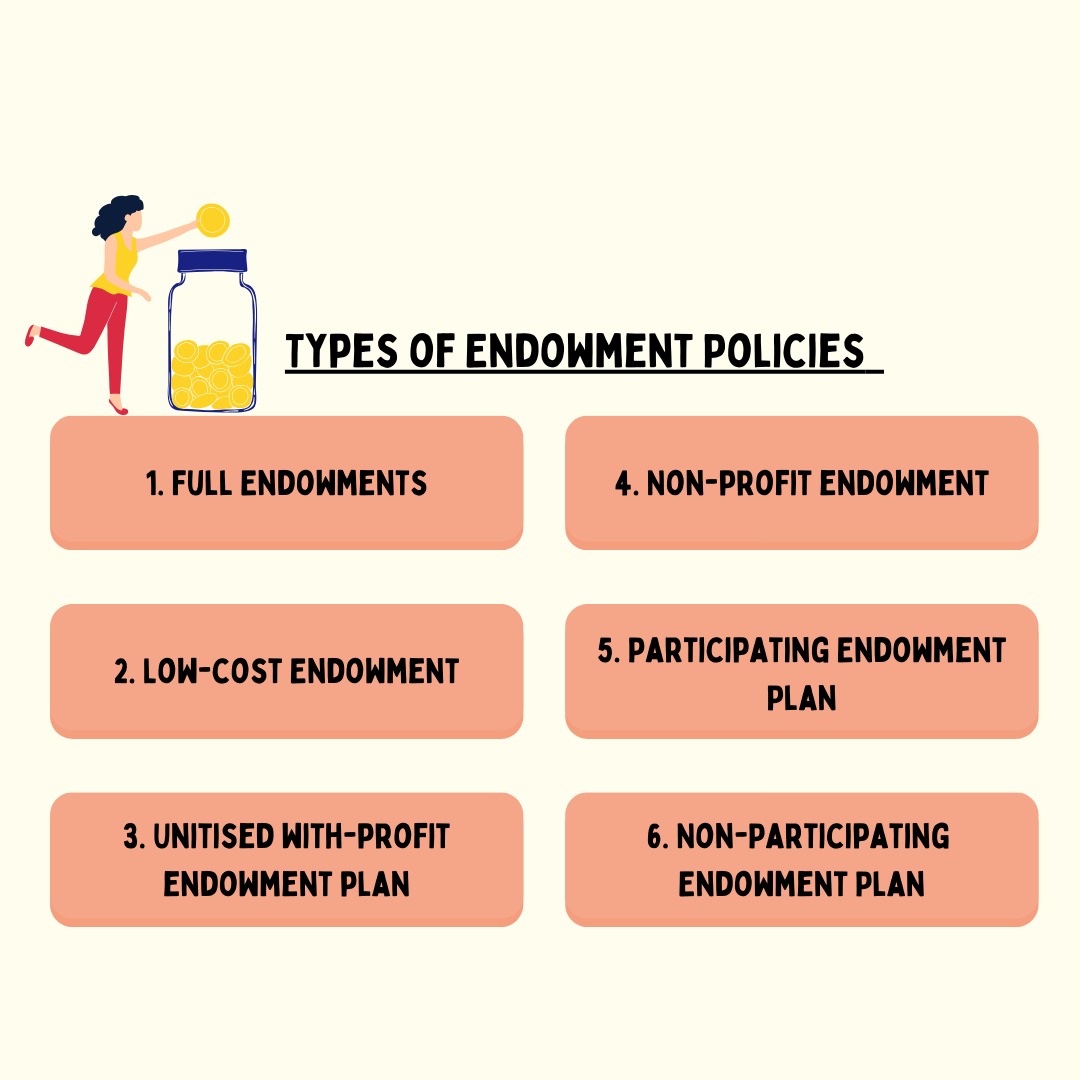

Types of Endowment Policy

After having a good grasp over what is an Endowment Policy and its benefits, here’s what you need to know about its types. There are 6 types of endowment policy you need to be aware of. Let’s see them one by one:

1. Full Endowments

With-profit endowment plans ensure a guaranteed sum at the end of the policy term, providing additional bonuses for a higher maturity benefit, making it a way to accumulate substantial earnings.

2. Low-cost Endowment

This plan involves lower premiums, helping you save for future expenses. It guarantees a sum for your nominee in case of an unfortunate event, with yearly bonuses increasing the amount at maturity. It’s designed to build a fund for specific goals or loan repayments.

3. Unitised with-profit endowment plan

Combining the potential of ULIPs with guaranteed returns, this plan offers a safe investment option by minimizing the impact of market fluctuations. It ensures a guaranteed payout at maturity, providing both safety and higher return potential.

4. Non-profit endowment

Providing a lump sum on maturity or to the nominee in case of an unfortunate event, this plan lacks bonuses, serving as a financial safety net for your family without additional complexities.

5. Participating Endowment Plan

Offering life cover and returns, this plan includes bonuses based on the insurer’s performance, enhancing overall returns and combining protection with financial growth.

6. Non-Participating Endowment Plan

In contrast, these plans lack bonuses and provide fixed maturity and death benefits predetermined at the policy’s start, simplifying the structure without additional profit-sharing elements.

Now you’re aware of even the types of endowment policy. It’s time for you to see if the endowment policy is meant for you.

Should You Go For an Endowment Policy?

So now that you know what endowment policy is, what are its different types, and what are its benefits, you must know whether it is something you should go for.

An endowment plan for your financial portfolio is a prudent choice, particularly if you fall into one or more of the following categories:

1. Income Strategists

If you are looking to diversify your income sources, an endowment plan can serve as a valuable addition. With the potential to provide a lump sum income in the future, it becomes an attractive option for those strategizing to create an alternative and stable financial stream.

2. Future Planners

Individuals with a foresighted approach to financial planning can find endowment plans beneficial. The assurance of a lump sum income in the future aligns seamlessly with long-term goals such as funding your child’s education, planning for your retirement, or undertaking major life events with financial ease.

3. Risk-Averse Investors

For those inclined towards low-risk investment options, an endowment plan offers a secure avenue to build savings. The combination of life insurance coverage and guaranteed returns makes it an appealing choice for individuals who prioritize financial security without exposing themselves to high market risks.

4. Family Protectors

If ensuring the financial well-being of your loved ones is a top priority, an endowment plan becomes a fitting solution. The plan acts as a protective shield, providing financial support to your family in case of an unfortunate event. It serves as a thoughtful strategy to secure your loved ones’ future while accumulating savings.

Now you are equipped with what is an endowment policy is. You know pretty well that it is a bit of both life insurance and long-term savings. With information on its benefits and types, make a decision on whether you want to go for an endowment policy or not. For more such useful guides, keep checking out this space.