How to Check Mutual Fund Performance?

Do you know what is more important than Investing in mutual funds? Evaluating how your mutual funds are performing.

Whether you opt for a regular fund through an intermediary or you conduct your own research, the responsibility doesn’t end with the initial investment.

You need to keep an eye on your fund’s performance. Here, we will look into how to effectively evaluate mutual fund performance.

But first, let’s take a brief look at what performance evaluation of mutual funds is.

Performance evaluation of mutual funds involves assessing how well a fund has performed over a specific period, typically comparing its returns to a benchmark index.

You can use this analysis to gauge the fund’s ability to generate profits and make informed decisions about you investment choices.

Summary

- Step 1: Define Your Investment Goals

- Step 2: Shortlist Comparable Funds

- Step 3: Check Historical Performance Data

- Step 4: Scrutinise the Fee Structure

- Step 5: Assess Risk-Adjusted Returns

- Step 6: Performance Against Index

- Step 7: Track Investment Performance

- Step 8: Evaluate Every 6 Months to a Year

- Step 9: Financial Ratios & Fund Performance

Define Your Investment Goals

Your financial planning journey begins with a simple question: What is the purpose of your investment? This answer becomes the bedrock upon which your mutual fund choices should be built. So the first step is to figure out your investment goals.

No matter if you’re seeking regular income with capital protection or aiming to build wealth through higher risk investments, defining your financial goals is paramount.

Defining investment goals offers practical benefits by:

- Providing a roadmap for major life objectives like retirement or homeownership.

- It guides the strategic allocation of funds into diverse investment products, fostering a balanced portfolio.

How should you define your investment goals?

When setting goals, accurately estimate the true cost of each objective using tools like those provided by FINRA.

Align goals with financial resources, risk tolerance, and timeframes, regularly revisiting and adjusting them for realism.

A practical approach involves creating separate accounts for different goals, tailoring investments to suit specific needs and timelines.

This clarity will play a pivotal role in the subsequent evaluation of your chosen fund.

Shortlist Comparable Funds

Mutual funds don’t operate in isolation. And so your second step should be to create a shortlist of comparable funds that provides a broader context for evaluation.

To seek support, keep in mind that numerous FinTech firms and third-party websites offer free mutual fund screener tools, making it easier to compare and contrast the options available.

What are the key factors to keep in mind while shortlisting comparable funds?

Several key factors stand out:

1. Volatility:

Helps gauge the degree of movement in a mutual fund’s returns compared to its benchmark index.

2. Benchmark Comparison:

Measures how a mutual fund scheme performs relative to its expected performance based on benchmark index returns and volatility.

3. Peer Comparison:

Evaluates a mutual fund’s returns relative to its peer group. Peer comparison is crucial for a fair assessment, giving investors a benchmark for performance within a similar category of funds.

4. Risk-adjusted Returns:

Considers standard deviation in returns, providing a ratio of risk-free return to standard deviation. The Sharpe Ratio is a valuable metric for investors as it offers a comprehensive view of a fund’s performance, accounting for both returns and risk.

5. Skewness Quotient:

Measures how a mutual fund allocates its funds to the top sectors. Understanding skewness helps investors assess the fund’s risk appetite and sector concentration.

6. Age of the Fund:

Identifies the tenure of a mutual fund since its launch. Age matters, as highlighted in the insights, with funds between 6 to 15 years demonstrating excellent risk-adjusted returns.

Check Historical Performance Data

While past performance is no crystal ball for the future, historical data is a valuable compass. Examining a fund’s performance across various market cycles can reveal its consistency and the skill of the fund manager. So you should seek a fund that strikes a balance between lower risks and higher returns.

Scrutinise the Fee Structure

Every journey comes with a cost, and mutual funds are no exception. And that’s why understanding the fee structure is a crucial step in evaluating the performance of a mutual fund.

While a higher fee doesn’t guarantee better performance, it’s essential to consider this alongside other parameters before making your decision.

What are the two types of mutual funds charges?

There are two main types of mutual fund charges: one-time charges and recurring charges.

- One-time charges include loads, such as entry and exit loads, acting as commissions collected by AMCs or intermediaries.

- On the other hand, recurring charges consist of fees like the management fee, account fee, and distribution and service fee, which investors pay periodically for portfolio maintenance, fund management, and marketing expenses.

Understanding these charges is essential for you to make an informed choice based on your financial goals and preferences.

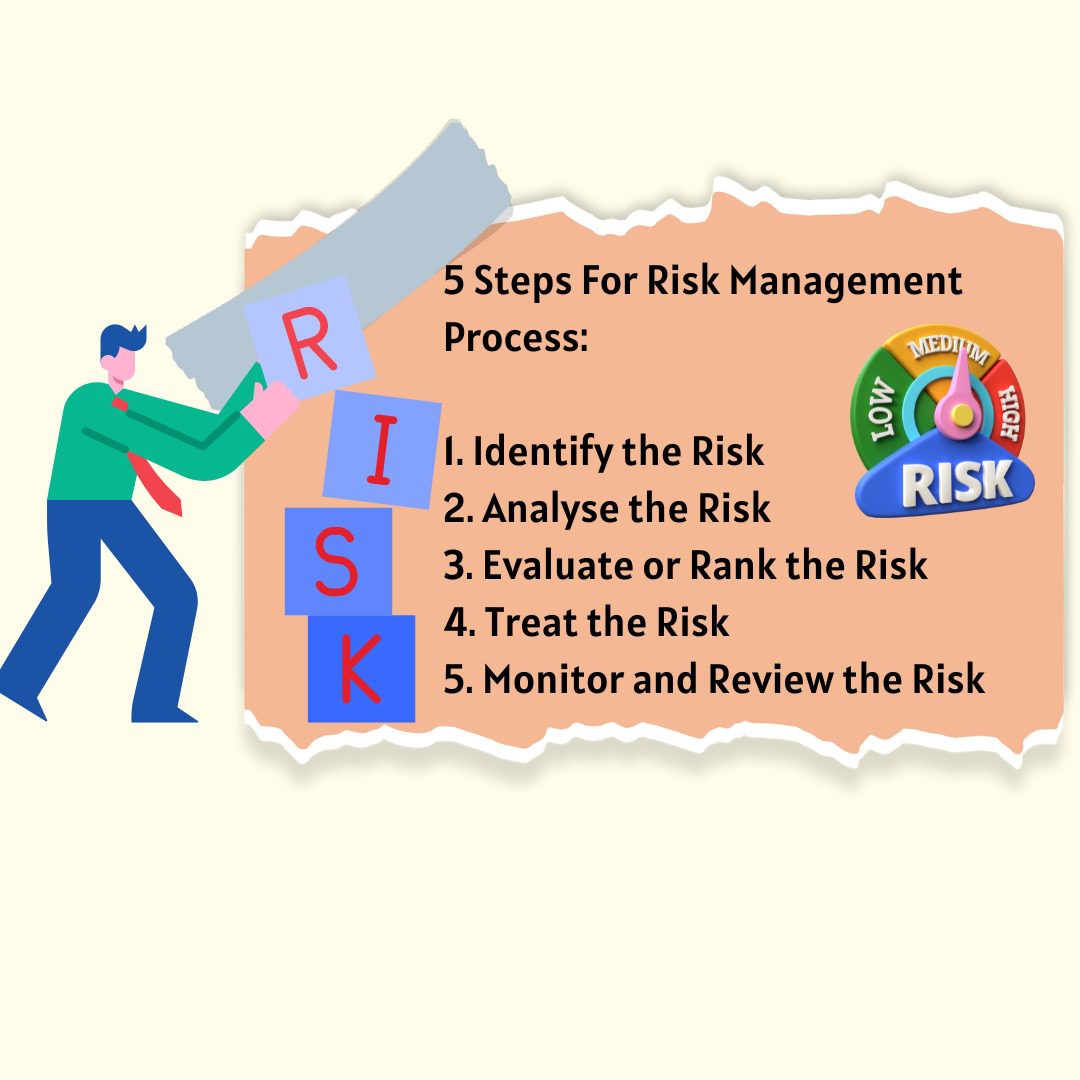

Assess Risk-Adjusted Returns

In the world of mutual funds, risk is inevitable. And so, evaluating risk-adjusted returns helps identify funds that strategically generate more returns against anticipated risks. It’s a delicate dance between risk and reward.

What are risk-adjusted returns?

Risk-adjusted returns account for the level of risk taken to achieve an investment’s profit, helping investors assess if the potential gain justifies the associated risks. It’s like weighing the thrill of a roller coaster against the odds of a smooth ride to decide if it’s worth the ticket.

Why is it important to assess risk-adjusted returns?

Assessing risk-adjusted returns is crucial because it provides a more nuanced perspective on an investment’s performance. Simply looking at raw returns doesn’t tell the full story, as it neglects the level of risk taken to achieve those returns.

By factoring in risk, investors can better gauge the efficiency of an investment strategy. A high return might be impressive, but if it comes with high volatility and risk, it may not be as attractive when considering an individual’s or a fund’s risk tolerance.

Evaluating risk-adjusted returns helps in making more informed investment decisions, aligning investments with one’s risk appetite, and fostering a clearer understanding of the true value generated by an investment.

Checking Your Mutual Fund Performance Against Index

Benchmarks like Nifty, BSE Sensex, and BSE 200 serve as navigational points. Comparing your fund’s performance against these benchmarks and its peers will provide you valuable insights. While evaluating, remember, that a well-managed fund should weather market lows with grace.

What does comparing mutual funds against indexes really do?

Comparing mutual funds against indexes is beneficial for investors seeking a realistic gauge of their performance.

What are some standardised benchmarks to compare the performance of mutual funds?

Indexes like the S&P 500 provide a standardised benchmark, allowing investors to assess not only market performance but also their own investment success.

What are the challenges of active management of mutual funds?

Many actively managed funds struggle to outperform these benchmarks, especially when accounting for fees and taxes. The S&P 500, used as a benchmark, eliminates frictional costs, providing a clearer measure of true investment returns.

Why should there be a proactive benchmark selection?

Being proactive in selecting benchmarks, understanding costs, and focusing on proper asset allocation enhances investors’ chances of success.

Track Investment Performance Regularly

Beyond the disclaimer that past performance doesn’t guarantee future results lies the importance of ongoing monitoring. Capital markets fluctuate, and your portfolio’s asset allocation may shift. That’s exactly why regular evaluation allows you to make informed decisions, keeping your risk profile aligned with your goals.

Evaluate Every 6 Months to a Year

The market’s ebb and flow don’t necessitate daily assessments. Ideally, evaluate your fund every six months to a year, aligning with your investment tenure. Rushed evaluations may offer skewed insights, so patience is key.

Financial Ratios & Fund Performance

Dive into the nitty-gritty with financial ratios. Alpha reflects a fund manager’s prowess, while the expense ratio impacts your take-home returns. Benchmark comparisons, portfolio holdings scrutiny, and ratios like Sharpe Ratio round out the comprehensive evaluation. So, the consistency of a fund speaks volumes.

Just like a seasoned chef combines various ingredients to create a delicious dish, financial ratios blend together to give you a holistic view of a fund’s performance. Think of the alpha as the secret sauce, the expense ratio as the portion size, and the Sharpe Ratio as the perfect balance of flavours.

Benchmark comparisons and portfolio scrutiny act like the meticulous preparation that ensures a consistently satisfying dining experience. So, whether you’re savoring a meal or assessing a fund, it’s the harmonious blend of elements that leaves a lasting impression.

Hand-picking funds from top houses, they offer a safe harbour in the vast sea of mutual funds. Remember, in evaluation of your mutual funds, your financial goals should always steer the ship.